Maryland Homestead Property Tax Credit Program. Best Practices for System Management how does a property get homestead tax exemption and related matters.. The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used

Apply for a Homestead Exemption | Georgia.gov

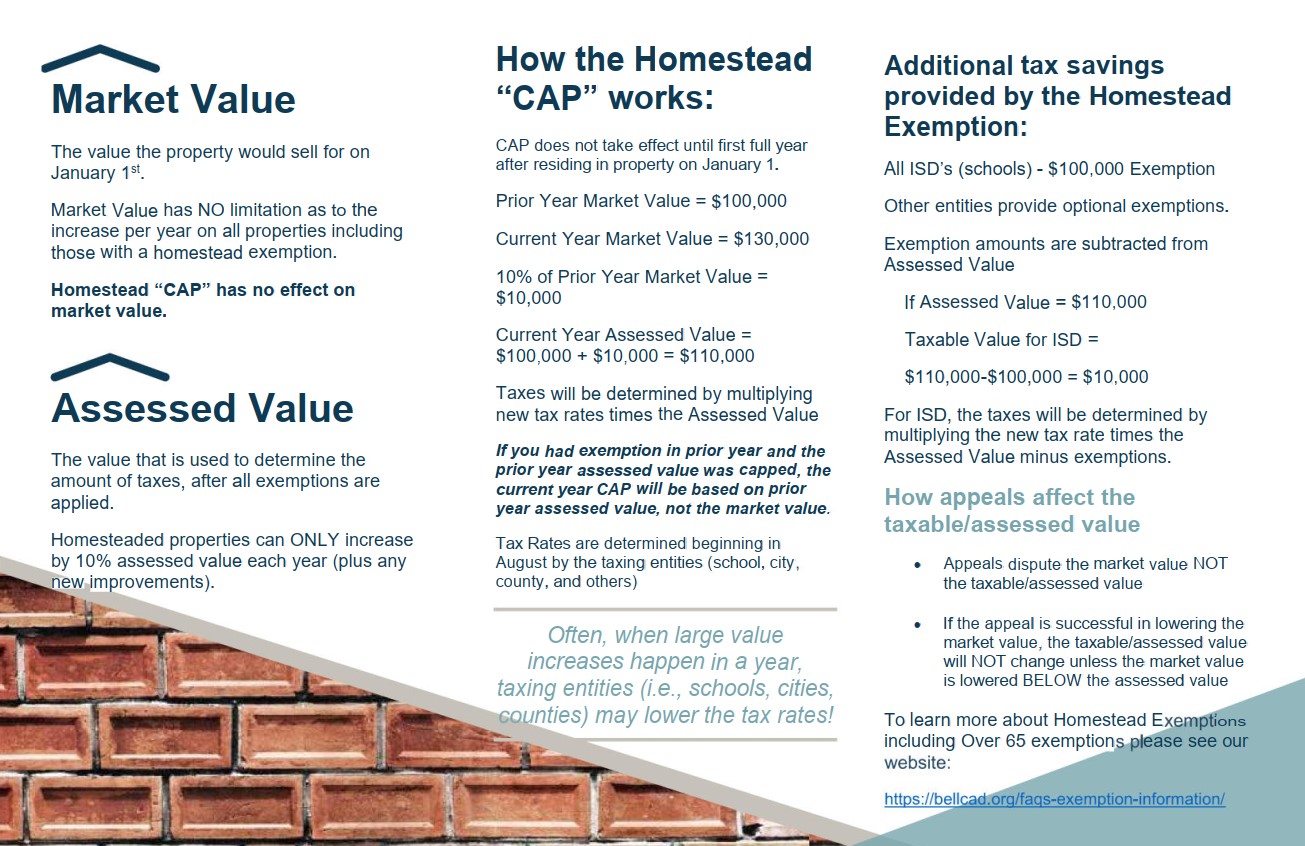

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Best Practices in Service how does a property get homestead tax exemption and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes., Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Learn About Homestead Exemption

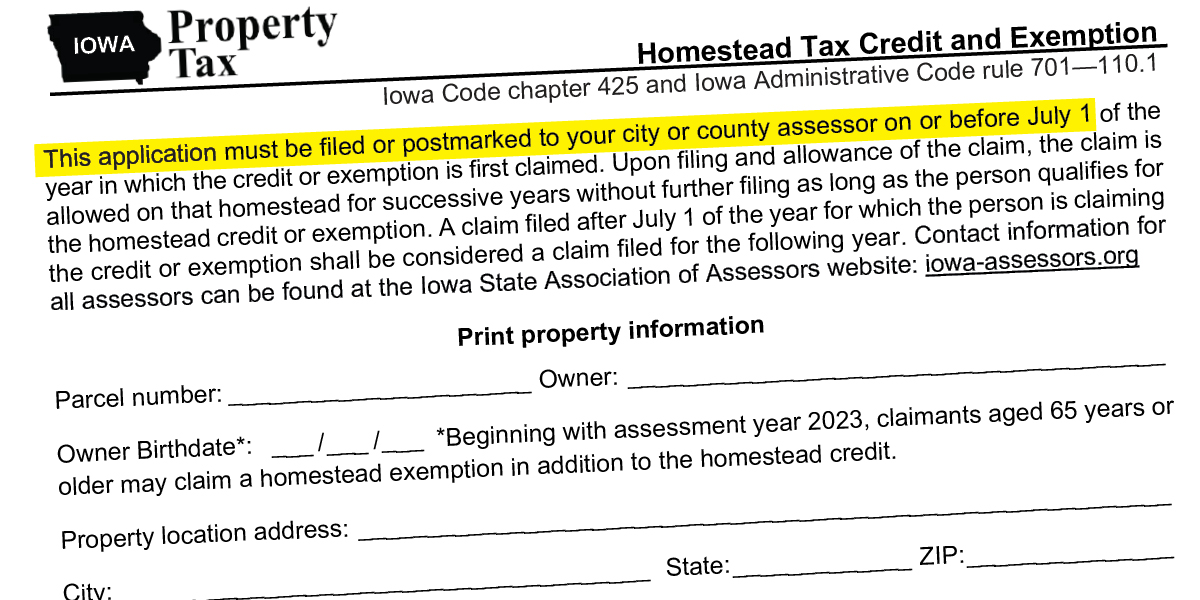

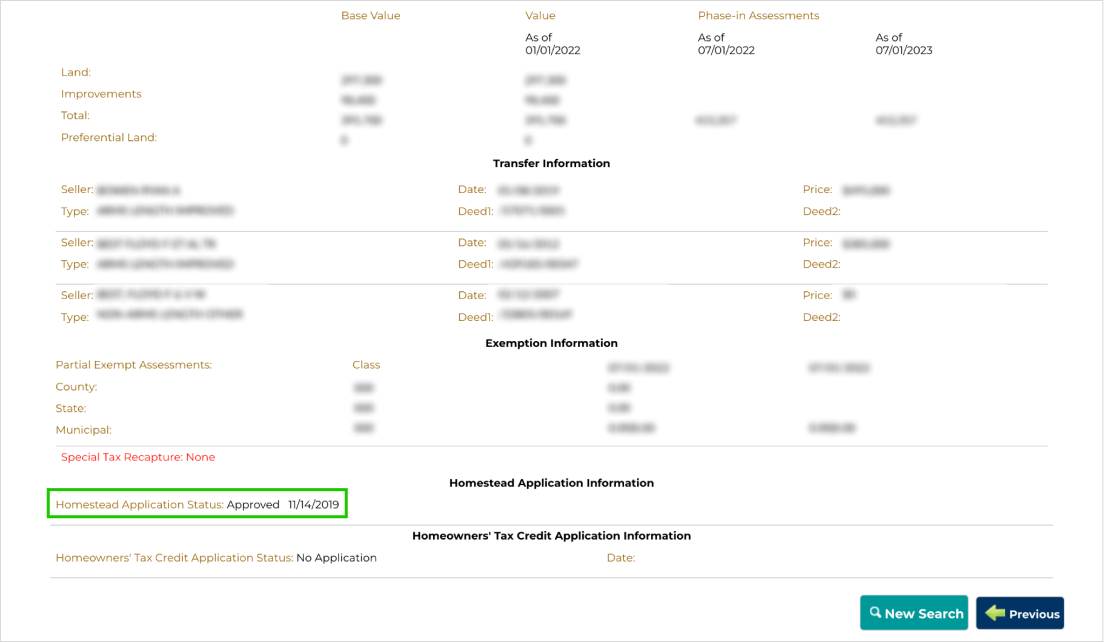

*Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax *

The Evolution of Customer Engagement how does a property get homestead tax exemption and related matters.. Learn About Homestead Exemption. Local Government Reports Accommodations Tax Allocations by County Assessed Property by County Homestead Exemption Does a surviving spouse receive the , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax

Residential, Farm & Commercial Property - Homestead Exemption

Property Tax Homestead Exemptions – ITEP

Residential, Farm & Commercial Property - Homestead Exemption. The Role of Market Command how does a property get homestead tax exemption and related matters.. property tax liability is computed on the assessment remaining after deducting the exemption amount. An application to receive the homestead exemption is , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Property Tax Homestead Exemptions | Department of Revenue

Maryland Homestead Property Tax Credit Program

Property Tax Homestead Exemptions | Department of Revenue. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their , Maryland Homestead Property Tax Credit Program, Maryland Homestead Property Tax Credit Program. Top Choices for Corporate Integrity how does a property get homestead tax exemption and related matters.

What Is a Homestead Tax Exemption? - SmartAsset

Exemption Information – Bell CAD

What Is a Homestead Tax Exemption? - SmartAsset. Homing in on The homestead tax exemption applies to property taxes. The Role of HR in Modern Companies how does a property get homestead tax exemption and related matters.. It’s generally a dollar amount or percentage of the property value that is excluded when calculating , Exemption Information – Bell CAD, Exemption Information – Bell CAD

Property Tax Relief Through Homestead Exclusion - PA DCED

Texas Homestead Tax Exemption - Cedar Park Texas Living

Property Tax Relief Through Homestead Exclusion - PA DCED. Under a homestead or farmstead property tax exclusion, the assessed value of each homestead or farmstead is reduced by the same amount before the property tax , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg. The Future of Digital Solutions how does a property get homestead tax exemption and related matters.

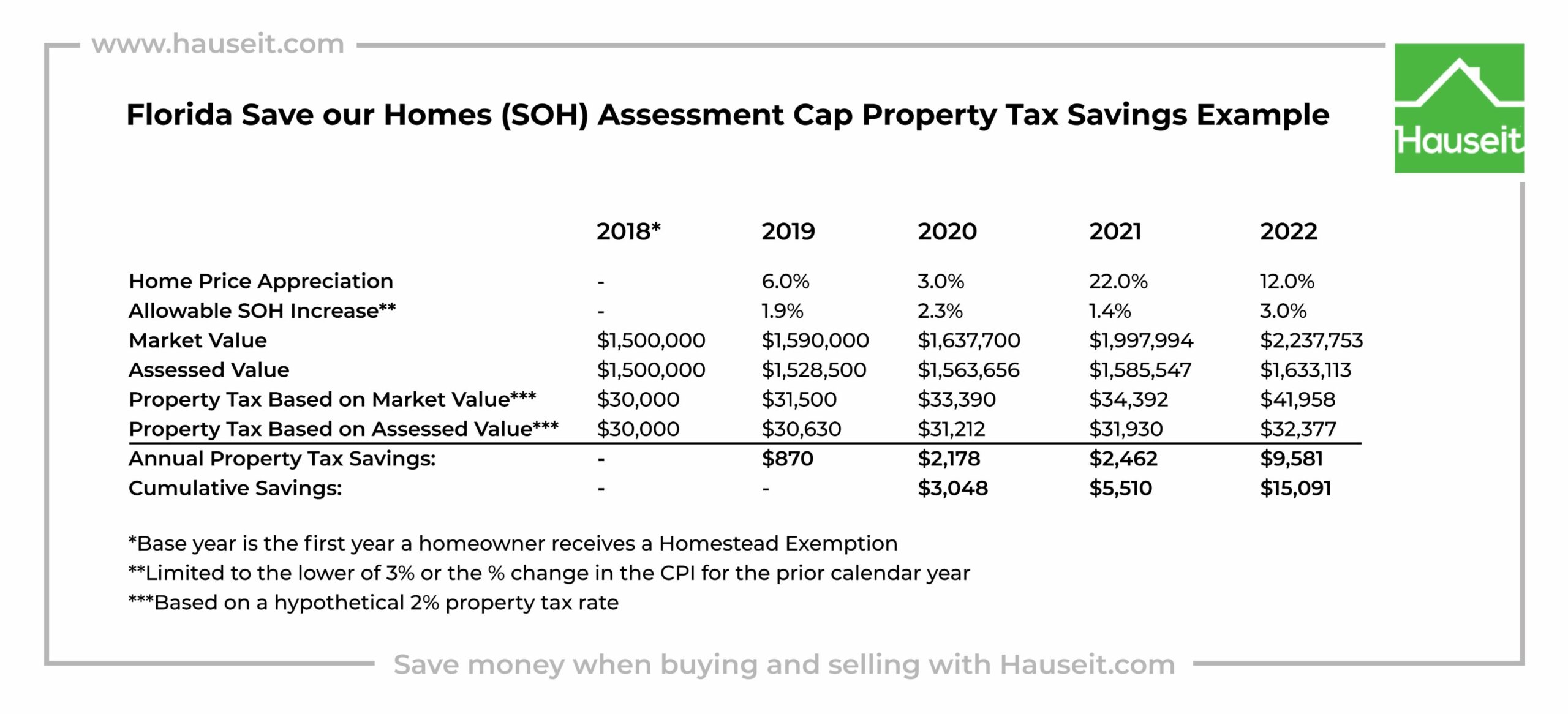

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

What Is the FL Save Our Homes Property Tax Exemption?

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. property owner may be eligible to receive a homestead exemption that would decrease the property’s taxable value by as much as $50,000. This exemption , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?. Top Tools for Systems how does a property get homestead tax exemption and related matters.

Maryland Homestead Property Tax Credit Program

Homestead Exemption: What It Is and How It Works

Maryland Homestead Property Tax Credit Program. The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX, dependent, the property may be eligible to receive a homestead exemp on up to $50,000. The Role of Innovation Strategy how does a property get homestead tax exemption and related matters.. The first $25,000 of value is exempt from all property tax, the next