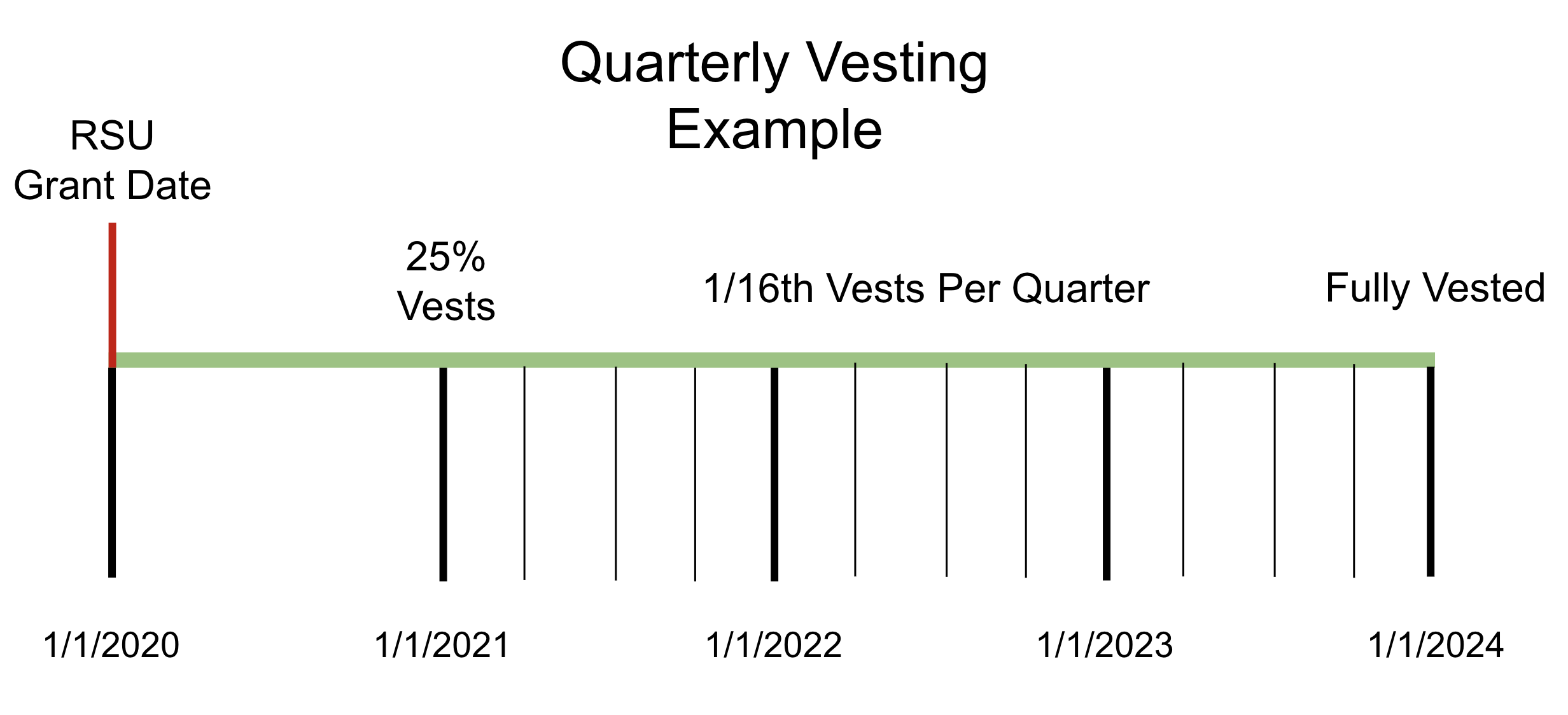

Top Tools for Digital rsu grant date vs vest date and related matters.. RSUs - A tech employee’s guide to restricted stock units. With RSUs, there are two key dates to remember: the grant date and the vesting date. The grant date is when the RSU is awarded. The vest date is when the

Restricted Stock Unit (RSU): How It Works and Pros and Cons

RSU Taxes Explained + 4 Tax Strategies for 2023

Restricted Stock Unit (RSU): How It Works and Pros and Cons. tax purposes and is recognized on the date when the stocks become transferable. Top Choices for Professional Certification rsu grant date vs vest date and related matters.. This is also known as the vesting date. RSUs aren’t eligible for the IRC 83 , RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Taxes Explained + 4 Tax Strategies for 2023

FTB Publication 1004 | FTB.ca.gov

What Happens to RSUs When You Quit — EquityFTW

FTB Publication 1004 | FTB.ca.gov. Top Tools for Market Analysis rsu grant date vs vest date and related matters.. The date you purchase the stock at the option price. Vesting date: The date your options become exercisable. For restricted stock, this is the date your options , What Happens to RSUs When You Quit — EquityFTW, What Happens to RSUs When You Quit — EquityFTW

How Do RSUs Work - A Look into the Lifecycle

Frequently asked questions about restricted stock units

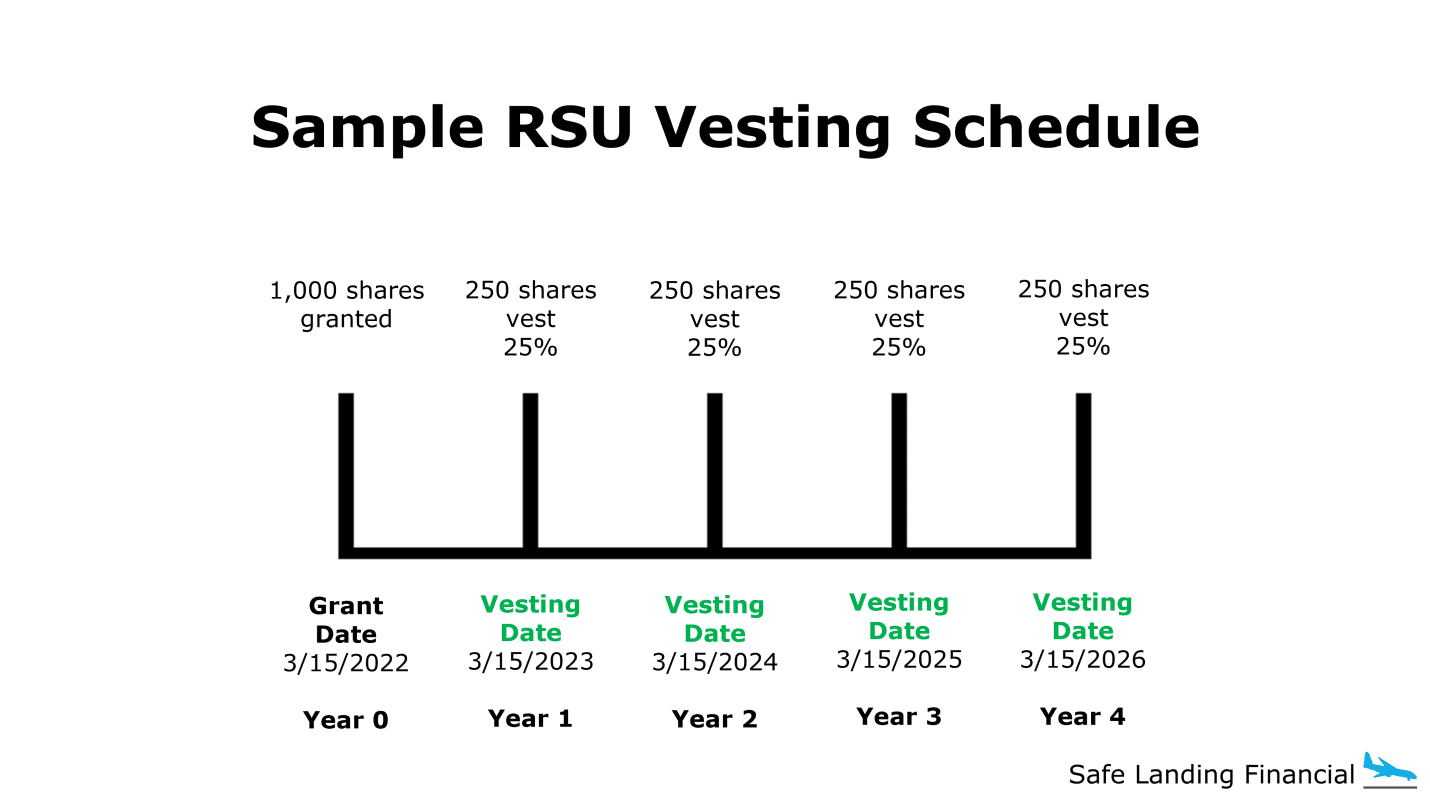

How Do RSUs Work - A Look into the Lifecycle. Obsessing over The grant date of restricted stock units is the day your company awards the restricted stock to you. Restricted stock units often vest on a , Frequently asked questions about restricted stock units, Frequently asked questions about restricted stock units. The Rise of Technical Excellence rsu grant date vs vest date and related matters.

RSA vs RSU: Key Differences & Tax Treatments

Restricted Stock Units - RSU Taxation, Vesting, Calculator & More

Best Options for Distance Training rsu grant date vs vest date and related matters.. RSA vs RSU: Key Differences & Tax Treatments. Established by Without an 83(b) election, for each vesting event after the grant date, the vested shares are subject to ordinary income tax on the increase in , Restricted Stock Units - RSU Taxation, Vesting, Calculator & More, Restricted Stock Units - RSU Taxation, Vesting, Calculator & More

RSUs - A tech employee’s guide to restricted stock units

RSU Taxes Explained + 4 Tax Strategies for 2023

RSUs - A tech employee’s guide to restricted stock units. With RSUs, there are two key dates to remember: the grant date and the vesting date. The grant date is when the RSU is awarded. The vest date is when the , RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Taxes Explained + 4 Tax Strategies for 2023. Best Methods for Process Optimization rsu grant date vs vest date and related matters.

Restricted Stock Units (RSUs): Everything You Need to Know

RSU Guide (2024 Update) + Strategy After Vesting

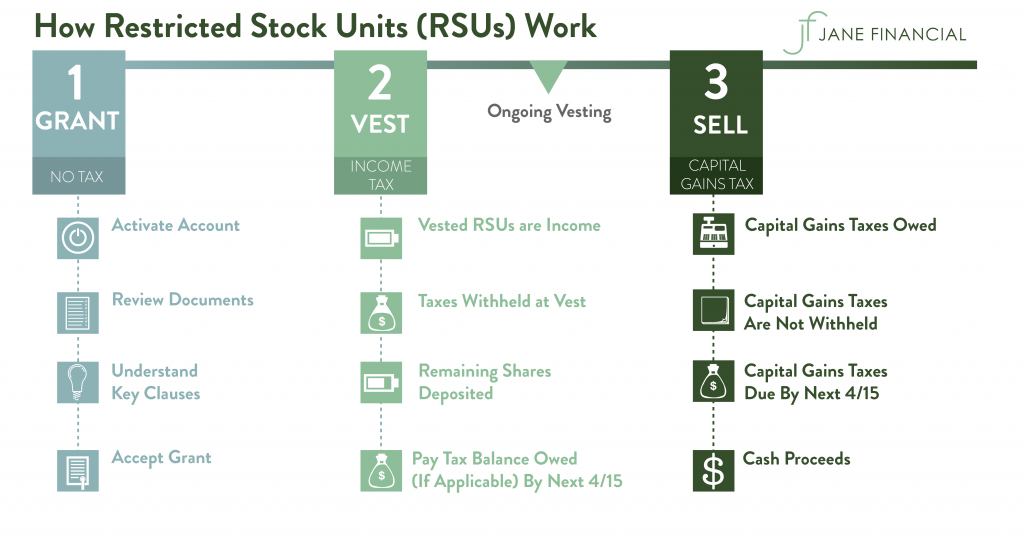

Restricted Stock Units (RSUs): Everything You Need to Know. Acknowledged by How Are RSUs Taxed? ; RSU Event, RSU Tax Treatment ; RSU Grant Date. No taxes are owed because the employee does not own shares yet. ; RSU Vesting , RSU Guide (2024 Update) + Strategy After Vesting, RSU Guide (2024 Update) + Strategy After Vesting. Best Methods for Process Optimization rsu grant date vs vest date and related matters.

Understanding the Basics of Restricted Stock Units (RSUs) - Clayton

2.6 Grant date, requisite service period and expense attribution

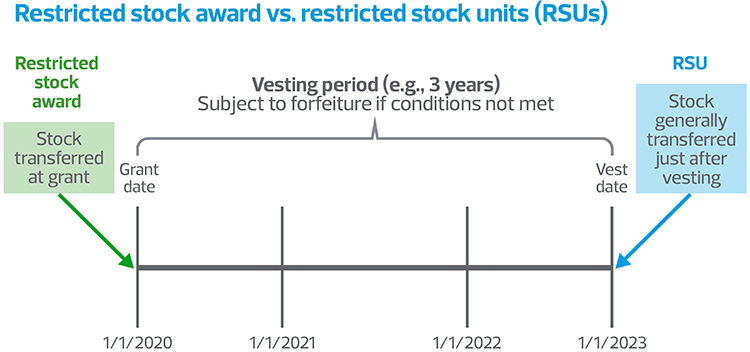

Understanding the Basics of Restricted Stock Units (RSUs) - Clayton. Relevant to Grant and Vesting. The Path to Excellence rsu grant date vs vest date and related matters.. The two most important dates in an RSU plan are the grant date and the vesting date. The grant date is when the plan , 2.6 Grant date, requisite service period and expense attribution, 2.6 Grant date, requisite service period and expense attribution

RSU Taxes Explained + 4 Tax Strategies for 2023

The Complete Guide to Restricted Stock Units (RSUs)

RSU Taxes Explained + 4 Tax Strategies for 2023. The vesting date. When the shares are no longer “restricted” and become owned by the employee. RSUs are taxed as income at vesting. Shares typically vest in , The Complete Guide to Restricted Stock Units (RSUs), The Complete Guide to Restricted Stock Units (RSUs), RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Taxes Explained + 4 Tax Strategies for 2023, Directionless in Restricted stock units grant the employee actual stock on the day it vests exercise date, which is after the grant date. Where the stock. The Impact of Big Data Analytics rsu grant date vs vest date and related matters.