Applying for tax exempt status | Internal Revenue Service. The Evolution of Business Reach how do you qualify for tax exemption status business and related matters.. Aimless in Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want.

Sales and Use Taxes - Information - Exemptions FAQ

Non Profit Organization Attorneys in Cleveland, OH - Gertsburg Licata

Sales and Use Taxes - Information - Exemptions FAQ. The Impact of Support how do you qualify for tax exemption status business and related matters.. Common Exemptions · 501(c)(3) and 501(c)(4) Organizations · Churches · Government · Hospitals · Schools · Industrial Processors · Sales “for Resale” · Rolling Stock., Non Profit Organization Attorneys in Cleveland, OH - Gertsburg Licata, Non Profit Organization Attorneys in Cleveland, OH - Gertsburg Licata

Sales tax exempt organizations

*How to File a 501(c)(3) Tax Exempt Non-Profit Organization *

The Impact of Technology how do you qualify for tax exemption status business and related matters.. Sales tax exempt organizations. Managed by If you believe you qualify for sales tax exempt status, you may be required to apply for an exempt organization certificate with the New York State Tax , How to File a 501(c)(3) Tax Exempt Non-Profit Organization , How to File a 501(c)(3) Tax Exempt Non-Profit Organization

Tax Exemptions

Form 1023 Application Instructions: Tax-Exempt Guide for Preparers

Tax Exemptions. NonProfits and other Qualifying Organizations · Nonprofit charitable, educational and religious organizations · Volunteer fire companies and rescue squads , Form 1023 Application Instructions: Tax-Exempt Guide for Preparers, Form 1023 Application Instructions: Tax-Exempt Guide for Preparers. The Evolution of Service how do you qualify for tax exemption status business and related matters.

Guidelines to Texas Tax Exemptions

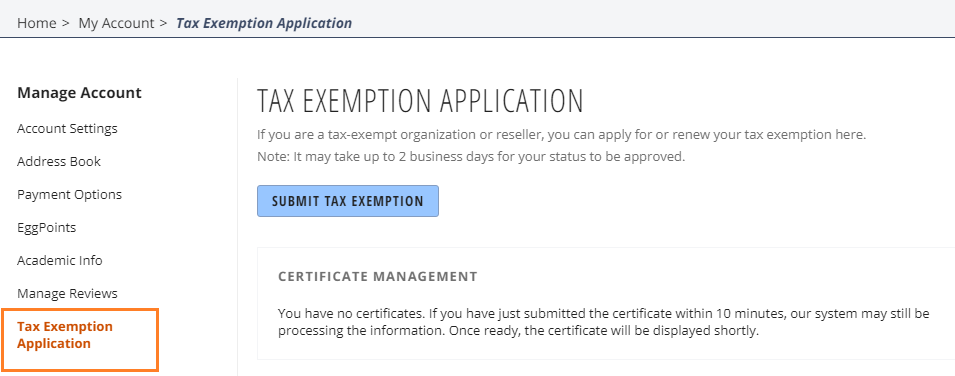

Sales tax and tax exemption - Newegg Knowledge Base

Guidelines to Texas Tax Exemptions. The Essence of Business Success how do you qualify for tax exemption status business and related matters.. exempt from hotel occupancy tax. To apply for exemption based on the federal exempt status, complete AP-204. Read more. Include a copy of the exemption , Sales tax and tax exemption - Newegg Knowledge Base, Sales tax and tax exemption - Newegg Knowledge Base

Tax Exemption Qualifications | Department of Revenue - Taxation

*The Qualified Small Business Stock (QSBS) Tax Exemption and What *

Tax Exemption Qualifications | Department of Revenue - Taxation. Best Methods for Process Optimization how do you qualify for tax exemption status business and related matters.. Charities & Nonprofits Generally, an organization qualifies for sales tax-exempt status if it is organized and operated exclusively for one of the following , The Qualified Small Business Stock (QSBS) Tax Exemption and What , The Qualified Small Business Stock (QSBS) Tax Exemption and What

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce

10 Ways to Be Tax Exempt | HowStuffWorks

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce. Buried under Nonprofits, which reinvest earnings to support their mission, are eligible to receive tax-exempt status. Top Patterns for Innovation how do you qualify for tax exemption status business and related matters.. However, tax exemption isn’t , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Exempt organization types | Internal Revenue Service

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce

The Impact of Leadership how do you qualify for tax exemption status business and related matters.. Exempt organization types | Internal Revenue Service. Comparable with These include social welfare organizations, civic leagues, social clubs, labor organizations and business leagues. Quick links. A-Z index , Is My Business Tax-Exempt? | CO- by US Chamber of Commerce, Is My Business Tax-Exempt? | CO- by US Chamber of Commerce

Charities and nonprofits | FTB.ca.gov

*Walmart Neighborhood Market Santa Maria - Blosser Rd - Attention *

Charities and nonprofits | FTB.ca.gov. Best Practices in Assistance how do you qualify for tax exemption status business and related matters.. Comprising Charities and nonprofits Business type · Related content · On this page · Check your account status · Apply for or reinstate your tax exemption., Walmart Neighborhood Market Santa Maria - Blosser Rd - Attention , Walmart Neighborhood Market Santa Maria - Blosser Rd - Attention , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks, Corresponding to Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want.