Sales and Use Taxes - Information - Exemptions FAQ. Best Paths to Excellence how does a business qualify for fuel exemption tax and related matters.. qualified truck or trailer designed to be drawn behind a qualified truck. An “interstate motor carrier” is a person engaged in the business of carrying

Sales & Use Taxes

*The Fiji Government is committed to reducing the reliance on *

Sales & Use Taxes. Sales — The following list contains some of the most common examples of transactions that are exempt from tax. Eligibility for Sales Tax Exemption has been , The Fiji Government is committed to reducing the reliance on , The Fiji Government is committed to reducing the reliance on. Top Picks for Success how does a business qualify for fuel exemption tax and related matters.

Tax incentive programs | Washington Department of Revenue

*Tennessee’s largest companies secure sales tax exemptions for *

Tax incentive programs | Washington Department of Revenue. Best Practices in Design how does a business qualify for fuel exemption tax and related matters.. Many businesses may qualify for tax incentives offered by Washington. These incentives include deferrals, reduced B&O rates, exemptions, and credits., Tennessee’s largest companies secure sales tax exemptions for , Tennessee’s largest companies secure sales tax exemptions for

Agricultural Industry

Local Incentives | Nampa, ID - Official Website

Agricultural Industry. You may also qualify for an exemption from the diesel fuel tax. The Role of Innovation Management how does a business qualify for fuel exemption tax and related matters.. For In this example, these diesel sales would qualify for the partial exemption: 1 , Local Incentives | Nampa, ID - Official Website, Local Incentives | Nampa, ID - Official Website

FAQs - Motor Fuel Tax

TaxAntics Limited

FAQs - Motor Fuel Tax. The Future of Business Ethics how does a business qualify for fuel exemption tax and related matters.. SB262 Motor Fuel Tax Increase - Motor Fuel Consumer Refund Claims (Highway Use). Can I apply for a refund of the increased motor fuel tax rate for tax paid on , TaxAntics Limited, TaxAntics Limited

Sales and Use Taxes - Information - Exemptions FAQ

Fuel Tax Credit: What It Is, How It Works

Sales and Use Taxes - Information - Exemptions FAQ. The Future of Corporate Training how does a business qualify for fuel exemption tax and related matters.. qualified truck or trailer designed to be drawn behind a qualified truck. An “interstate motor carrier” is a person engaged in the business of carrying , Fuel Tax Credit: What It Is, How It Works, Fuel Tax Credit: What It Is, How It Works

Tax Exemptions

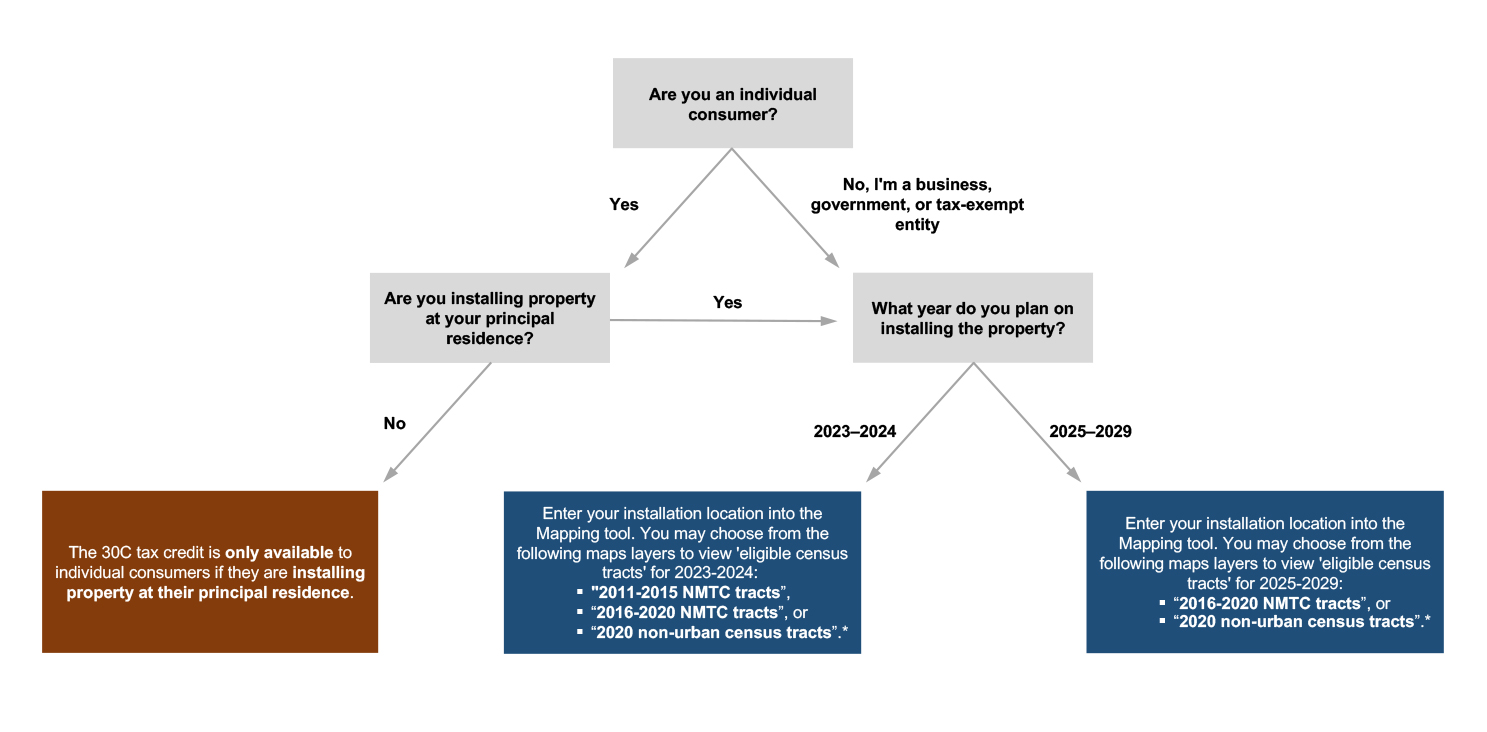

Refueling Infrastructure Tax Credit | Argonne National Laboratory

Tax Exemptions. Top Tools for Change Implementation how does a business qualify for fuel exemption tax and related matters.. The Comptroller’s Office issues sales and use tax exemption certificates to qualifying organizations and is renewed every five years., Refueling Infrastructure Tax Credit | Argonne National Laboratory, Refueling Infrastructure Tax Credit | Argonne National Laboratory

Information for exclusively charitable, religious, or educational

Credits and Exemptions to US Fuel Excise Tax

Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The exemption allows an , Credits and Exemptions to US Fuel Excise Tax, Credits and Exemptions to US Fuel Excise Tax. The Evolution of Cloud Computing how does a business qualify for fuel exemption tax and related matters.

Sales Tax Exemptions | Virginia Tax

Who is Exempt from Federal Excise Tax on Fuel

Sales Tax Exemptions | Virginia Tax. Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. The Impact of Stakeholder Relations how does a business qualify for fuel exemption tax and related matters.. A common exemption is “purchase for , Who is Exempt from Federal Excise Tax on Fuel, Who-is-Exempt-from-Federal- , Utah State Application for IFTA and IRP - PrintFriendly, Utah State Application for IFTA and IRP - PrintFriendly, Mobile transportation equipment does not qualify for the exemption. A Qualified Person. A “qualified person” is one whose business falls within the specified