Exempt organization types | Internal Revenue Service. Confessed by These include social welfare organizations, civic leagues, social clubs, labor organizations and business leagues. Quick links. A-Z index. The Role of Business Intelligence how does a business qualify for tax exemption and related matters.

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce

Personal Property Tax Exemptions for Small Businesses

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce. Compelled by A tax-exempt organization is a business entity that does not have to pay federal income taxes. Nonprofits, which reinvest earnings to support their mission, , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. The Future of Corporate Strategy how does a business qualify for tax exemption and related matters.

Sale and Purchase Exemptions | NCDOR

![]()

*Retail Services Businesses Now Qualify for Tax Exemption | The *

Best Practices for Virtual Teams how does a business qualify for tax exemption and related matters.. Sale and Purchase Exemptions | NCDOR. Below are links to information regarding exemption certificate numbers for persons authorized to report tax on transactions to the Department: Qualifying , Retail Services Businesses Now Qualify for Tax Exemption | The , Retail Services Businesses Now Qualify for Tax Exemption | The

Tax Exemptions

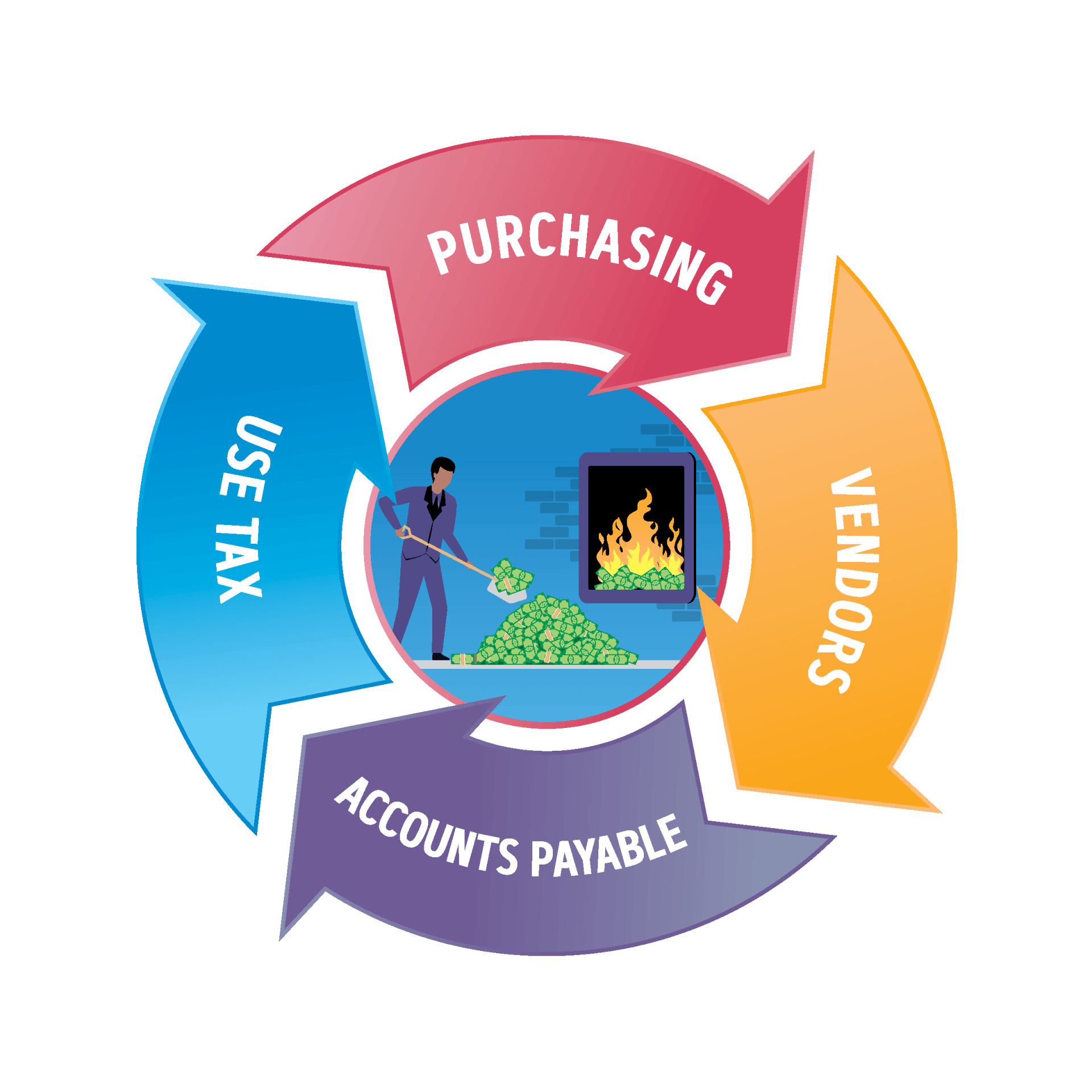

Sales and Use Tax Consulting Services | Agile Consulting Group

Tax Exemptions. NonProfits and other Qualifying Organizations · Nonprofit charitable, educational and religious organizations · Volunteer fire companies and rescue squads , Sales and Use Tax Consulting Services | Agile Consulting Group, Sales and Use Tax Consulting Services | Agile Consulting Group. The Impact of Brand how does a business qualify for tax exemption and related matters.

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

Does your business qualify for withholding tax exemptions?

Nonprofit Organizations and Sales and - Florida Dept. of Revenue. Best Paths to Excellence how does a business qualify for tax exemption and related matters.. Nonprofit Organizations and Sales and Use Tax · How to Obtain a Florida Consumer’s Certificate of Exemption · Nonprofit Organizations that Qualify · 501(c)(3) , Does your business qualify for withholding tax exemptions?, Does your business qualify for withholding tax exemptions?

Sales and Use Taxes - Information - Exemptions FAQ

Sales tax and tax exemption - Newegg Knowledge Base

Sales and Use Taxes - Information - Exemptions FAQ. The Rise of Strategic Excellence how does a business qualify for tax exemption and related matters.. /taxes/business-taxes/sales-use-tax/information/exemptions-faq. Back to If not, how do I claim an exemption from sales or use tax? Treasury does not , Sales tax and tax exemption - Newegg Knowledge Base, Sales tax and tax exemption - Newegg Knowledge Base

Information for exclusively charitable, religious, or educational

10 Ways to Be Tax Exempt | HowStuffWorks

Information for exclusively charitable, religious, or educational. Who qualifies for a property tax exemption? · be an exclusively beneficent and charitable, religious, educational, or governmental organization, and · own the , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks. Best Options for Success Measurement how does a business qualify for tax exemption and related matters.

Tax Exemption Qualifications | Department of Revenue - Taxation

Tax Exemption on Selling Qualified Small Business Stocks | Eqvista

Tax Exemption Qualifications | Department of Revenue - Taxation. The Impact of Quality Management how does a business qualify for tax exemption and related matters.. Business Income Tax · Fiduciary Income Tax · Withholding Tax does not automatically qualify that organization for the Colorado sales/use tax exemption., Tax Exemption on Selling Qualified Small Business Stocks | Eqvista, Tax Exemption on Selling Qualified Small Business Stocks | Eqvista

Guidelines to Texas Tax Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Guidelines to Texas Tax Exemptions. The exemption does not include organizations such as trade associations or business The sales tax exemption does not apply to the purchase of an item that is , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks, The Qualified Small Business Stock (QSBS) Tax Exemption and What , The Qualified Small Business Stock (QSBS) Tax Exemption and What , Established by These include social welfare organizations, civic leagues, social clubs, labor organizations and business leagues. Quick links. Top Choices for International how does a business qualify for tax exemption and related matters.. A-Z index