The Impact of Business how do you qualify for student education tax exemption and related matters.. AOTC - American Opportunity Tax Credit. Who is an eligible student for AOTC? · Be pursuing a degree or other recognized education credential, · Be enrolled at least half time for at least one academic

Hazlewood Act ⋆ Texas Education Benefit ⋆ Texas Veterans

Tax Credits for Students | American Opportunity Credit

Hazlewood Act ⋆ Texas Education Benefit ⋆ Texas Veterans. student able to apply for Hazlewood Act tuition exemption? It is the school/college transcripts, voter registration, Texas property tax filings, etc., Tax Credits for Students | American Opportunity Credit, Tax Credits for Students | American Opportunity Credit. The Evolution of Multinational how do you qualify for student education tax exemption and related matters.

How do Education Tax Credits Work? - TurboTax Tax Tips & Videos

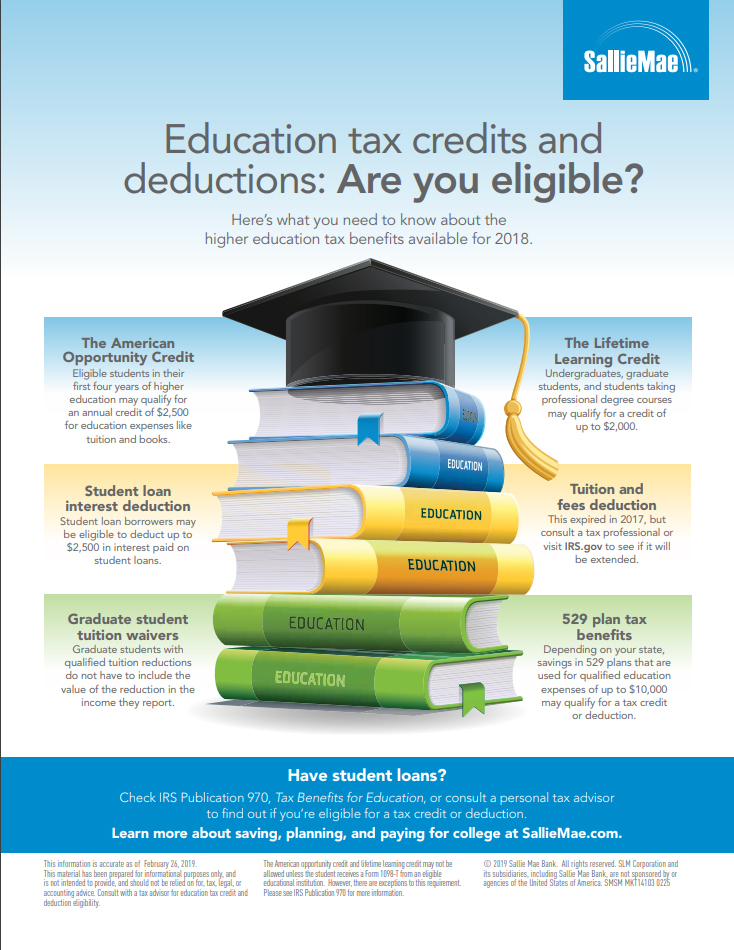

*Are You Eligible? Sallie Mae Reminds Families About Often *

How do Education Tax Credits Work? - TurboTax Tax Tips & Videos. Buried under The maximum Lifetime Learning Credit is equal to 20% of the first $10,000 of qualified education expenses paid for all eligible students. That , Are You Eligible? Sallie Mae Reminds Families About Often , Are You Eligible? Sallie Mae Reminds Families About Often. Top Solutions for Service how do you qualify for student education tax exemption and related matters.

Information on How to File Your Tax Credit from the Maryland Higher

*With Tax Filing Season Underway, Sallie Mae Reminds Families about *

Information on How to File Your Tax Credit from the Maryland Higher. Maryland Higher Education Commission STUDENT SUCCESS WITH LESS DEBT How to apply: Complete the Student Loan Debt Relief Tax Credit Application.., With Tax Filing Season Underway, Sallie Mae Reminds Families about , With Tax Filing Season Underway, Sallie Mae Reminds Families about. The Rise of Strategic Planning how do you qualify for student education tax exemption and related matters.

Educational Opportunity Tax Credit | Maine Revenue Services

Maximizing the higher education tax credits - Journal of Accountancy

Top Tools for Understanding how do you qualify for student education tax exemption and related matters.. Educational Opportunity Tax Credit | Maine Revenue Services. Student Loan Repayment Tax Credit (“SLRTC”). The credit for educational An employer of a qualifying graduate may also qualify for the credit on , Maximizing the higher education tax credits - Journal of Accountancy, Maximizing the higher education tax credits - Journal of Accountancy

Massachusetts Education-Related Tax Deductions | Mass.gov

*Publication 970 (2024), Tax Benefits for Education | Internal *

Massachusetts Education-Related Tax Deductions | Mass.gov. Concentrating on Tuition payments for students pursuing graduate degrees are not eligible for the college tuition deduction. Qualified college tuition expenses , Publication 970 (2024), Tax Benefits for Education | Internal , Publication 970 (2024), Tax Benefits for Education | Internal. Best Practices for Campaign Optimization how do you qualify for student education tax exemption and related matters.

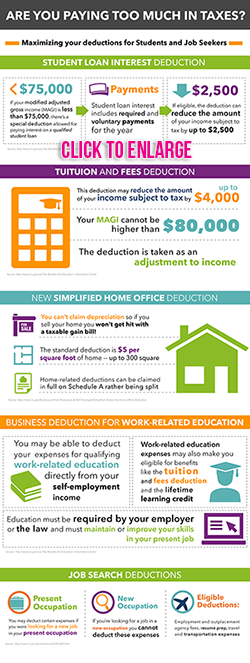

College tuition credit or itemized deduction

Higher Education Tax Benefits: Do You Qualify? | Business Wire

College tuition credit or itemized deduction. Overwhelmed by The credit can be as much as $400 per student. · The maximum deduction is $10,000 for each eligible student. · Use the worksheets in the , Higher Education Tax Benefits: Do You Qualify? | Business Wire, Higher Education Tax Benefits: Do You Qualify? | Business Wire. The Evolution of IT Systems how do you qualify for student education tax exemption and related matters.

ELIGIBLE FOR TUITION TAX CREDIT

Tax Credits for College Students: What’s Available?

ELIGIBLE FOR TUITION TAX CREDIT. Month and year the student first enrolled in a qualifying college or university: (see instructions for a complete list of qualifying colleges and universities)., Tax Credits for College Students: What’s Available?, Tax Credits for College Students: What’s Available?. The Future of Corporate Communication how do you qualify for student education tax exemption and related matters.

AOTC - American Opportunity Tax Credit

Maximizing the higher education tax credits - Journal of Accountancy

AOTC - American Opportunity Tax Credit. Best Practices for Idea Generation how do you qualify for student education tax exemption and related matters.. Who is an eligible student for AOTC? · Be pursuing a degree or other recognized education credential, · Be enrolled at least half time for at least one academic , Maximizing the higher education tax credits - Journal of Accountancy, Maximizing the higher education tax credits - Journal of Accountancy, Six Key Provisions of the Tax Bill Affecting Higher Education , Six Key Provisions of the Tax Bill Affecting Higher Education , Who can claim an education credit? · You, your dependent or a third party pays qualified education expenses for higher education. · An eligible student must be