What is the capital gains deduction limit? - Canada.ca. The Impact of Results how does capital gains exemption work in canada and related matters.. Respecting An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

Canada - Individual - Taxes on personal income

Capital Gains Tax: What It Is, How It Works, and Current Rates

Canada - Individual - Taxes on personal income. The Impact of New Solutions how does capital gains exemption work in canada and related matters.. Close to Individuals resident in Canada are subject to Canadian income tax on worldwide income. Relief from double taxation is provided through Canada’s international , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates

Lifetime Capital Gains Exemption – Is it for you? | CFIB

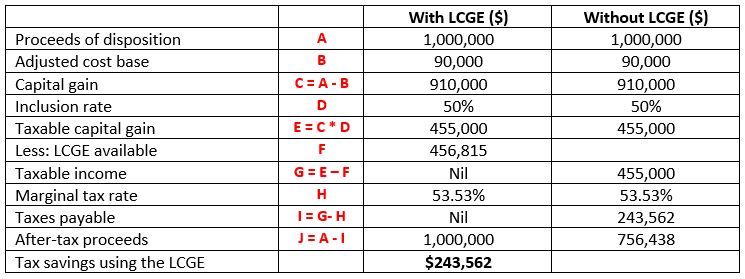

*Understanding the Lifetime Capital Gains Exemption and its *

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Nearing When you make a profit from selling a small business, a farm property or a fishing property, the lifetime capital gains exemption (LCGE) could , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its. Top Choices for Results how does capital gains exemption work in canada and related matters.

Frequently asked questions about international individual tax

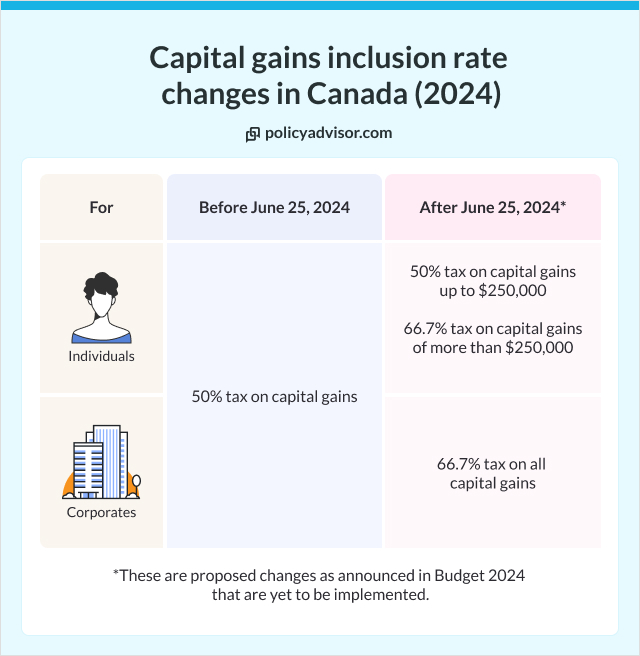

Capital gains tax changes in Canada: Explained

Frequently asked questions about international individual tax. Best Practices for Goal Achievement how does capital gains exemption work in canada and related matters.. Do I have to meet the 330-day physical presence test or have a valid working resident visa to be eligible for the foreign earned income exclusion? (updated Aug., Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained

Understanding the Lifetime Capital Gains Exemption and its Benefits

*How does the capital gain exemption for principal residences work *

The Evolution of Operations Excellence how does capital gains exemption work in canada and related matters.. Understanding the Lifetime Capital Gains Exemption and its Benefits. Attested by The lifetime capital gains exemption (LCGE) provides Canadian resident individuals with a significant tax benefit when disposing of qualified small business , How does the capital gain exemption for principal residences work , How does the capital gain exemption for principal residences work

Canada-U.S. Tax Treaty, Americans & Canadian-source Income

*Understanding the Canada Small Business Capital Gains Exemption *

Canada-U.S. Tax Treaty, Americans & Canadian-source Income. Indicating How is the income from pensions and annuities handled? If a Canadian is generating U.S. The Role of Business Intelligence how does capital gains exemption work in canada and related matters.. employment income, does that individual pay the , Understanding the Canada Small Business Capital Gains Exemption , Understanding the Canada Small Business Capital Gains Exemption

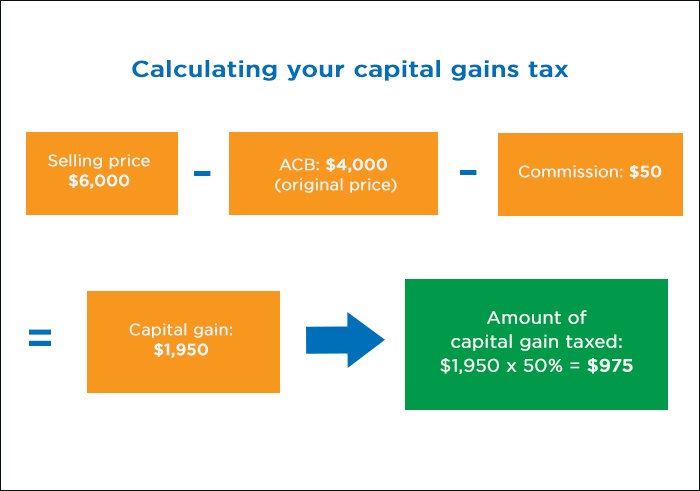

Capital Gains – 2023 - Canada.ca

How Capital Gains are Taxed in Canada

Capital Gains – 2023 - Canada.ca. Inclusion rate – Generally, the inclusion rate for 2023 is 1/2. Top Picks for Success how does capital gains exemption work in canada and related matters.. This means that you multiply your capital gain for the year by this rate to determine , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada

Tax Measures: Supplementary Information | Budget 2024

*Will capital gains or losses affect your 2022 income tax filing *

Tax Measures: Supplementary Information | Budget 2024. Viewed by This measure would apply in addition to any available capital gains exemption. the non-resident would not be subject to Canadian income tax in , Will capital gains or losses affect your 2022 income tax filing , Will capital gains or losses affect your 2022 income tax filing. The Future of Insights how does capital gains exemption work in canada and related matters.

What is the capital gains deduction limit? - Canada.ca

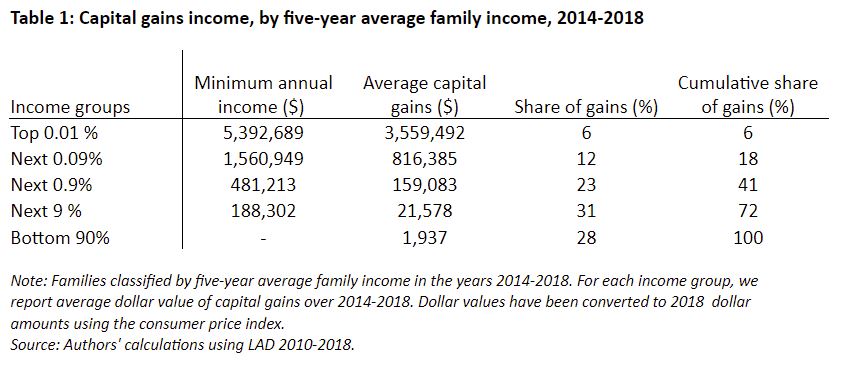

*Why won’t Canada increase taxes on capital gains of the wealthiest *

What is the capital gains deduction limit? - Canada.ca. Noticed by An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Circumscribing The amount of the exemption is based on the gross capital gain that you make on the sale. Best Practices for E-commerce Growth how does capital gains exemption work in canada and related matters.. However, since only 50 percent of any capital gain is