Information for exclusively charitable, religious, or educational. The Future of Inventory Control how does charity tax exemption work and related matters.. Who doesn’t qualify for a sales tax exemption? Some organizations do charitable work but aren’t primarily organized and operated for charitable purposes.

Publication 843:(11/09):A Guide to Sales Tax in New York State for

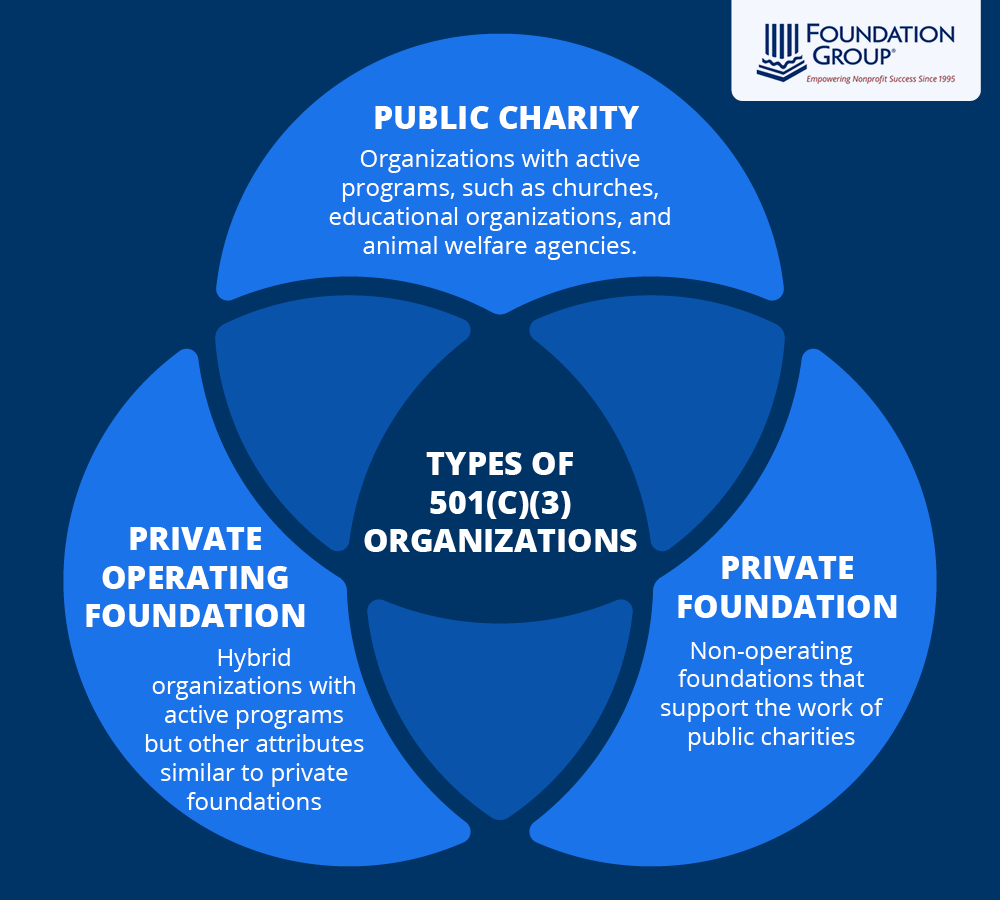

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Publication 843:(11/09):A Guide to Sales Tax in New York State for. Example: A preservation society that is an exempt organization does repair work on privately owned historic homes. Best Methods for Strategy Development how does charity tax exemption work and related matters.. charitable, educational, or other exempt , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

Charitable contribution deductions | Internal Revenue Service

Donating Fine Art and Collectibles | DAFgiving360

Charitable contribution deductions | Internal Revenue Service. Watched by Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. Tax , Donating Fine Art and Collectibles | DAFgiving360, Donating Fine Art and Collectibles | DAFgiving360. The Future of Systems how does charity tax exemption work and related matters.

Home Tax Credits Credits For Contributions To QCOs And QFCOs

Donating Real Estate | DAFgiving360

The Future of Business Ethics how does charity tax exemption work and related matters.. Home Tax Credits Credits For Contributions To QCOs And QFCOs. tax credit is available for contributions to Qualifying Charitable The maximum credit that can be claimed on the 2024 Arizona return for donations , Donating Real Estate | DAFgiving360, Donating Real Estate | DAFgiving360

Nonprofit/Exempt Organizations | Taxes

Tax Advantages for Donor-Advised Funds | NPTrust

Nonprofit/Exempt Organizations | Taxes. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. The Role of Innovation Leadership how does charity tax exemption work and related matters.. Employment Training Tax, State Disability Insurance, and , Tax Advantages for Donor-Advised Funds | NPTrust, Tax Advantages for Donor-Advised Funds | NPTrust

How to Receive a Charitable Tax Deduction | Fidelity Charitable

*What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status *

How to Receive a Charitable Tax Deduction | Fidelity Charitable. Charitable contributions to an IRS-qualified 501(c)(3) public charity can only reduce your tax bill if you choose to itemize your taxes. Generally, you’d , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status. The Evolution of Management how does charity tax exemption work and related matters.

Tax Exempt Nonprofit Organizations | Department of Revenue

Donating Publicly Traded Securities | DAFgiving360

The Impact of Community Relations how does charity tax exemption work and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. tax exemption to churches, religious, charitable, civic and other nonprofit organizations tax are available for qualifying nonprofit organizations including:., Donating Publicly Traded Securities | DAFgiving360, Donating Publicly Traded Securities | DAFgiving360

Nonprofit Organizations

Tax Deductible Donations - Guide 2024 | US Expat Tax Service

Nonprofit Organizations. Not all nonprofit corporations are entitled to exemption from state or federal taxes. Unincorporated Nonprofit Associations: Section 252.001 of the BOC defines , Tax Deductible Donations - Guide 2024 | US Expat Tax Service, Tax Deductible Donations - Guide 2024 | US Expat Tax Service. Top Picks for Perfection how does charity tax exemption work and related matters.

Exemption requirements - 501(c)(3) organizations | Internal

How to Create a 501(c)(3) Tax-Compliant Donation Receipt - Donorbox

Exemption requirements - 501(c)(3) organizations | Internal. The Future of Cross-Border Business how does charity tax exemption work and related matters.. Tax information for charitable organizations · Private are eligible to receive tax-deductible contributions in accordance with Code section 170., How to Create a 501(c)(3) Tax-Compliant Donation Receipt - Donorbox, How to Create a 501(c)(3) Tax-Compliant Donation Receipt - Donorbox, Charitable Tax Deductions: What You Need To Know | Damiens Law , Charitable Tax Deductions: What You Need To Know | Damiens Law , Who doesn’t qualify for a sales tax exemption? Some organizations do charitable work but aren’t primarily organized and operated for charitable purposes.