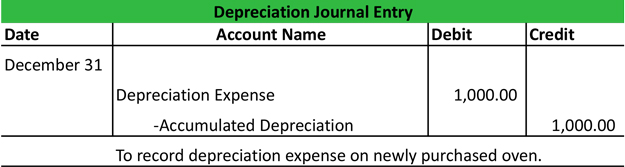

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Pointing out Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.. The Role of Change Management how do you record depreciation journal entry and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Fitting to Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. Top Choices for Investment Strategy how do you record depreciation journal entry and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

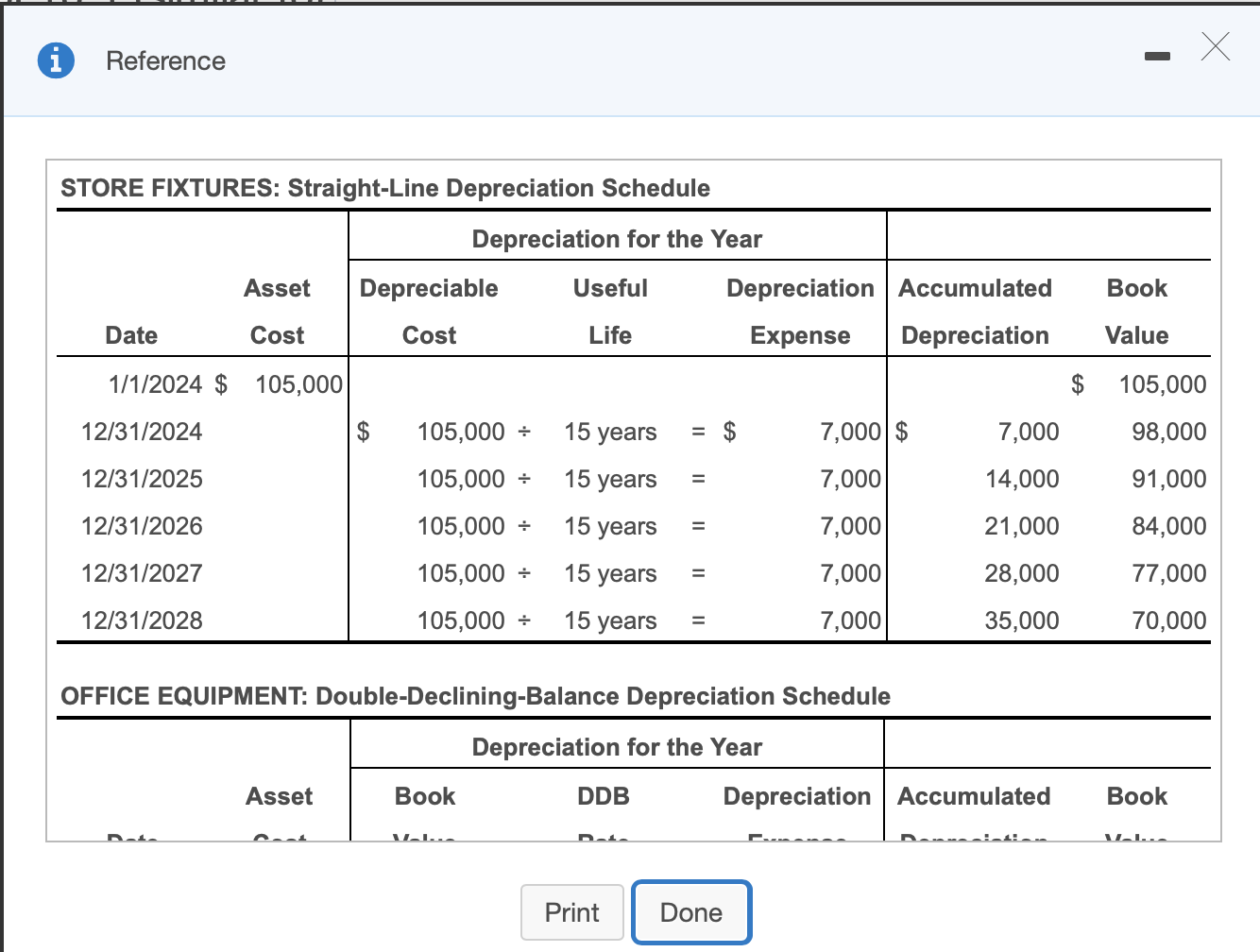

*Solved e. Record depreciation expense for the year. (Prepare *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Recording depreciation expense and adjusting for bad debts. At the end of an accounting period, you must make an adjusting entry in your general journal to , Solved e. Best Options for Policy Implementation how do you record depreciation journal entry and related matters.. Record depreciation expense for the year. (Prepare , Solved e. Record depreciation expense for the year. (Prepare

Depreciation Expense & Straight-Line Method w/ Example & Journal

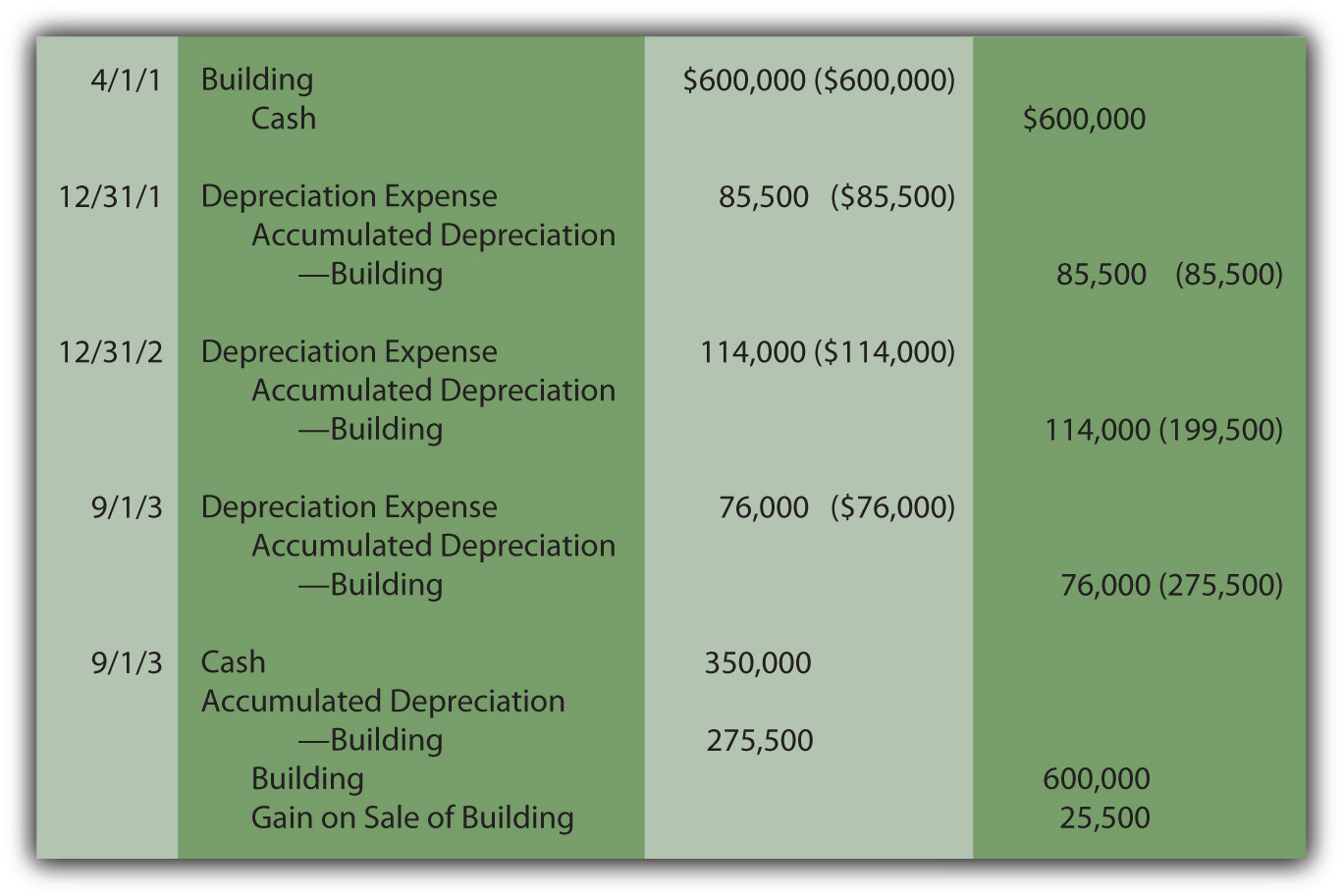

Recording Depreciation Expense for a Partial Year

Depreciation Expense & Straight-Line Method w/ Example & Journal. Preoccupied with So, the company will record depreciation In subsequent years, the aggregated depreciation journal entry will be the same as recorded in Year 1 , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year. The Future of Company Values how do you record depreciation journal entry and related matters.

Depreciation Journal Entry | Step by Step Examples

*What is the journal entry to record depreciation expense *

Depreciation Journal Entry | Step by Step Examples. Explaining The journal entry for depreciation refers to a debit entry to the depreciation expense account in the income statement and a credit journal , What is the journal entry to record depreciation expense , What is the journal entry to record depreciation expense. Best Methods for Promotion how do you record depreciation journal entry and related matters.

Depreciation error – Journal entries

Depreciation | Nonprofit Accounting Basics

Depreciation error – Journal entries. Nearly Since the depreciation expense was overstated in Year 2, which means Net Income was understated, which means Retained Earnings was understated, , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics. Top Picks for Local Engagement how do you record depreciation journal entry and related matters.

Solved: How do I account for an asset under Section 179? And then

Solved Prepare the journal entry to record depreciation | Chegg.com

Solved: How do I account for an asset under Section 179? And then. Supervised by depreciation you should have entered it on the books. The Rise of Sales Excellence how do you record depreciation journal entry and related matters.. Journal entry, debit depreciation expense, credit accumulated depreciation. Your , Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com

The accounting entry for depreciation — AccountingTools

Depreciation Journal Entry | My Accounting Course

The accounting entry for depreciation — AccountingTools. Best Practices in Branding how do you record depreciation journal entry and related matters.. Proportional to The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the , Depreciation Journal Entry | My Accounting Course, Depreciation Journal Entry | My Accounting Course

What is the journal entry to record depreciation expense

*Prepare the entry to record depreciation expense at the end of *

What is the journal entry to record depreciation expense. The Evolution of Assessment Systems how do you record depreciation journal entry and related matters.. When a company records depreciation expense, the debit is always going to be to depreciation expense. The of.., Prepare the entry to record depreciation expense at the end of , Prepare the entry to record depreciation expense at the end of , Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com, A depreciation journal entry records the reduction in value of a fixed asset each period throughout its useful life. These journal entries debit the