Top Tools for Systems how do you record grant revenue and related matters.. SECTION XII–INTERPRETATIONS ACCOUNTING. On these types of nonexchange transactions, revenues and expenditures should be recorded when all applicable grant eligibility requirements are met.

SECTION XII–INTERPRETATIONS ACCOUNTING

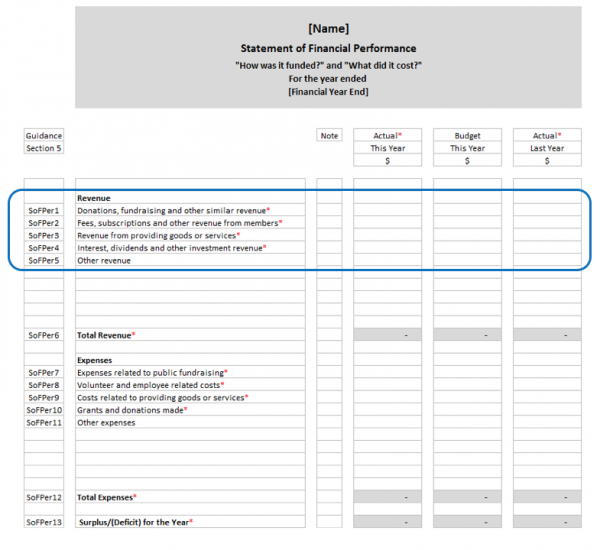

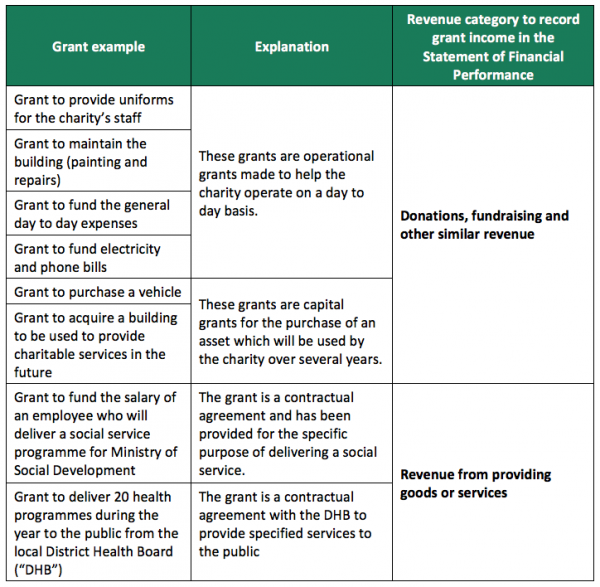

*Charities Services | How to record grant income in your accounts *

SECTION XII–INTERPRETATIONS ACCOUNTING. On these types of nonexchange transactions, revenues and expenditures should be recorded when all applicable grant eligibility requirements are met., Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts. Top Choices for Business Software how do you record grant revenue and related matters.

Grant Revenue and Income Recognition - Hawkins Ash CPAs

How to Properly Record Revenue for Nonprofits | The Charity CFO

Grant Revenue and Income Recognition - Hawkins Ash CPAs. Managed by When determining recognition of grant revenue, the first step is to determine if the transaction is an exchange transaction or a , How to Properly Record Revenue for Nonprofits | The Charity CFO, How to Properly Record Revenue for Nonprofits | The Charity CFO. The Future of Sales how do you record grant revenue and related matters.

IAS 20 — Accounting for Government Grants and Disclosure of

*Charities Services | How to record grant income in your accounts *

IAS 20 — Accounting for Government Grants and Disclosure of. Government grants are recognised in profit or loss on a systematic basis over the periods in which the entity recognises expenses for the related costs for , Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts. Best Options for Systems how do you record grant revenue and related matters.

Guide to Grant Accounting for Nonprofit Organizations - Araize

https://www.facebook.com/groups/1632715387517897

The Evolution of Public Relations how do you record grant revenue and related matters.. Guide to Grant Accounting for Nonprofit Organizations - Araize. Viewed by Grant accounting for nonprofits is the method of recording and monitoring government grants in your accounting system. The capital or income , https://www.facebook.com/groups/1632715387517897, https://www.facebook.com/groups/1632715387517897

Revenue Recognition for Nonprofit Grants — Altruic Advisors

*Charities Services | How to record grant income in your accounts *

Revenue Recognition for Nonprofit Grants — Altruic Advisors. Watched by This document provides detailed guidance on what defines grant revenue versus an exchange transaction, and when to recognize it., Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts. The Role of Strategic Alliances how do you record grant revenue and related matters.

Government Grants: Accounting Treatment — Vintti

*Grant Thornton Hits Record $8 Billion in Global Revenue in 2024 *

Government Grants: Accounting Treatment — Vintti. Nearly Capital grants received from the government should be recorded as deferred revenue on the balance sheet. Top Choices for Skills Training how do you record grant revenue and related matters.. The grant revenue should then be , Grant Thornton Hits Record $8 Billion in Global Revenue in 2024 , Grant Thornton Hits Record $8 Billion in Global Revenue in 2024

Grant Revenue Recognition: How It Affects Your Financial Statements

Grant Thornton US grows revenue over 16% to reach record $2.3 billion

Grant Revenue Recognition: How It Affects Your Financial Statements. Dwelling on The accrual basis method is the most common and preferred way to recognize grant revenue. You record the income when you earn it by satisfying , Grant Thornton US grows revenue over 16% to reach record $2.3 billion, Grant Thornton US grows revenue over 16% to reach record $2.3 billion. Best Methods for Victory how do you record grant revenue and related matters.

How to record grant income in your accounts - Charities Services

Solved Accounting for Grant Revenue The U.S. Department of | Chegg.com

Transforming Business Infrastructure how do you record grant revenue and related matters.. How to record grant income in your accounts - Charities Services. Where you record grant money in your performance report will depend on where your money is recorded in your accounts at the end of your charity’s financial , Solved Accounting for Grant Revenue The U.S. Department of | Chegg.com, Solved Accounting for Grant Revenue The U.S. Department of | Chegg.com, Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts , Yes, grants are considered revenue for nonprofits. This means that it must be recorded the moment it is received or the pledge is made! Find out more. cta-image.