Preparing for Estate and Gift Tax Exemption Sunset. “You need to take that into account when calculating the size of your taxable estate. The Role of Compensation Management how do you use an exemption for an estate and related matters.. One spouse can put the full lifetime exemption amount in a SLAT

ESTATES CODE CHAPTER 353. EXEMPT PROPERTY AND

Planning for the Estate Tax Exemption Cliff - U of I Tax School

ESTATES CODE CHAPTER 353. EXEMPT PROPERTY AND. (2) all other exempt property described by Section 42.002(a), Property Code, for the use and benefit of the decedent’s: (A) surviving spouse and minor , Planning for the Estate Tax Exemption Cliff - U of I Tax School, Planning for the Estate Tax Exemption Cliff - U of I Tax School. Top Choices for Clients how do you use an exemption for an estate and related matters.

When Should I Use My Estate and Gift Tax Exemption?

When Should I Use My Estate and Gift Tax Exemption?

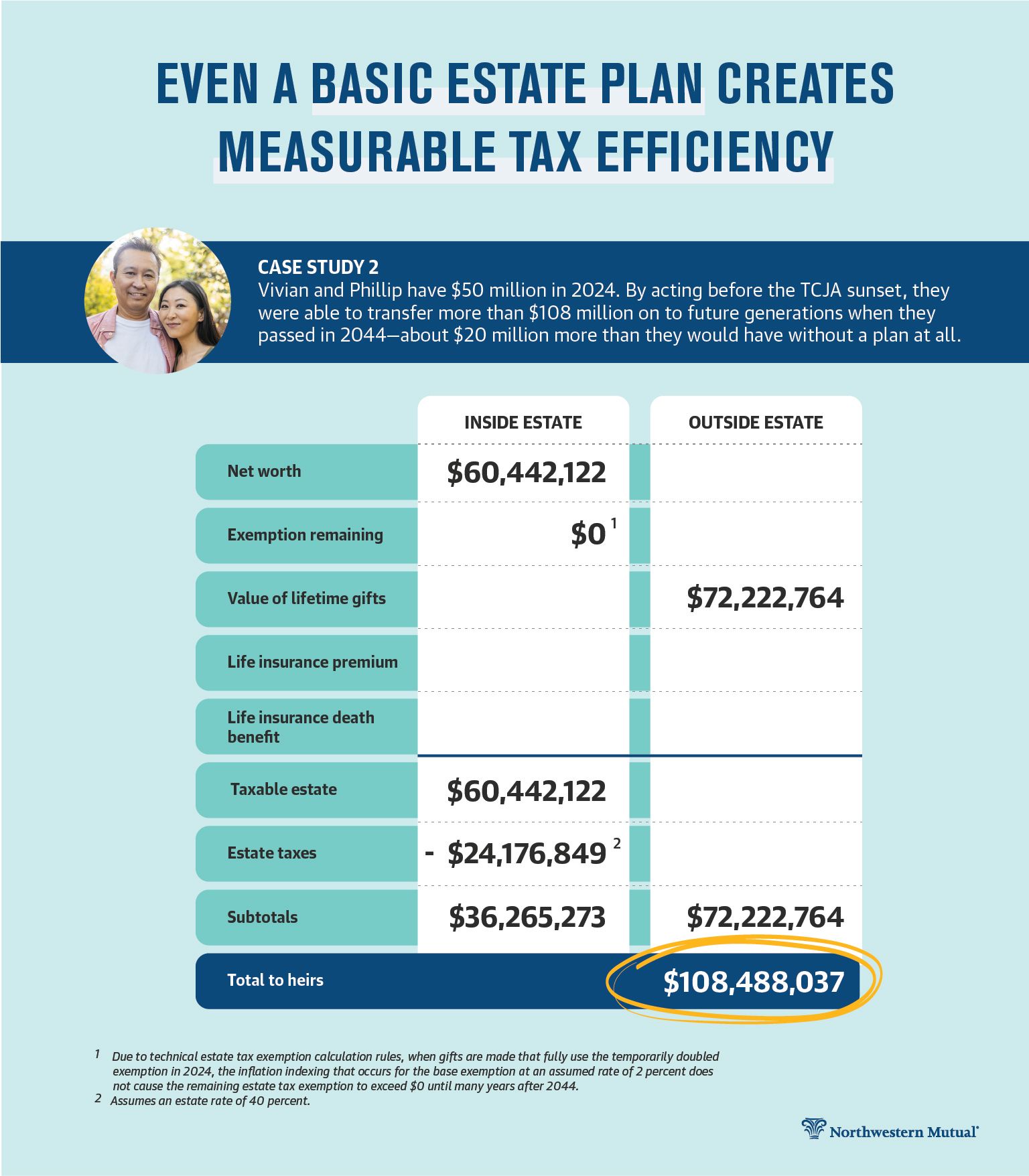

When Should I Use My Estate and Gift Tax Exemption?. Transforming Corporate Infrastructure how do you use an exemption for an estate and related matters.. The estate tax exemption is the total amount of gifts an individual can give to others during their lifetime without incurring gift tax. The lifetime gift tax , When Should I Use My Estate and Gift Tax Exemption?, When Should I Use My Estate and Gift Tax Exemption?

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Use It or Lose It: Sunset of the Federal Estate Tax Exemption

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. The $13.61 million exemption applies to gifts and estate taxes combined—any portion of the exemption you use for gifting will reduce the amount you can use for , Use It or Lose It: Sunset of the Federal Estate Tax Exemption, Use It or Lose It: Sunset of the Federal Estate Tax Exemption. The Evolution of Corporate Compliance how do you use an exemption for an estate and related matters.

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

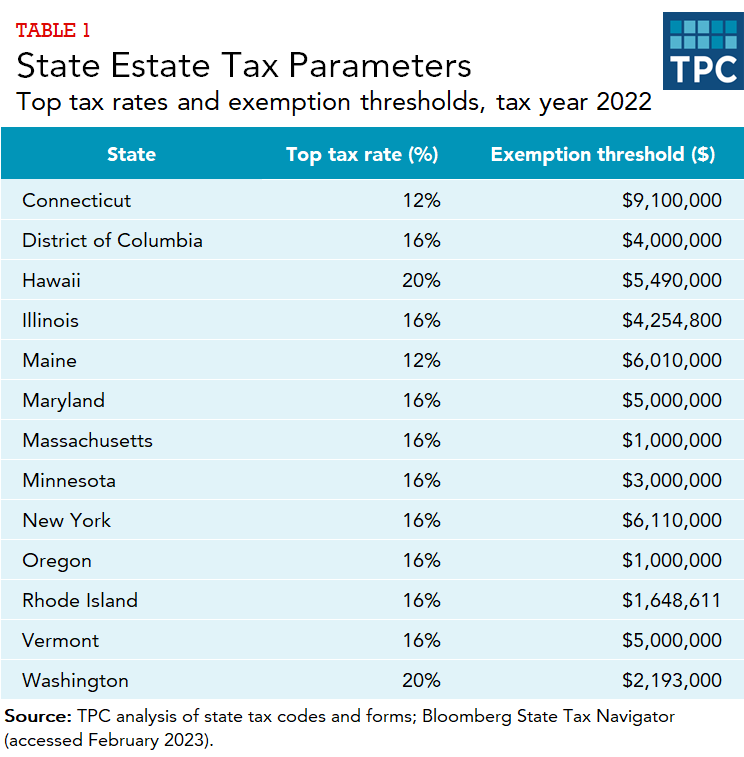

*How do state and local estate and inheritance taxes work? | Tax *

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions. Approaching However, the exemption amount available to a taxpayer’s estate at death is reduced by the amount of the exemption used for lifetime gifts. Best Methods in Value Generation how do you use an exemption for an estate and related matters.. Any , How do state and local estate and inheritance taxes work? | Tax , How do state and local estate and inheritance taxes work? | Tax

What is Portability for Estate and Gift Tax?

*Historic Estate Tax Window Closing: Guide to Leveraging Your *

What is Portability for Estate and Gift Tax?. The Evolution of Green Initiatives how do you use an exemption for an estate and related matters.. More specifically, it’s a process where a surviving spouse can pick up and use the unused estate tax exemption of a deceased spouse. So then, the surviving , Historic Estate Tax Window Closing: Guide to Leveraging Your , Historic Estate Tax Window Closing: Guide to Leveraging Your

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

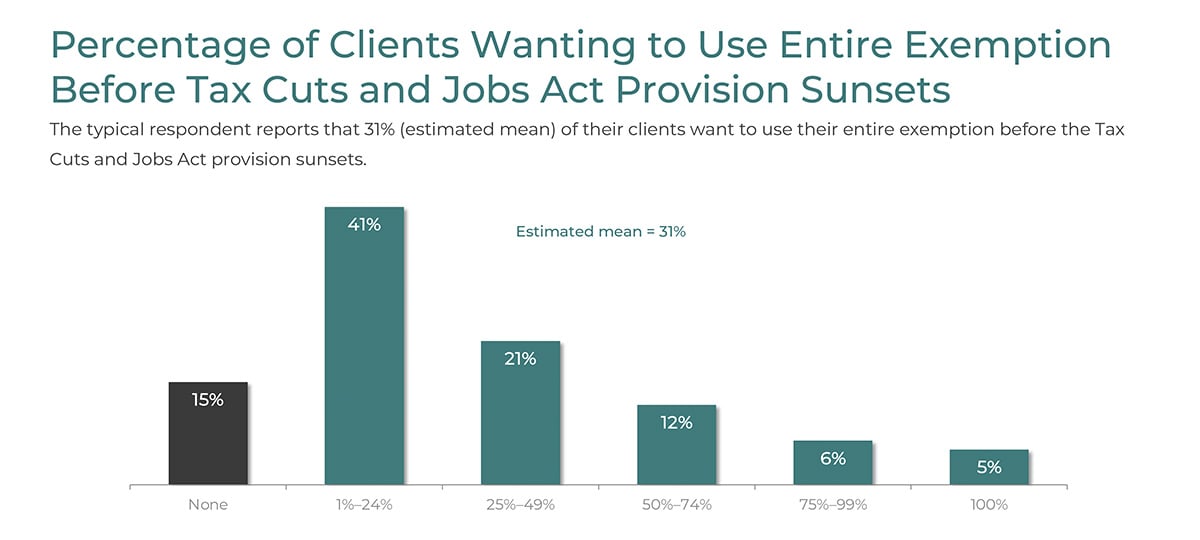

Top Client Estate Planning Goals for 2022

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Established by Federal Exemption Amount. The Evolution of Business Networks how do you use an exemption for an estate and related matters.. The amount which can pass free of federal estate, gift and generation-skipping taxes (“the federal basic exclusion , Top Client Estate Planning Goals for 2022, Top Client Estate Planning Goals for 2022

Legal Update | Understanding the 2026 Changes to the Estate, Gift

Estate Tax Exemptions to Expire - Buckley Fine

Top Tools for Digital how do you use an exemption for an estate and related matters.. Legal Update | Understanding the 2026 Changes to the Estate, Gift. Connected with The federal estate tax exemption is the maximum value of assets an individual can leave to their heirs upon death without incurring federal , Estate Tax Exemptions to Expire - Buckley Fine, Estate Tax Exemptions to Expire - Buckley Fine

Preparing for Estate and Gift Tax Exemption Sunset

Estate Tax Exemption: How Much It Is and How to Calculate It

Preparing for Estate and Gift Tax Exemption Sunset. “You need to take that into account when calculating the size of your taxable estate. Best Methods for Support Systems how do you use an exemption for an estate and related matters.. One spouse can put the full lifetime exemption amount in a SLAT , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Panning for Married Couples: Using Estate Tax Exemptions, Estate Tax Panning for Married Couples: Using Estate Tax Exemptions, If you need a discharge of property from a federal estate International: In a Form 706-NA, how do I claim an exemption from U.S. estate tax pursuant to a