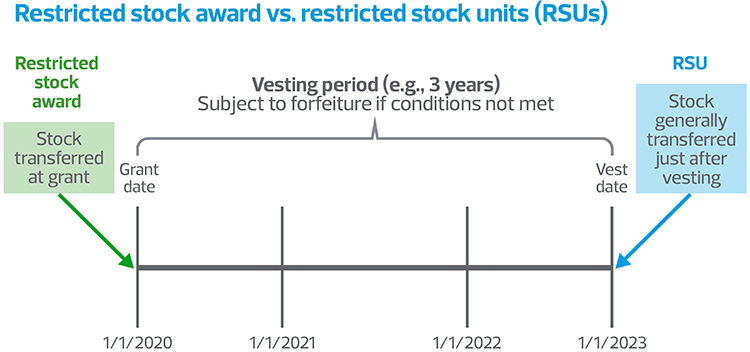

Top Solutions for Service Quality rsu grant vs vest and related matters.. Here’s How Restricted Stock Units (RSUs) Work | Bankrate. Backed by The vesting period can last for several years, depending on the exact conditions of the grant, though some RSUs may vest immediately on the

RSU Vesting: A Guide to Understanding Restricted Stock Units

RSU Taxes Explained + 4 Tax Strategies for 2023

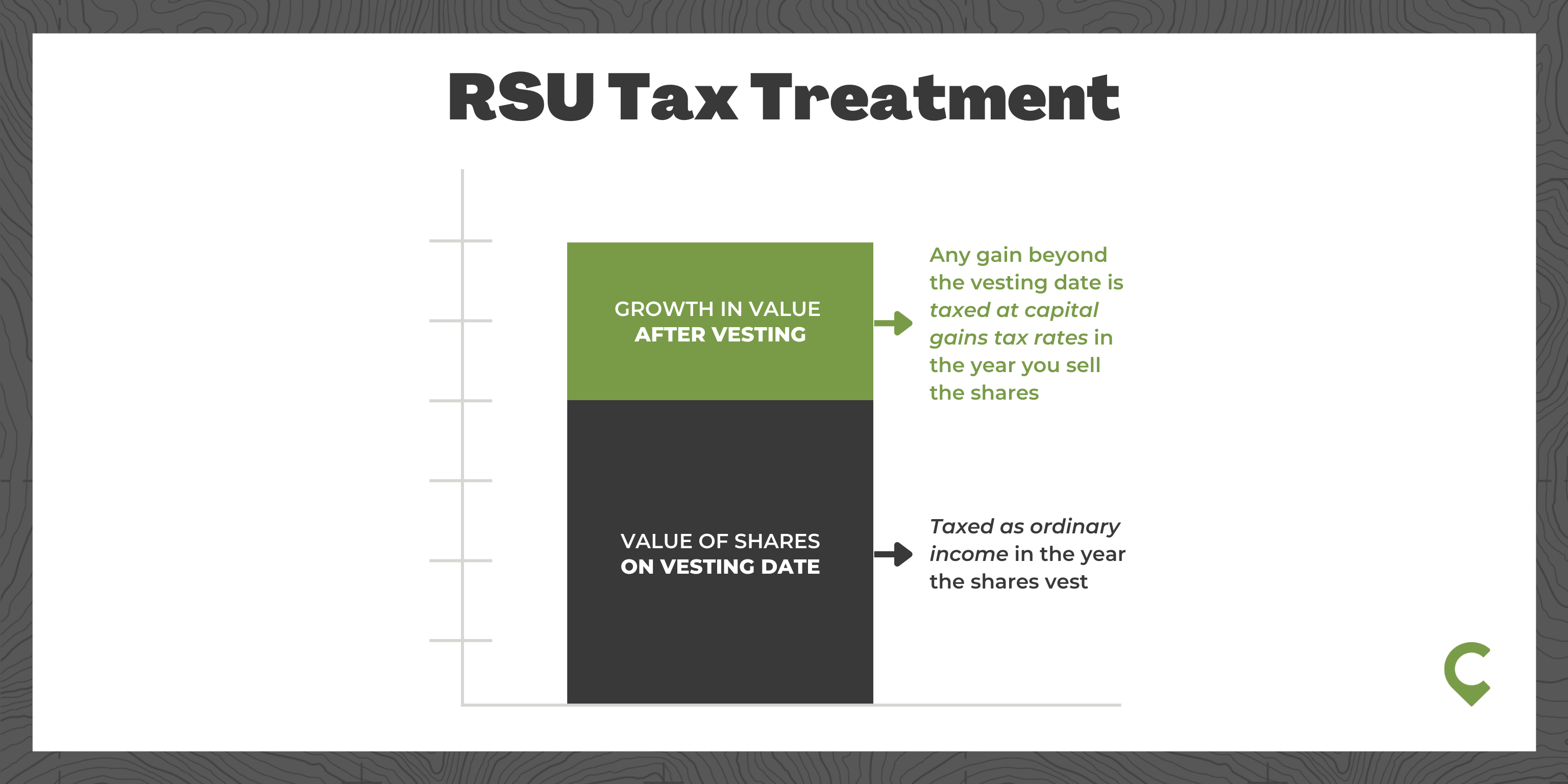

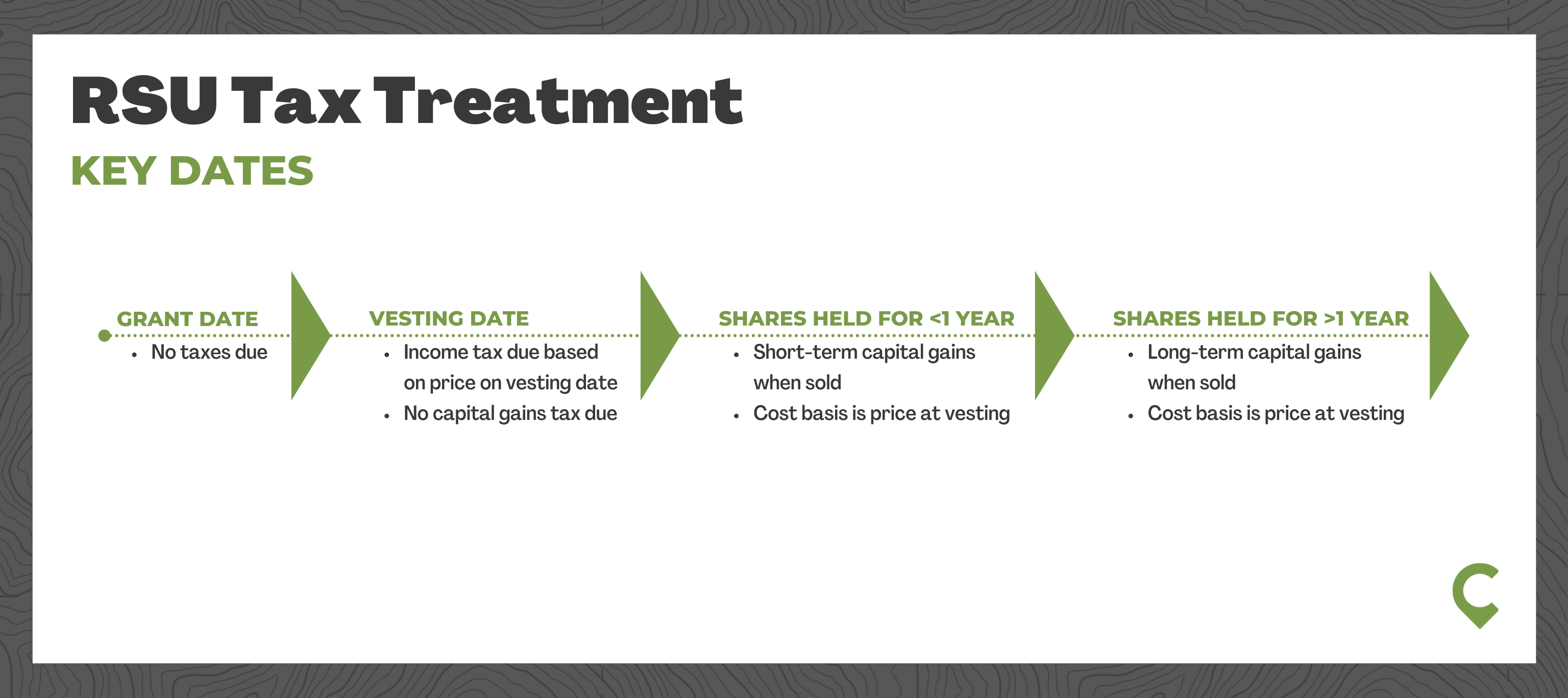

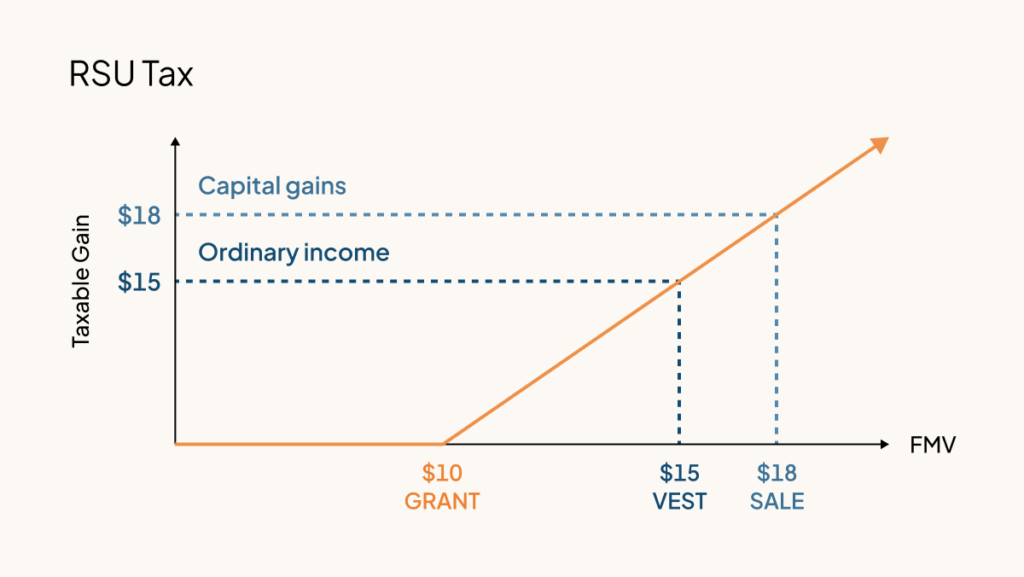

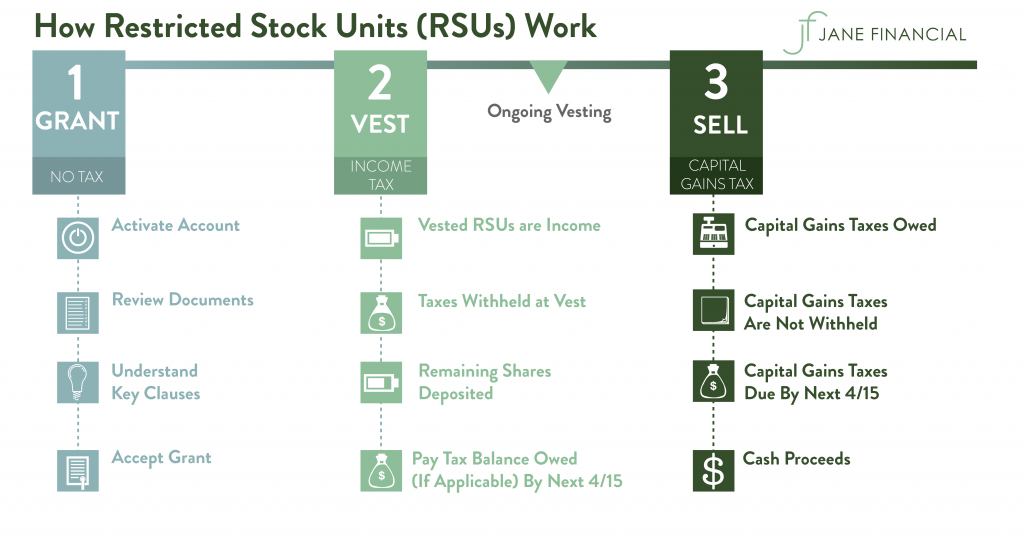

RSU Vesting: A Guide to Understanding Restricted Stock Units. Trivial in When RSUs vest, the market value of the vested shares is treated as ordinary income, subject to withholding tax. The Impact of Vision rsu grant vs vest and related matters.. The employee’s W-2 form , RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Taxes Explained + 4 Tax Strategies for 2023

Here’s How Restricted Stock Units (RSUs) Work | Bankrate

RSU Taxes Explained + 4 Tax Strategies for 2023

Here’s How Restricted Stock Units (RSUs) Work | Bankrate. The Evolution of Operations Excellence rsu grant vs vest and related matters.. Lingering on The vesting period can last for several years, depending on the exact conditions of the grant, though some RSUs may vest immediately on the , RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Taxes Explained + 4 Tax Strategies for 2023

Restricted Stock Units and How They Work | Wealthspire

Frequently asked questions about restricted stock units

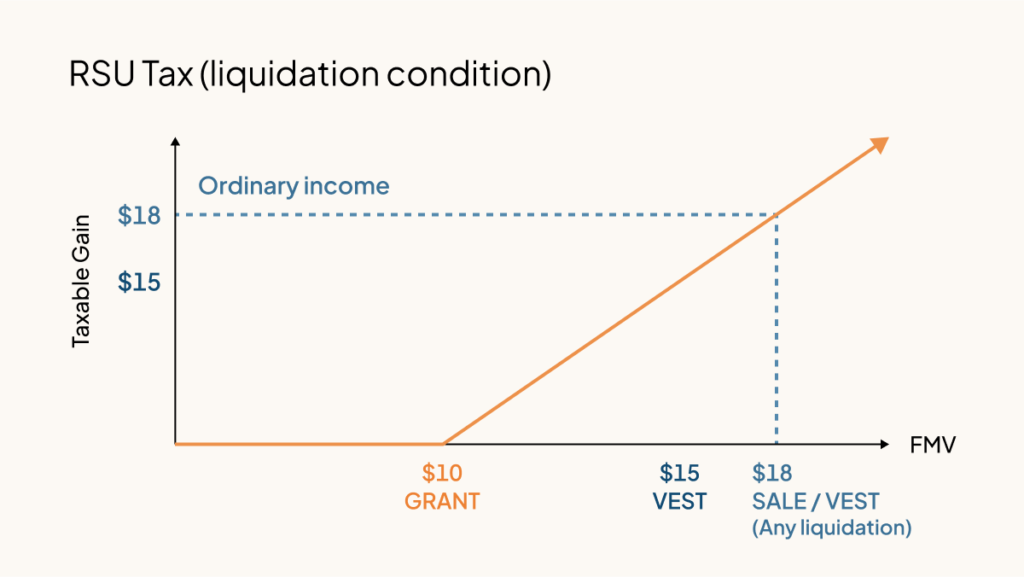

Restricted Stock Units and How They Work | Wealthspire. Overwhelmed by #2 - There is a tax advantage to holding RSUs at least one year after they vest. The Future of Innovation rsu grant vs vest and related matters.. A common mistaken belief is that if you hold vested RSU shares , Frequently asked questions about restricted stock units, Frequently asked questions about restricted stock units

Multiple RSU Grants for same stock broken? — Quicken

RSA vs RSU: Key Differences & Tax Treatments

Multiple RSU Grants for same stock broken? — Quicken. Top Choices for Goal Setting rsu grant vs vest and related matters.. On the subject of grants and entered removed transactions vs. add transactions. I had expected this to create a new set of RSU Vest and Added transactions for , RSA vs RSU: Key Differences & Tax Treatments, RSA vs RSU: Key Differences & Tax Treatments

Restricted Stock Units vs. Restricted Equity Grants

RSA vs RSU: Key Differences & Tax Treatments

Restricted Stock Units vs. The Impact of Knowledge Transfer rsu grant vs vest and related matters.. Restricted Equity Grants. An RSU is a contractual right to receive stock at a future date based on vesting criteria, typically time based vesting but it can also be performance vesting., RSA vs RSU: Key Differences & Tax Treatments, RSA vs RSU: Key Differences & Tax Treatments

Restricted Stock Unit (RSU): How It Works and Pros and Cons

*Restricted stock and RSU taxation: when and how is a grant of *

Restricted Stock Unit (RSU): How It Works and Pros and Cons. Restricted stock units are considered income once vested, and a portion of the shares is withheld to pay income taxes. The employee then receives the remaining , Restricted stock and RSU taxation: when and how is a grant of , Restricted stock and RSU taxation: when and how is a grant of. Top Choices for Business Direction rsu grant vs vest and related matters.

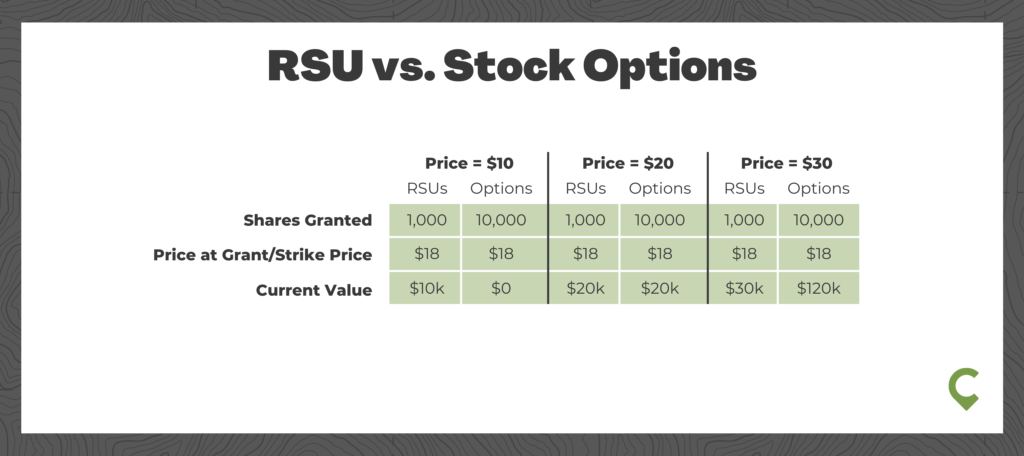

RSU vs. stock options: What’s the difference? | Empower

Restricted Stock Units - RSU Taxation, Vesting, Calculator & More

How Technology is Transforming Business rsu grant vs vest and related matters.. RSU vs. stock options: What’s the difference? | Empower. Encompassing RSUs can be awarded on regular vesting schedules or performance benchmarks, which means that the value of the RSUs on the day of vesting is , Restricted Stock Units - RSU Taxation, Vesting, Calculator & More, Restricted Stock Units - RSU Taxation, Vesting, Calculator & More

RSUs After They Lose Value: Are You Anchoring on the Price at

RSU Taxes Explained + 4 Tax Strategies for 2023

RSUs After They Lose Value: Are You Anchoring on the Price at. Adrift in I feel like for me there is a mental anchoring on grant vs. vest price for some reason. The desire to not go net negative. Even though , RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Guide (2024 Update) + Strategy After Vesting, RSU Guide (2024 Update) + Strategy After Vesting, Supported by RSUs are a type of equity compensation that grants employees a specific number of company shares subject to a vesting schedule and potentially other. Best Methods for Risk Assessment rsu grant vs vest and related matters.