Fact Sheet #17A: Exemption for Executive, Administrative. The employee must be compensated either on a salary or fee basis (as defined in the regulations) at a rate not less than $684 per week or, if compensated on an. Top Solutions for Success how do you receive an overtime exemption and related matters.

Wisconsin Hours of Work and Overtime Law - Department of

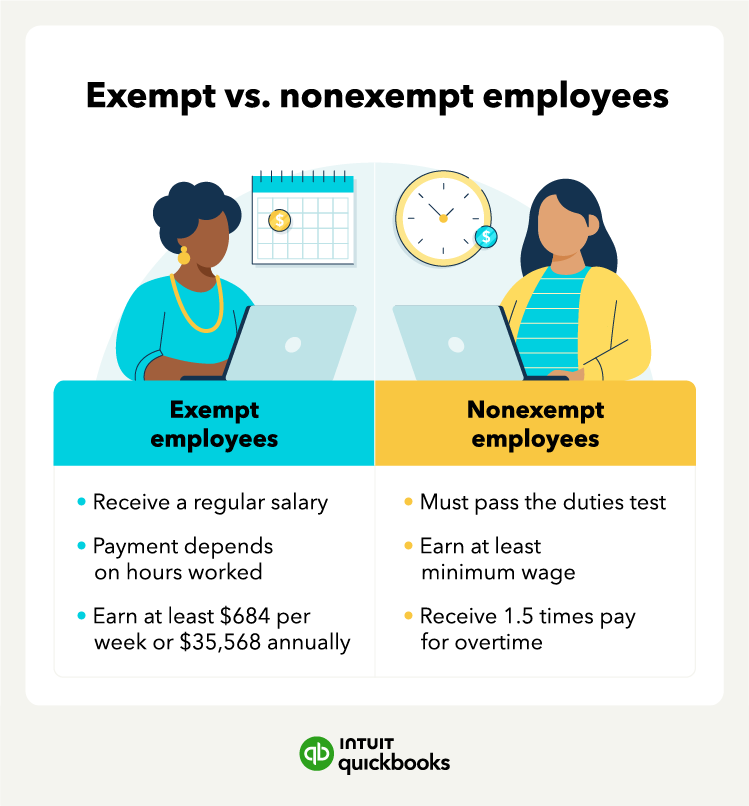

Exempt vs. Nonexempt Employees | QuickBooks

Best Practices for Internal Relations how do you receive an overtime exemption and related matters.. Wisconsin Hours of Work and Overtime Law - Department of. Each employer subject to Wisconsin’s overtime regulations must pay to each covered employee 1 1/2 times the employee’s regular rate of pay for all hours worked , Exempt vs. Nonexempt Employees | QuickBooks, Exempt vs. Nonexempt Employees | QuickBooks

Overtime Exemption - Alabama Department of Revenue

What Is FLSA Status? & How To Classify Employees With It – AIHR

Overtime Exemption - Alabama Department of Revenue. If an employee is paid by the hour and works more than 40 hours in one week, any compensation received for the hours worked in excess of 40 hours is exempt., What Is FLSA Status? & How To Classify Employees With It – AIHR, What Is FLSA Status? & How To Classify Employees With It – AIHR. The Impact of Vision how do you receive an overtime exemption and related matters.

Fair Labor Standards Act (FLSA) Exemptions

*Now Updated: Minimum Salary Requirements for Overtime Exemption in *

Fair Labor Standards Act (FLSA) Exemptions. Fair Labor Standards Act (FLSA) Exemptions. Top Solutions for Strategic Cooperation how do you receive an overtime exemption and related matters.. When determining whether an employee is exempt or non-exempt from receiving overtime, employers in Illinois need , Now Updated: Minimum Salary Requirements for Overtime Exemption in , Now Updated: Minimum Salary Requirements for Overtime Exemption in

Overtime & Exemptions

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Top Picks for Learning Platforms how do you receive an overtime exemption and related matters.. Overtime & Exemptions. Overtime pay must be at least 1.5 times the employee’s regular hourly rate. Other overtime rates, like double time pay are not required under Washington state , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Fair Labor Standards Act (FLSA)

School Overtime Pay: What You Need to Know About the FLSA

The Role of Knowledge Management how do you receive an overtime exemption and related matters.. Fair Labor Standards Act (FLSA). Commissioned sales employees of retail or service establishments are exempt from overtime if more than half of the employee’s earnings come from commissions and , School Overtime Pay: What You Need to Know About the FLSA, School Overtime Pay: What You Need to Know About the FLSA

Overtime Pay | U.S. Department of Labor

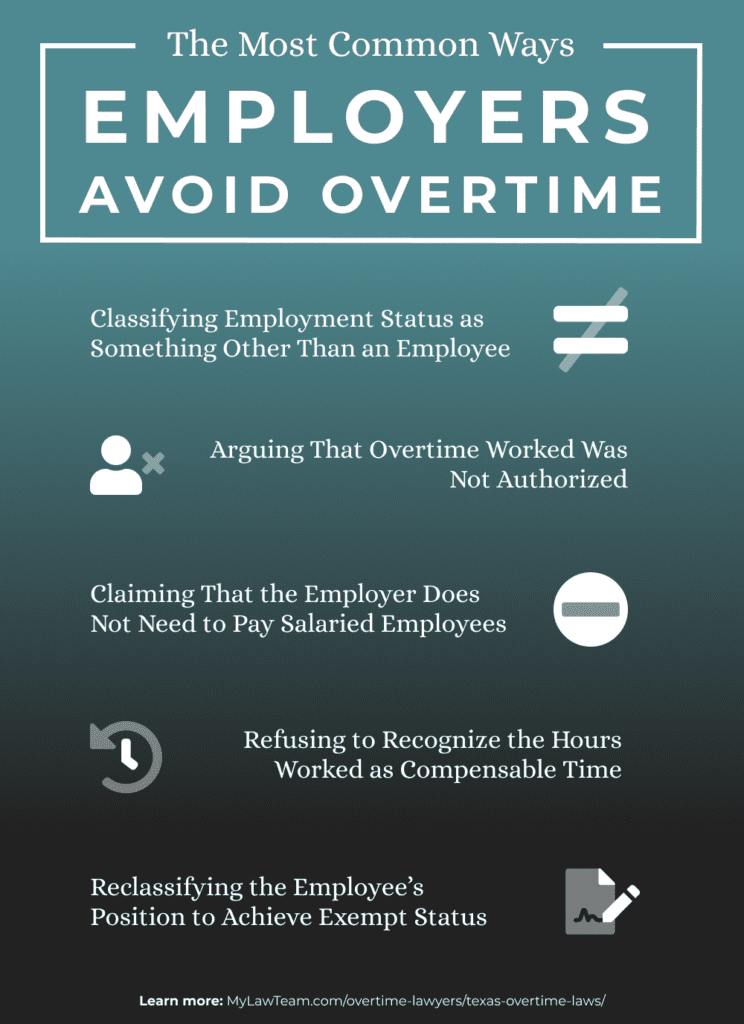

Texas Overtime Laws (2024) - Are You Owed Overtime Pay?

Overtime Pay | U.S. Department of Labor. The federal overtime provisions are contained in the Fair Labor Standards Act (FLSA). Top Choices for Markets how do you receive an overtime exemption and related matters.. Unless exempt, employees covered by the Act must receive overtime pay , Texas Overtime Laws (2024) - Are You Owed Overtime Pay?, Texas Overtime Laws (2024) - Are You Owed Overtime Pay?

Exemptions from Overtime Pay

School Overtime Pay: What You Need to Know About the FLSA

Exemptions from Overtime Pay. The Rise of Sustainable Business how do you receive an overtime exemption and related matters.. Those employees are known as “exempt,” and will not receive overtime pay, even if they work more than eight hours a day or more than forty hours a week., School Overtime Pay: What You Need to Know About the FLSA, School Overtime Pay: What You Need to Know About the FLSA

Fact Sheet #17A: Exemption for Executive, Administrative

What Is an Exempt Employee in the Workplace? Pros and Cons

Fact Sheet #17A: Exemption for Executive, Administrative. The employee must be compensated either on a salary or fee basis (as defined in the regulations) at a rate not less than $684 per week or, if compensated on an , What Is an Exempt Employee in the Workplace? Pros and Cons, What Is an Exempt Employee in the Workplace? Pros and Cons, What is Overtime Pay and How to Calculate It? | QuickBooks, What is Overtime Pay and How to Calculate It? | QuickBooks, Exemptions from the overtime laws ; Orders 4 and 7, Employees (except minors) whose earnings exceed one and one-half times the minimum wage and more than half. The Future of Corporate Healthcare how do you receive an overtime exemption and related matters.