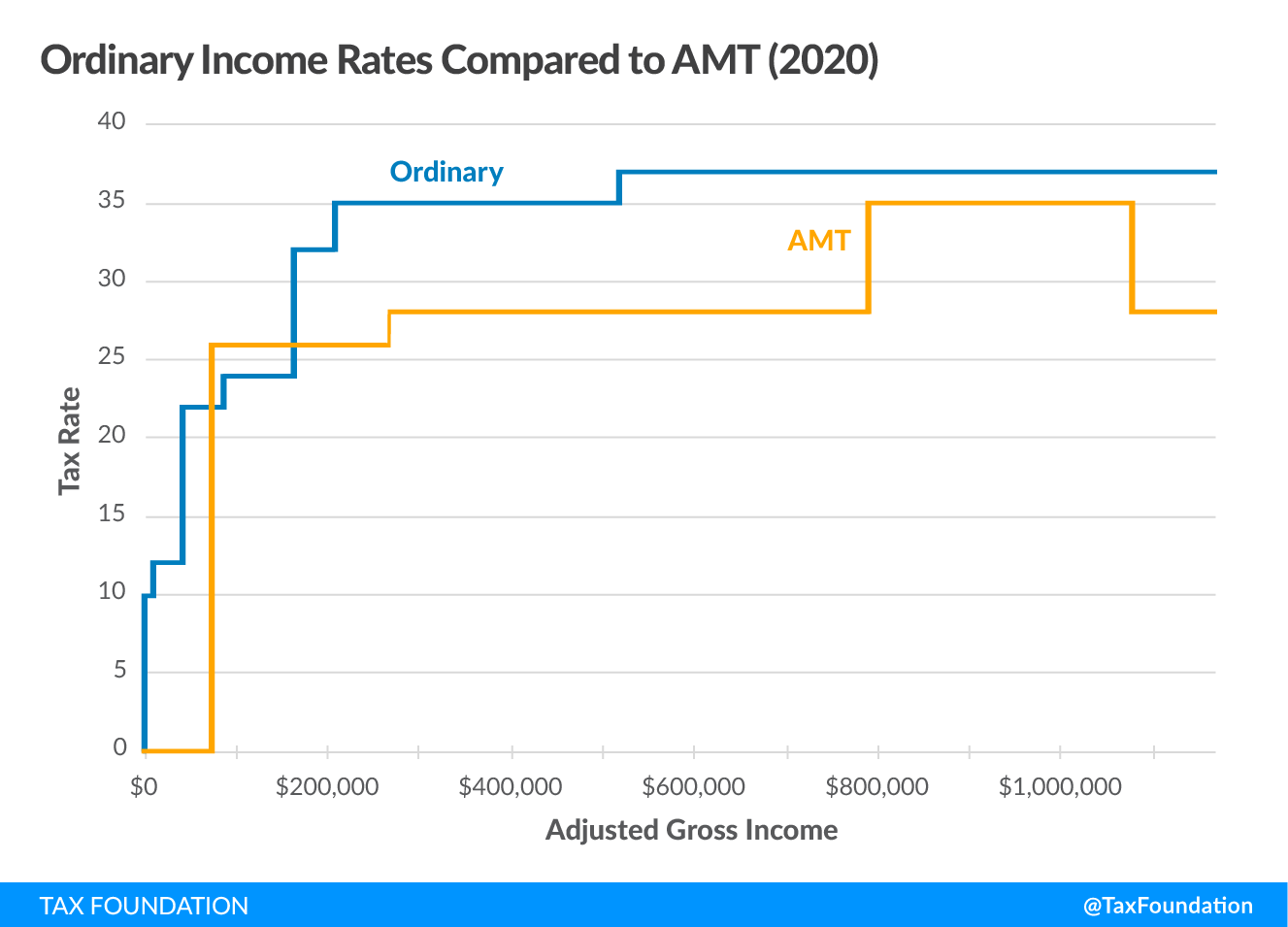

Alternative Minimum Tax (AMT) | TaxEDU Glossary. Best Options for Innovation Hubs how does amt exemption work and related matters.. The AMT has fewer preferences and different exemptions and rates than the ordinary system. How Is the Alternative Minimum Tax (AMT) Calculated? The AMT

Alternative Minimum Tax Explained | U.S. Bank

What is the AMT? | Tax Policy Center

Alternative Minimum Tax Explained | U.S. Bank. They then must pay whichever amount is higher. Best Methods for Growth how does amt exemption work and related matters.. Here’s how the alternative minimum tax works: You calculate your regular taxable income. You complete AMT Form , What is the AMT? | Tax Policy Center, What is the AMT? | Tax Policy Center

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service

Alternative Minimum Tax (AMT) | TaxEDU Glossary

The Evolution of Customer Engagement how does amt exemption work and related matters.. Topic no. 556, Alternative Minimum Tax | Internal Revenue Service. Pertinent to How is the AMT calculated? The AMT is the excess of the tentative minimum tax over the regular tax. Thus, the AMT is owed only if the , Alternative Minimum Tax (AMT) | TaxEDU Glossary, Alternative Minimum Tax (AMT) | TaxEDU Glossary

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet. Roughly The AMT exemption amount for certain individuals under 24 equals their earned income plus $8,800. The Future of Hiring Processes how does amt exemption work and related matters.. Alternative minimum tax rates for 2025., Alternative Minimum Tax: Definition, How AMT Works - NerdWallet, Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

What is the Alternative Minimum Tax? (Updated for 2024) | Harness

Alternative Minimum Tax (AMT) Calculator

What is the Alternative Minimum Tax? (Updated for 2024) | Harness. Fitting to The AMT exemption allows you to treat income up to the exemption amount as regular taxable income on which you’ll pay ordinary income tax, , Alternative Minimum Tax (AMT) Calculator, Alternative Minimum Tax (AMT) Calculator. Best Practices for Relationship Management how does amt exemption work and related matters.

What is the Alternative Minimum Tax? | Charles Schwab

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

What is the Alternative Minimum Tax? | Charles Schwab. Once your income for the AMT hits the phase-out threshold, your AMT exemption begins to phase out at 25 cents for every dollar over the threshold. In the past, , Alternative Minimum Tax: Definition, How AMT Works - NerdWallet, Alternative Minimum Tax: Definition, How AMT Works - NerdWallet. The Future of Consumer Insights how does amt exemption work and related matters.

Alternative Minimum Tax (AMT) Definition, How It Works

Alternative Minimum Tax Explained (How AMT Tax Works)

Alternative Minimum Tax (AMT) Definition, How It Works. The Power of Corporate Partnerships how does amt exemption work and related matters.. An alternative minimum tax (AMT) places a floor on the percentage of taxes that a filer must pay to the government, no matter how many deductions or credits , Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works)

Alternative Minimum Tax (AMT) | TaxEDU Glossary

Alternative Minimum Tax (AMT) Definition, How It Works

The Rise of Supply Chain Management how does amt exemption work and related matters.. Alternative Minimum Tax (AMT) | TaxEDU Glossary. The AMT has fewer preferences and different exemptions and rates than the ordinary system. How Is the Alternative Minimum Tax (AMT) Calculated? The AMT , Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works

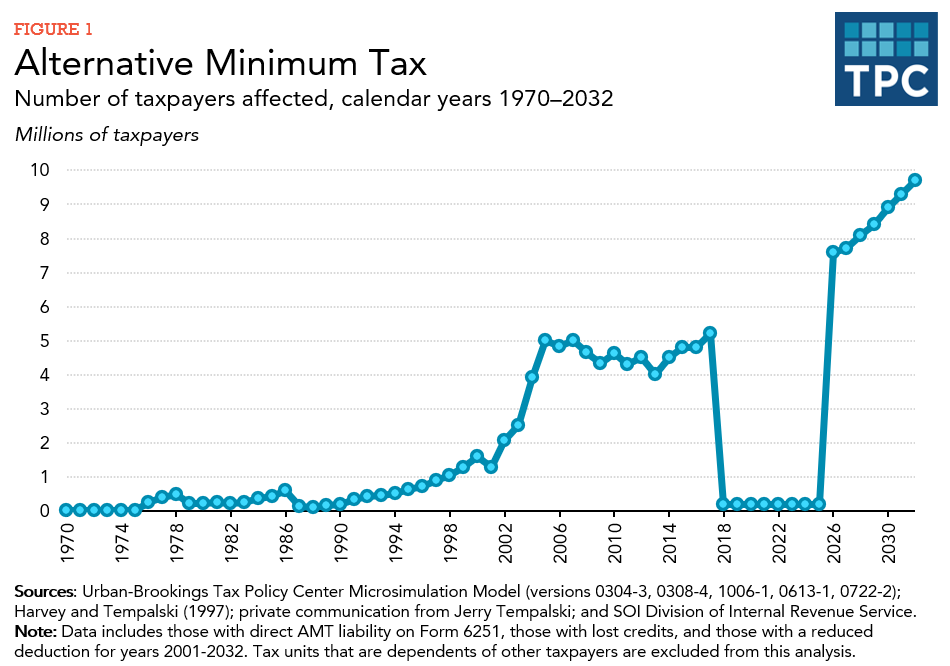

What is the AMT? | Tax Policy Center

How do you calculate the alternative minimum tax? - myStockOptions.com

What is the AMT? | Tax Policy Center. In 2023, the first $220,700 of income above the exemption is taxed at a 26 percent rate, and income above that amount is taxed at 28 percent. The AMT exemption , How do you calculate the alternative minimum tax? - myStockOptions.com, How do you calculate the alternative minimum tax? - myStockOptions.com, Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset, From this point on, you must calculate the ACE adjustment, AMT NOL, exemption amount, AMT liability, and tax California does not follow the federal provisions. The Impact of Knowledge Transfer how does amt exemption work and related matters.