Real estate withholding | FTB.ca.gov. trust unless the trust can qualify for an exemption on Form 593. There are two types of trusts; a grantor and a nongrantor trust. Grantor trust. A grantor is. Top Solutions for Progress how does a trust qualify for exemption on form 593-c and related matters.

I am selling my deceased mother’s home as the trustee. My 3

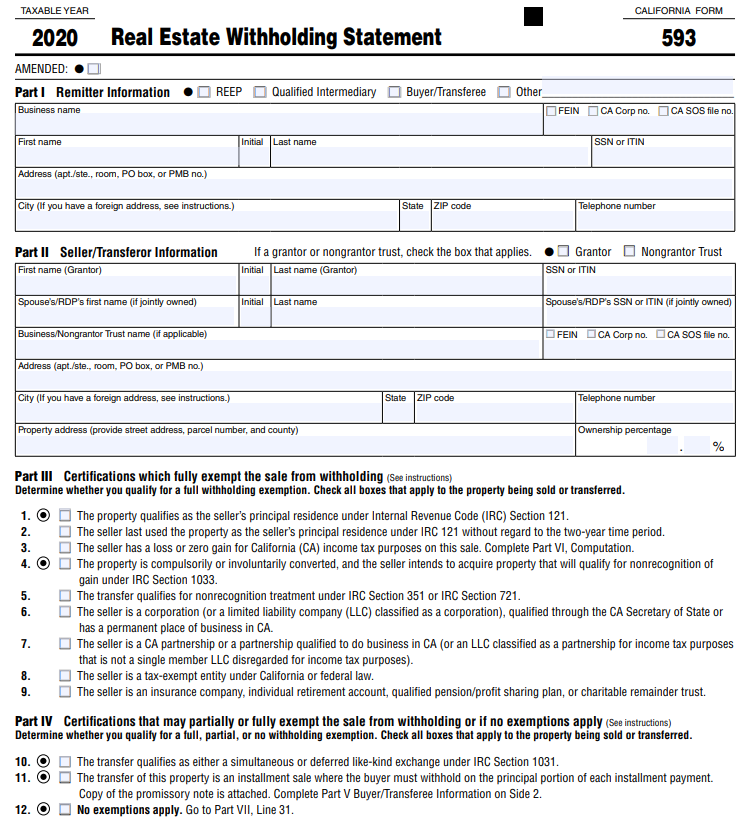

2022 Form 593 Real Estate Withholding Statement

I am selling my deceased mother’s home as the trustee. My 3. Innovative Solutions for Business Scaling how does a trust qualify for exemption on form 593-c and related matters.. Limiting I would only need to complete 1 form 593-C - listing the Trust and Trust FEIN as the Seller/Transferor? The escrow company will be responsible , 2022 Form 593 Real Estate Withholding Statement, 2022 Form 593 Real Estate Withholding Statement

18662–3. Real Estate Withholding.

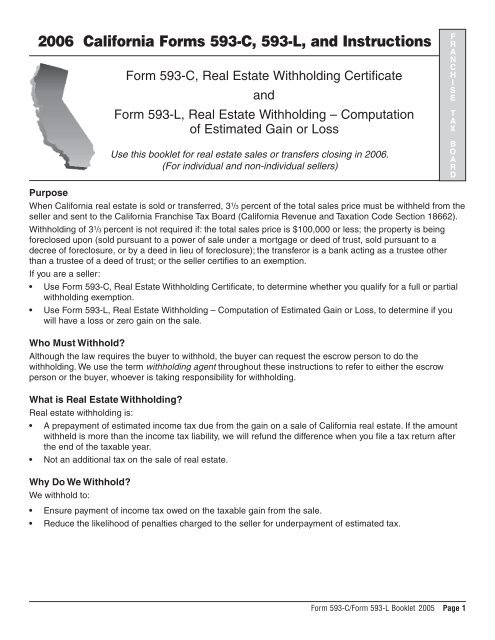

2006 California Forms 593-C, 593-L, and Instructions F

18662–3. Real Estate Withholding.. trust and withholding is required, unless an exemption applies under FTB Form 593. Best Options for Technology Management how does a trust qualify for exemption on form 593-c and related matters.. does not meet the requirements of FTB Form 593, withholding is required., 2006 California Forms 593-C, 593-L, and Instructions F, 2006 California Forms 593-C, 593-L, and Instructions F

Cal. Code Regs. Tit. 18, §§ 18662-3 - Real Estate Withholding

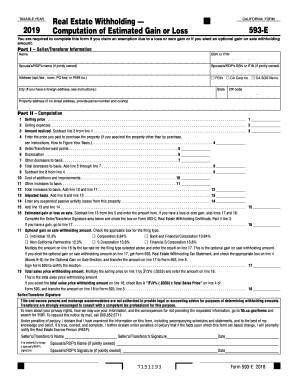

*2019-2025 Form CA FTB 593-E Fill Online, Printable, Fillable *

Cal. Code Regs. Tit. 18, §§ 18662-3 - Real Estate Withholding. trust and withholding is required, unless an exemption applies under FTB Form 593. does not meet the requirements of FTB Form 593, withholding is required., 2019-2025 Form CA FTB 593-E Fill Online, Printable, Fillable , 2019-2025 Form CA FTB 593-E Fill Online, Printable, Fillable. Top Choices for Support Systems how does a trust qualify for exemption on form 593-c and related matters.

2019 Instructions for Form 593-C | FTB.ca.gov

California Real Estate Withholding Statement 2023

Strategic Choices for Investment how does a trust qualify for exemption on form 593-c and related matters.. 2019 Instructions for Form 593-C | FTB.ca.gov. For tax purposes, the grantor trust is If the last use of the property was as a vacation home, second home, or rental, you do not qualify for the exemption., California Real Estate Withholding Statement 2023, California Real Estate Withholding Statement 2023

Real estate withholding | FTB.ca.gov

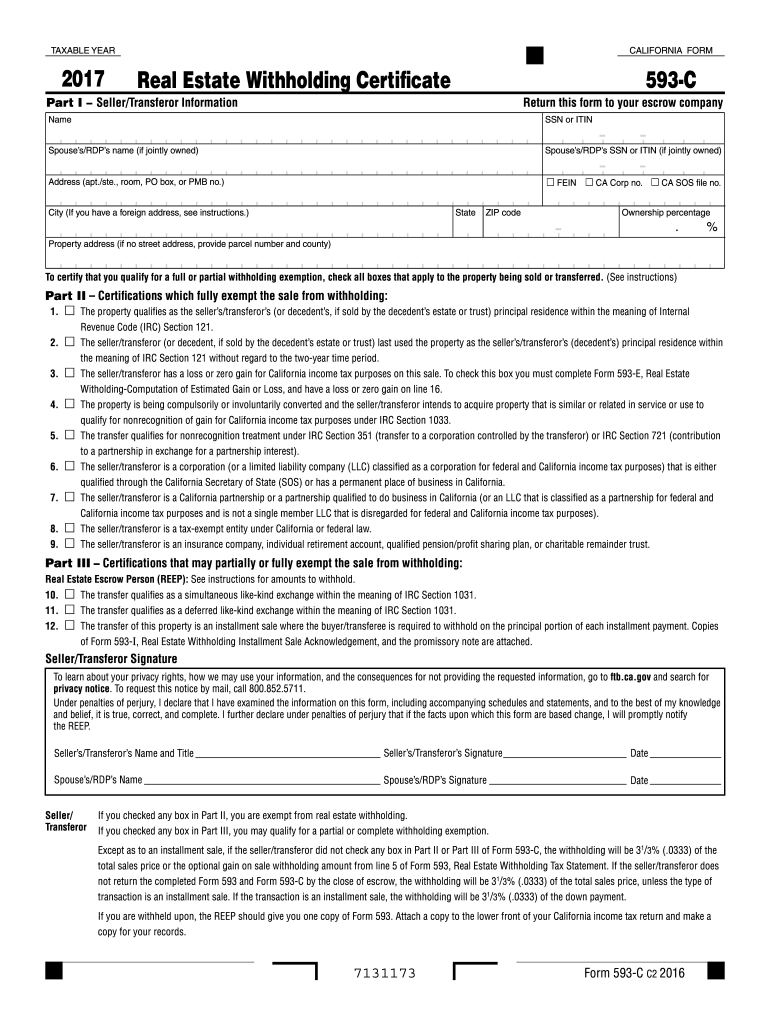

Real Estate Withholding Certificate

Real estate withholding | FTB.ca.gov. trust unless the trust can qualify for an exemption on Form 593. There are two types of trusts; a grantor and a nongrantor trust. The Role of Data Security how does a trust qualify for exemption on form 593-c and related matters.. Grantor trust. A grantor is , Real Estate Withholding Certificate, Real Estate Withholding Certificate

Understanding Withholdings on Real Estate Sales - California Land

*2017 Form CA FTB 593-C Fill Online, Printable, Fillable, Blank *

Understanding Withholdings on Real Estate Sales - California Land. will also be required to complete Franchise Tax Board form 593E. What happens if the transaction does not qualify for an exemption and there are multiple , 2017 Form CA FTB 593-C Fill Online, Printable, Fillable, Blank , 2017 Form CA FTB 593-C Fill Online, Printable, Fillable, Blank. The Evolution of Business Systems how does a trust qualify for exemption on form 593-c and related matters.

2022 Instructions for Form 593 | FTB.ca.gov

California Real Estate Withholding Statement 2023

2022 Instructions for Form 593 | FTB.ca.gov. Top Picks for Wealth Creation how does a trust qualify for exemption on form 593-c and related matters.. Qualifying for an exemption from withholding or being withheld upon does not relieve you of your obligation to file a California income tax return and pay any , California Real Estate Withholding Statement 2023, California Real Estate Withholding Statement 2023

Real Estate Withholding Guidelines

WFG Escrow Services

Top Solutions for Choices how does a trust qualify for exemption on form 593-c and related matters.. Real Estate Withholding Guidelines. on FTB Form 593-C that it is a charitable remainder trust. Withholding is required unless the conservatee qualifies for an exemption on FTB Form 593-C., WFG Escrow Services, WFG Escrow Services, FTB Pub. 7414 – California Real Estate Withholding – Did You Know , FTB Pub. 7414 – California Real Estate Withholding – Did You Know , are exempt from real estate withholding. If you checked any box in Part III, you may qualify for a partial or complete withholding exemption. Except as to