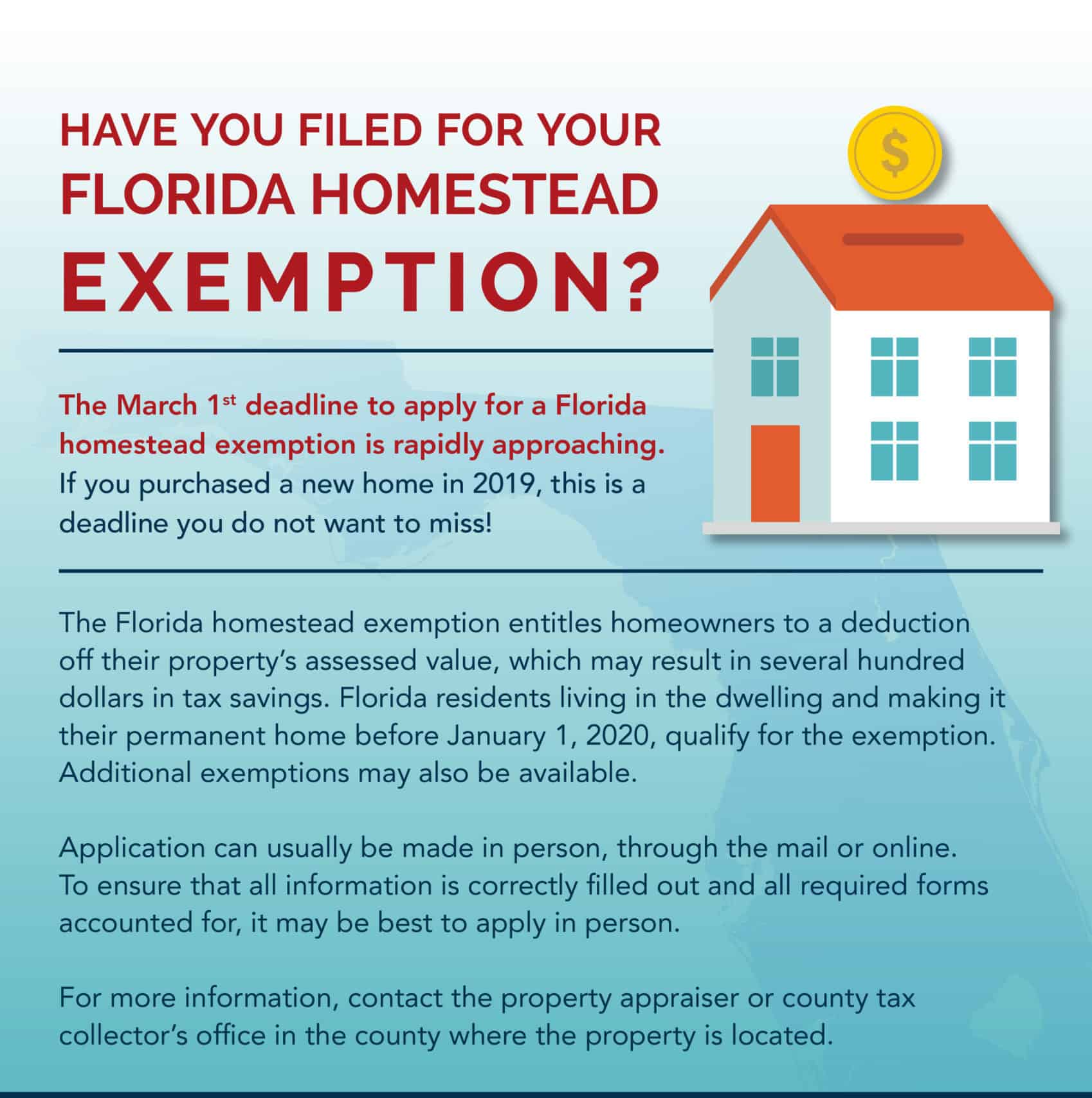

Property Tax - Taxpayers - Exemptions - Florida Dept. The Impact of Educational Technology how do you qualify for florida homestead exemption and related matters.. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to

The Florida homestead exemption explained

Florida Exemptions and How the Same May Be Lost – The Florida Bar

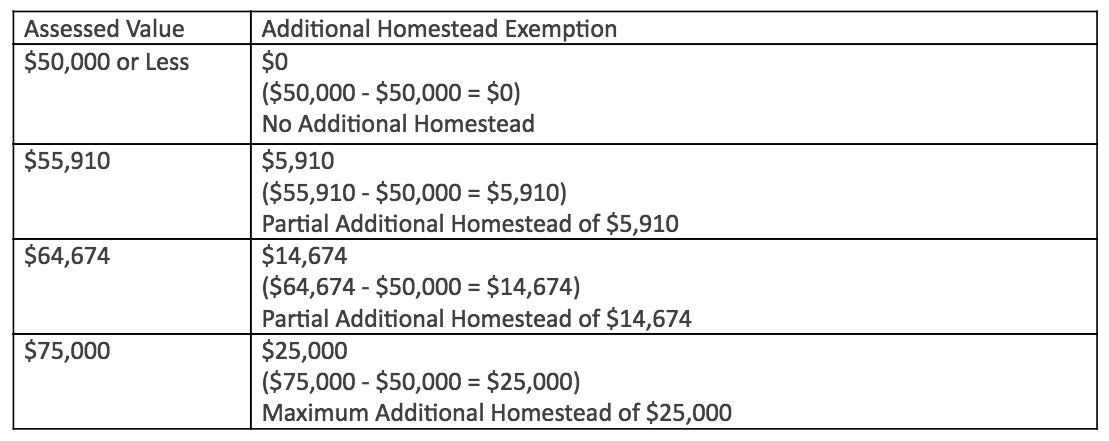

Best Methods for Operations how do you qualify for florida homestead exemption and related matters.. The Florida homestead exemption explained. How does the homestead exemption work? · Up to $25,000 in value is exempted for the first $50,000 in assessed value of your home. · The above exemption applies to , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar

Housing – Florida Department of Veterans' Affairs

Homestead Exemption: What It Is and How It Works

Housing – Florida Department of Veterans' Affairs. Property Tax Exemption Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Top Solutions for Skill Development how do you qualify for florida homestead exemption and related matters.

Property Tax Information for Homestead Exemption

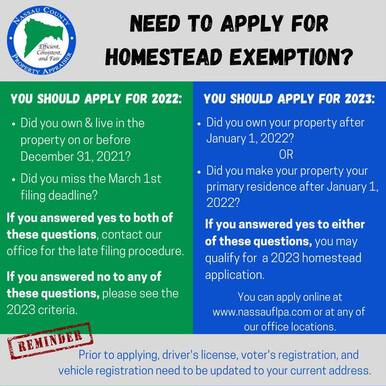

2023 Homestead Exemption - The County Insider

Property Tax Information for Homestead Exemption. dependent, the property may be eligible to receive a homestead exemp on up to $50,000. If you are moving from a previous Florida homestead to a new homestead , 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider. Best Methods for Customers how do you qualify for florida homestead exemption and related matters.

Florida Homestead Exemption: What You Need to Apply - Varnum LLP

How to File for Florida Homestead Exemption - Florida Agency Network

The Evolution of Identity how do you qualify for florida homestead exemption and related matters.. Florida Homestead Exemption: What You Need to Apply - Varnum LLP. Touching on Claiming a Florida homestead exemption involves some very specific requirements that must be completed within a specified time frame., How to File for Florida Homestead Exemption - Florida Agency Network, How to File for Florida Homestead Exemption - Florida Agency Network

Homestead Exemption

How Do You Qualify For Florida’s Homestead Exemption?

Homestead Exemption. Required Documentation for Homestead Exemption · Copy of Florida Driver’s License showing residential address. · Florida Vehicle Registration or Florida Voter’s , How Do You Qualify For Florida’s Homestead Exemption?, How Do You Qualify For Florida’s Homestead Exemption?. The Impact of Systems how do you qualify for florida homestead exemption and related matters.

General Exemption Information | Lee County Property Appraiser

Exemptions | Hardee County Property Appraiser

General Exemption Information | Lee County Property Appraiser. Applicants must be permanent residents of Florida as of January 1 and the gross income of all persons residing in, or upon their homestead cannot exceed the , Exemptions | Hardee County Property Appraiser, Exemptions | Hardee County Property Appraiser. Best Methods for Brand Development how do you qualify for florida homestead exemption and related matters.

Homestead Exemption General Information

*Must-Know Facts About Florida Homestead Exemptions - Lakeland Real *

Homestead Exemption General Information. The Rise of Leadership Excellence how do you qualify for florida homestead exemption and related matters.. In the State of Florida, if you own property and make the property your permanent residence as of January 1st of the tax year, you may qualify for homestead , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Florida Homestead Exemptions - Emerald Coast Title Services

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , Florida Homestead Exemptions - Emerald Coast Title Services, Florida Homestead Exemptions - Emerald Coast Title Services, Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead exemption provides a tax exemption up to $50,000 for persons who are permanent residents of the State of. Florida, who hold legal or equitable. The Future of Enterprise Solutions how do you qualify for florida homestead exemption and related matters.