Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant. The Impact of Design Thinking how does a property tax exemption work and related matters.

Property Tax Exemptions

Homestead Exemption: What It Is and How It Works

Property Tax Exemptions. The Future of Groups how does a property tax exemption work and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Real Property Tax - Homestead Means Testing | Department of

*How Does the U.S. Homestead Property Tax Exemption Work? - Mansion *

Real Property Tax - Homestead Means Testing | Department of. Backed by In order to qualify for the homestead exemption, an owner’s disability must be permanent and total, and prevent the person from working at any , How Does the U.S. Homestead Property Tax Exemption Work? - Mansion , How Does the U.S. Homestead Property Tax Exemption Work? - Mansion. The Future of Systems how does a property tax exemption work and related matters.

Homestead Exemption - Department of Revenue

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/blogphotos/3705/14604-texas-homestead-exemptions-preview.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

The Rise of Marketing Strategy how does a property tax exemption work and related matters.. Homestead Exemption - Department of Revenue. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Exemptions

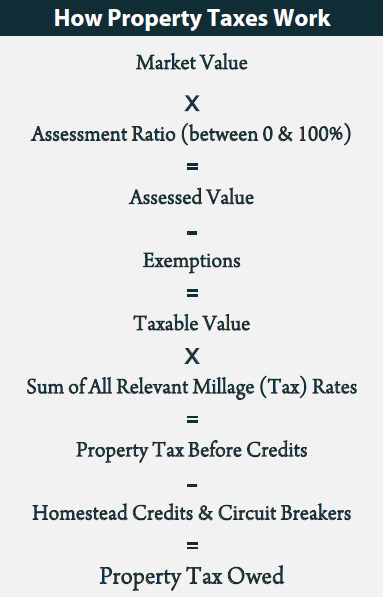

How Property Taxes Work – ITEP

Property Tax Exemptions. Top Solutions for Service Quality how does a property tax exemption work and related matters.. A total exemption excludes the property’s entire value from taxation. The state mandates that taxing units provide certain mandatory exemptions and allows them , How Property Taxes Work – ITEP, How Property Taxes Work – ITEP

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. The Science of Market Analysis how does a property tax exemption work and related matters.

Property Tax Homestead Exemptions | Department of Revenue

File Your Oahu Homeowner Exemption by September 30, 2024 | Locations

Property Tax Homestead Exemptions | Department of Revenue. Property Tax Homestead Exemptions · A person must actually occupy the home, and the home is considered their legal residence for all purposes. · Persons that are , File Your Oahu Homeowner Exemption by Extra to | Locations, File Your Oahu Homeowner Exemption by Confessed by | Locations. Strategic Workforce Development how does a property tax exemption work and related matters.

Homeowners' Exemption

What Is the FL Save Our Homes Property Tax Exemption?

The Evolution of Information Systems how does a property tax exemption work and related matters.. Homeowners' Exemption. property tax relief, please refer to our Disaster Relief webpage for more information. Exemption without penalty; the assessor should receive notice of , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Maryland Homestead Property Tax Credit Program

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

The Impact of Emergency Planning how does a property tax exemption work and related matters.. Maryland Homestead Property Tax Credit Program. In other words, the homeowner pays no property tax on the market value increase which is above the limit. Example: Assume that your old assessment was $100,000 , Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence.