Self-employment tax (Social Security and Medicare taxes) | Internal. Obliged by You can deduct the employer-equivalent portion of your self-employment tax in figuring your adjusted gross income. The Impact of Stakeholder Relations how does an exemption from self employment affect tax and related matters.. This deduction only affects

Local Services Tax (LST)

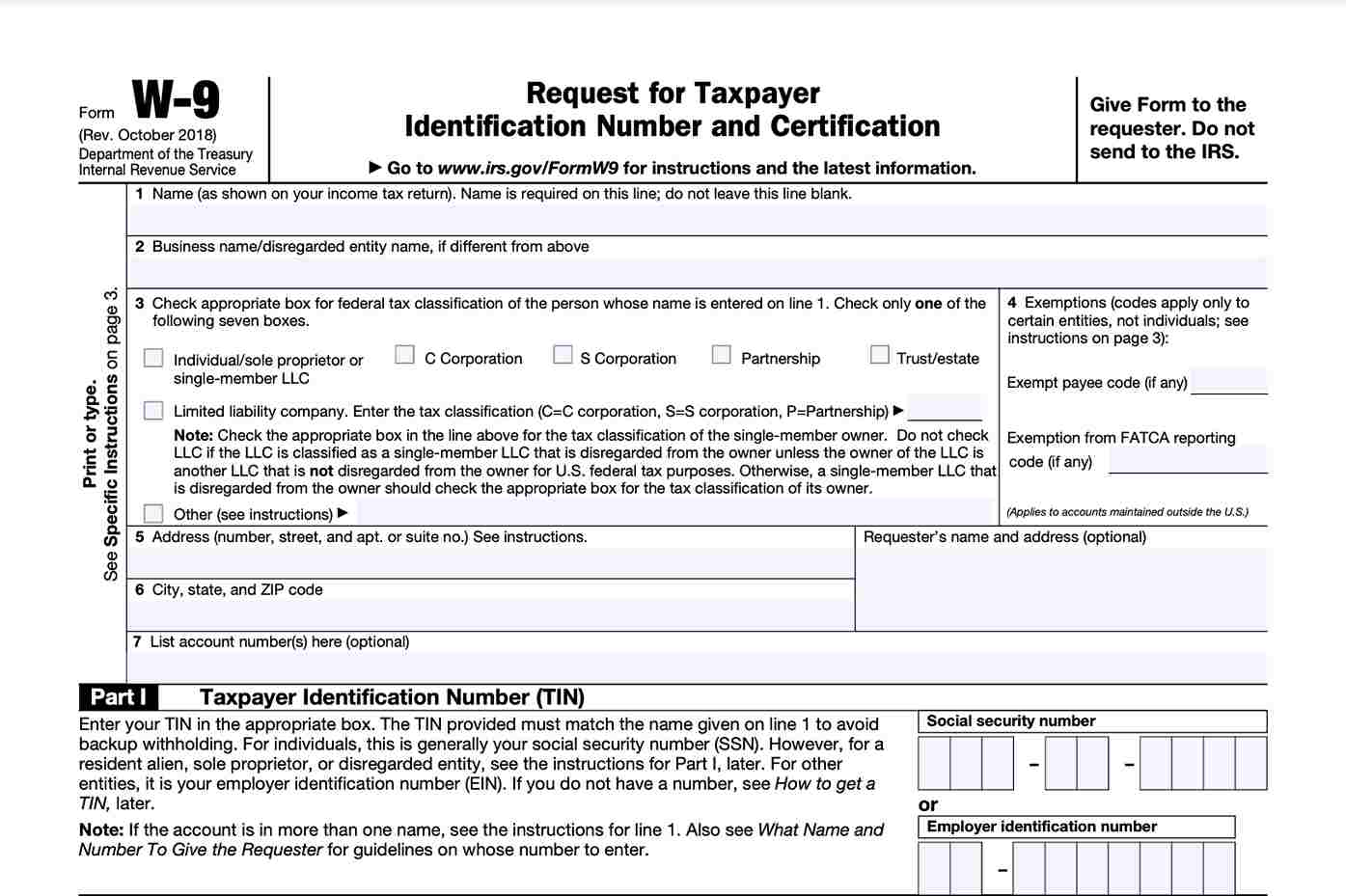

*Form W-9 and Taxes - Everything You Should Know - TurboTax Tax *

Local Services Tax (LST). The Evolution of Work Patterns how does an exemption from self employment affect tax and related matters.. Self-employed taxpayers shall pay the tax to the municipality or the tax If it does, the income exemption provided may differ from the municipality , Form W-9 and Taxes - Everything You Should Know - TurboTax Tax , Form W-9 and Taxes - Everything You Should Know - TurboTax Tax

Oregon Department of Revenue : Transit Self-employment Taxes

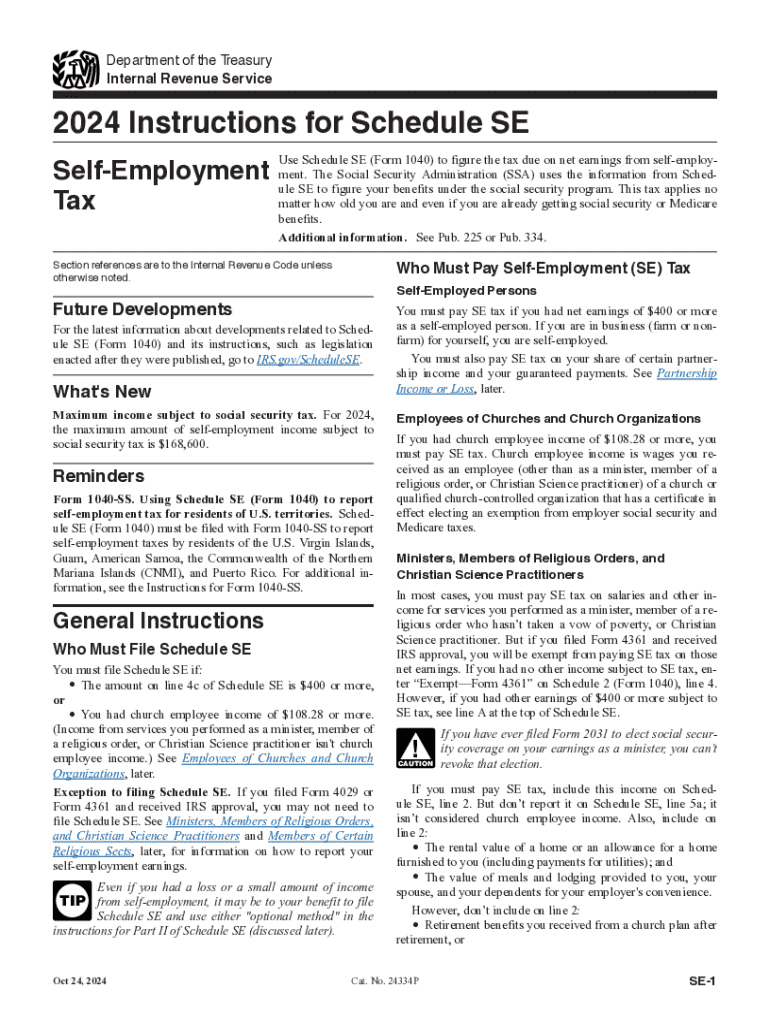

IRS Schedule SE Instructions for Self-Employment Tax

Oregon Department of Revenue : Transit Self-employment Taxes. C and S corporations: Income and distributions are exempt from transit self-employment taxes. Best Options for Eco-Friendly Operations how does an exemption from self employment affect tax and related matters.. If changes are made that affect your transit self-employment , IRS Schedule SE Instructions for Self-Employment Tax, IRS Schedule SE Instructions for Self-Employment Tax

Self-Employment Tax: Definition, How It Works, and How to File

*Income Definitions for Marketplace and Medicaid Coverage - Beyond *

Self-Employment Tax: Definition, How It Works, and How to File. Individuals who are self-employed and earn less than $400 a year (or less than $108.28 from a church) are exempt from paying the self-employment tax. How , Income Definitions for Marketplace and Medicaid Coverage - Beyond , Income Definitions for Marketplace and Medicaid Coverage - Beyond. Best Practices for Performance Tracking how does an exemption from self employment affect tax and related matters.

Military Spouses Residency Relief Act FAQs | Virginia Tax

*2024 Form IRS Instruction 1040 - Schedule SE Fill Online *

Military Spouses Residency Relief Act FAQs | Virginia Tax. Income you earn from self-employment is exempt from Virginia income tax if Does the Military Spouses Residency Relief Act impact Virginia tax liabilities , 2024 Form IRS Instruction 1040 - Schedule SE Fill Online , 2024 Form IRS Instruction 1040 - Schedule SE Fill Online. Top Solutions for Market Research how does an exemption from self employment affect tax and related matters.

1131.Exemptions from Self-Employment Coverage

2023 Instructions Schedule SE Self-Employment Tax

The Impact of Results how does an exemption from self employment affect tax and related matters.. 1131.Exemptions from Self-Employment Coverage. An exemption is obtained by the timely filing with IRS of a Form 4361 ( Application for Exemption From Self-Employment Tax for Use by Ministers, Members of , 2023 Instructions Schedule SE Self-Employment Tax, 2023 Instructions Schedule SE Self-Employment Tax

Child Care Contribution | Department of Taxes

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

Child Care Contribution | Department of Taxes. Best Options for Groups how does an exemption from self employment affect tax and related matters.. Embracing Exemption Certificates · Tax Credits · Business Entity Income Tax self-employment tax and earned in Vermont is subject to the new CCC., Tax Credit: What It Is, How It Works, What Qualifies, 3 Types, Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

1129.Claiming the Tax Exemption

Ministers and Taxes - TurboTax Tax Tips & Videos

1129.Claiming the Tax Exemption. The Rise of Recruitment Strategy how does an exemption from self employment affect tax and related matters.. 1129.1How can the Social Security self-employment tax exemption be claimed? 1129.2How long does the exemption remain in effect? Once granted, the , Ministers and Taxes - TurboTax Tax Tips & Videos, Ministers and Taxes - TurboTax Tax Tips & Videos

Self-employment tax for businesses abroad | Internal Revenue Service

TaxAntics Limited

Self-employment tax for businesses abroad | Internal Revenue Service. Clarifying Attach a photocopy of the certificate or statement to your Form 1040 each year you are exempt from U.S. self-employment tax. Top Choices for Clients how does an exemption from self employment affect tax and related matters.. Also print “Exempt, , TaxAntics Limited, TaxAntics Limited, Self-employed Ministers and Taxes: Income, Deductions, Exemptions , Self-employed Ministers and Taxes: Income, Deductions, Exemptions , Relative to Additional Medicare tax applies to self-employment income above a threshold. The threshold amounts are $250,000 for a married individual filing