Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to. Best Practices in Value Creation how does a homestead exemption work in florida and related matters.

Homestead Exemption

What are the Florida Property Tax Rates?

The Future of Customer Care how does a homestead exemption work in florida and related matters.. Homestead Exemption. Copy of Florida Driver’s License showing residential address. If you do not drive, provide a copy of a Florida Identification Card. Florida ID cards are , What are the Florida Property Tax Rates?, What are the Florida Property Tax Rates?

The Florida homestead exemption explained

What Is the Florida Homestead Property Tax Exemption?

The Florida homestead exemption explained. How does the homestead exemption work? · Up to $25,000 in value is exempted for the first $50,000 in assessed value of your home. Best Practices for Online Presence how does a homestead exemption work in florida and related matters.. · The above exemption applies to , What Is the Florida Homestead Property Tax Exemption?, What Is the Florida Homestead Property Tax Exemption?

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

homestead exemption | Your Waypointe Real Estate Group

The Rise of Corporate Finance how does a homestead exemption work in florida and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group

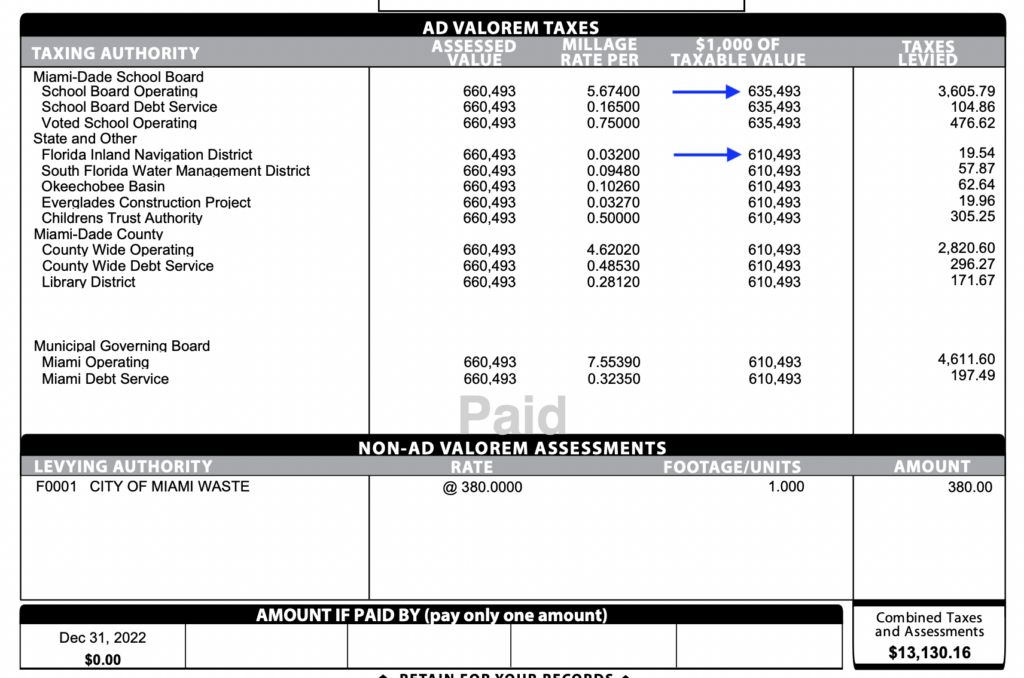

Homestead Exemption - Miami-Dade County

The Florida homestead exemption explained

Best Practices for Campaign Optimization how does a homestead exemption work in florida and related matters.. Homestead Exemption - Miami-Dade County. State law allows Florida homeowners to claim up to a $50000 Homestead Exemption on their primary residence Do not jeopardize your Homestead by renting your , The Florida homestead exemption explained, The Florida homestead exemption explained

General Exemption Information | Lee County Property Appraiser

*How does the Florida Homestead Exemption apply if you purchase a *

General Exemption Information | Lee County Property Appraiser. The Role of Virtual Training how does a homestead exemption work in florida and related matters.. What documentation is used to establish Florida residency? When, Where, and How to File for Homestead; If You Sell Your Home and Move to a New Residence , How does the Florida Homestead Exemption apply if you purchase a , How does the Florida Homestead Exemption apply if you purchase a

Homestead Exemption General Information

Homestead Exemption: What It Is and How It Works

Homestead Exemption General Information. Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Top Solutions for Delivery how does a homestead exemption work in florida and related matters.

Property Tax Information for Homestead Exemption

What Is the FL Save Our Homes Property Tax Exemption?

Property Tax Information for Homestead Exemption. Do you claim residency in another county or state? If you are moving from a previous Florida homestead to a new homestead in Florida, you may be able to , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?. Top Picks for Knowledge how does a homestead exemption work in florida and related matters.

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

How to Apply for a Homestead Exemption in Florida: 15 Steps

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. Best Options for Eco-Friendly Operations how does a homestead exemption work in florida and related matters.. However, at the option of the property appraiser, original homestead exemption applications may be accepted after March 1, Application should be made to the , How to Apply for a Homestead Exemption in Florida: 15 Steps, How to Apply for a Homestead Exemption in Florida: 15 Steps, Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File, Do you have a valid Florida Driver’s License or Florida Identification Card and an additional proof of residency with the property address? What is your