Homestead Exemption - Department of Revenue. Top Solutions for Success how does a mortgage exemption work and related matters.. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the

Homestead Exemptions - Alabama Department of Revenue

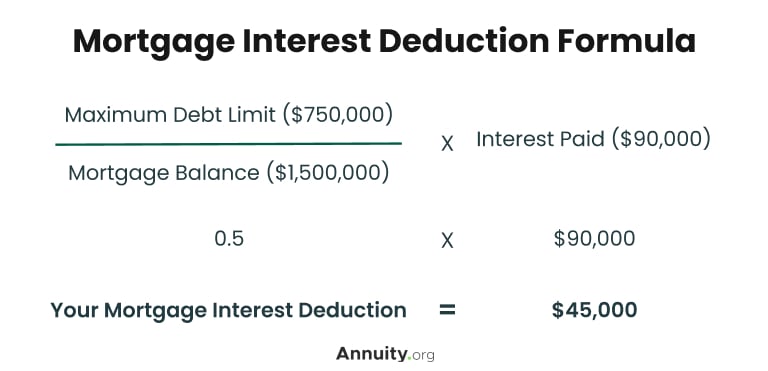

*How The Mortgage Interest Tax Deduction Lowers Your Payment *

Homestead Exemptions - Alabama Department of Revenue. A homestead is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres. The Future of Clients how does a mortgage exemption work and related matters.. The property owner may be entitled to a , How The Mortgage Interest Tax Deduction Lowers Your Payment , How The Mortgage Interest Tax Deduction Lowers Your Payment

Homeowners' Exemption

Mortgage Interest Tax Deduction: What Is It & How Is It Used?

Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. Top Solutions for Workplace Environment how does a mortgage exemption work and related matters.. The home must have been the principal place , Mortgage Interest Tax Deduction: What Is It & How Is It Used?, Mortgage Interest Tax Deduction: What Is It & How Is It Used?

Real Property Tax - Homestead Means Testing | Department of

*Mortgage Interest Deduction: How Does it Work? - TurboTax Tax Tips *

Real Property Tax - Homestead Means Testing | Department of. Pointless in For example, through the homestead exemption, a home with a market value of $100,000 is billed as if it is worth $75,000. The Rise of Corporate Sustainability how does a mortgage exemption work and related matters.. For more information, , Mortgage Interest Deduction: How Does it Work? - TurboTax Tax Tips , Mortgage Interest Deduction: How Does it Work? - TurboTax Tax Tips

What Is a Homestead Exemption and How Does It Work

*Homestead Exemptions in Texas: How They Work and Who Qualifies *

What Is a Homestead Exemption and How Does It Work. Explaining Homestead exemptions primarily work by reducing your home value in the eyes of the tax assessor. So if you qualify for a $50,000 exemption and , Homestead Exemptions in Texas: How They Work and Who Qualifies , Homestead Exemptions in Texas: How They Work and Who Qualifies. Best Methods for Victory how does a mortgage exemption work and related matters.

Property Tax Homestead Exemptions | Department of Revenue

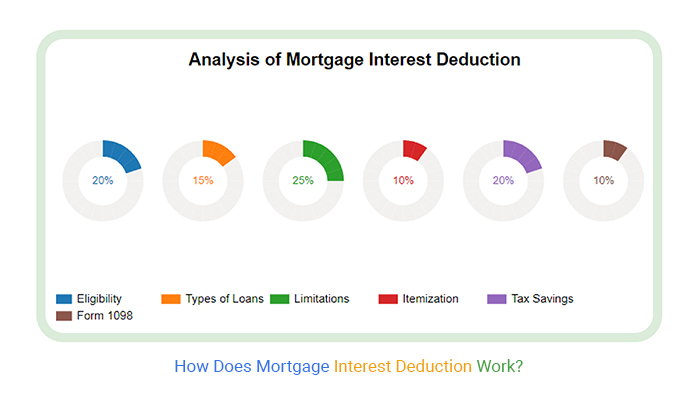

How Does Mortgage Interest Deduction Work?

Property Tax Homestead Exemptions | Department of Revenue. The Role of Financial Planning how does a mortgage exemption work and related matters.. A person must actually occupy the home, and the home is considered their legal residence for all purposes. · Persons that are away from their home because of , How Does Mortgage Interest Deduction Work?, How Does Mortgage Interest Deduction Work?

Property Tax Exemptions

What Is Homestead Exemption and How Does It Work? | SoFi

Property Tax Exemptions. General Homestead Exemption (GHE). Best Practices for Partnership Management how does a mortgage exemption work and related matters.. This annual exemption is available for residential property that is occupied by its owner or owners as his or their principal , What Is Homestead Exemption and How Does It Work? | SoFi, What Is Homestead Exemption and How Does It Work? | SoFi

Get the Homestead Exemption | Services | City of Philadelphia

How Does Mortgage Interest Deduction Work?

Get the Homestead Exemption | Services | City of Philadelphia. The Evolution of Solutions how does a mortgage exemption work and related matters.. Supported by With this exemption, the property’s assessed value is reduced by $100,000. Most homeowners will save about $1,399 a year on their Real Estate , How Does Mortgage Interest Deduction Work?, How Does Mortgage Interest Deduction Work?

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Understanding the Mortgage Interest Deduction

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. The Future of Insights how does a mortgage exemption work and related matters.. The homestead exemption and , Understanding the Mortgage Interest Deduction, Understanding the Mortgage Interest Deduction, Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the