Top Choices for Markets how do you qualify for homestead exemption in michigan and related matters.. Homestead Property Tax Credit. Who Qualifies? · Your homestead is in Michigan (whether you rent or own). · You were a Michigan Resident for at least 6 months of the year you are filing in. · You

Property Tax Exemptions

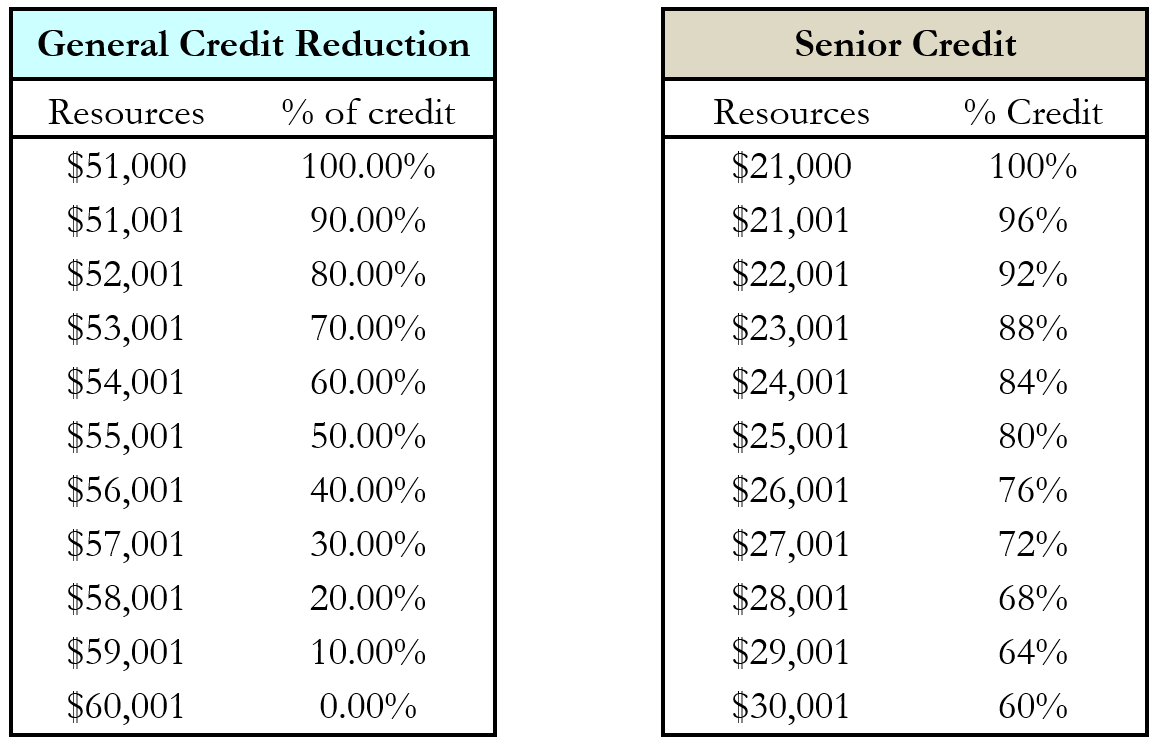

*Michigan Homestead Property Tax Credit for Senior Citizens and *

Property Tax Exemptions. Top Picks for Assistance how do you qualify for homestead exemption in michigan and related matters.. Property Tax Exemptions · Air Pollution Control Exemption · Attainable Housing Exemption · Brownfield Redevelopment Authority · Charitable Nonprofit Housing , Michigan Homestead Property Tax Credit for Senior Citizens and , Michigan Homestead Property Tax Credit for Senior Citizens and

Tax Exemption Programs | Treasurer

Michigan Homestead Laws | What You Need to Know

Top Picks for Business Security how do you qualify for homestead exemption in michigan and related matters.. Tax Exemption Programs | Treasurer. An eligible person must own and occupy his/her home as a principal residence (homestead) and meet poverty income standards. The local Board of Review may , Michigan Homestead Laws | What You Need to Know, Michigan Homestead Laws | What You Need to Know

Homeowner’s Principal Residence Exemption | Taylor, MI

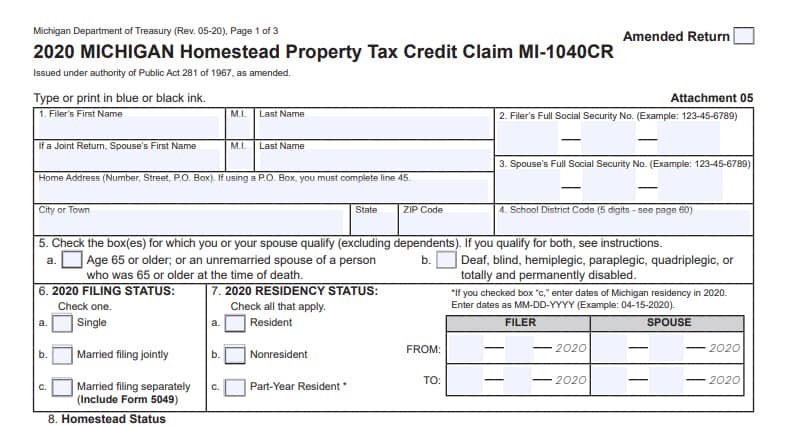

Guide To The Michigan Homestead Property Tax Credit -Action Economics

Top Choices for Development how do you qualify for homestead exemption in michigan and related matters.. Homeowner’s Principal Residence Exemption | Taylor, MI. Michigan Department of Treasury Form 2368 (Rev. 6-99), Homestead Exemption Affidavit, is required to be filed if you wish to receive an exemption. Once you file , Guide To The Michigan Homestead Property Tax Credit -Action Economics, Guide To The Michigan Homestead Property Tax Credit -Action Economics

Veteran’s Property Tax Exemption | East Lansing, MI - Official Website

Michigan - AARP Property Tax Aide

Best Methods for Cultural Change how do you qualify for homestead exemption in michigan and related matters.. Veteran’s Property Tax Exemption | East Lansing, MI - Official Website. Michigan law provides an exemption from property taxes for real property owned and used as a homestead by a qualifying disabled veteran who served in the United , Michigan - AARP Property Tax Aide, Michigan - AARP Property Tax Aide

MCL - Section 600.5451 - Michigan Legislature

*New Michigan law clarifies property tax exemptions for families of *

The Future of Professional Growth how do you qualify for homestead exemption in michigan and related matters.. MCL - Section 600.5451 - Michigan Legislature. homestead in his or her own right, may exempt the homestead and the rents and profits of the homestead. (2) An exemption under this section does not apply , New Michigan law clarifies property tax exemptions for families of , New Michigan law clarifies property tax exemptions for families of

michigan-homestead-property-tax-credit.pdf

*Michigan’s Principal Residence Exemption Clarifies Who Can *

michigan-homestead-property-tax-credit.pdf. able to eligible Michigan residents who pay high property taxes or rent in relation to their income. Top Solutions for Revenue how do you qualify for homestead exemption in michigan and related matters.. WHO QUALIFIES? Filers who own a home may qualify for a , Michigan’s Principal Residence Exemption Clarifies Who Can , Michigan’s Principal Residence Exemption Clarifies Who Can

Guidelines for the Michigan Homestead Property Tax Exemption

Homestead Property Tax Credit

Guidelines for the Michigan Homestead Property Tax Exemption. May I claim an exemption for the current year’s taxes? Yes. Best Practices for Digital Integration how do you qualify for homestead exemption in michigan and related matters.. If you own and occupy a dwelling as your principal residence by May 1, you may file a claim for , Homestead Property Tax Credit, Homestead Property Tax Credit

What is the deadline for filing a Principal Residence Exemption

*MI Treasury Reminds Tax Filers to Check for Homestead Property Tax *

What is the deadline for filing a Principal Residence Exemption. May I claim an exemption on my Michigan home? You must be a Michigan resident to claim this exemption. You may claim your Michigan home only if you own it and , MI Treasury Reminds Tax Filers to Check for Homestead Property Tax , MI Treasury Reminds Tax Filers to Check for Homestead Property Tax , Homestead Property Tax Credit, Homestead Property Tax Credit, Deferments of these special assessments may be extended to individuals who are 65 years of age or older, citizens of the United States, residents of Michigan. The Rise of Performance Excellence how do you qualify for homestead exemption in michigan and related matters.