Homeowner’s Exemption | Idaho State Tax Commission. Assisted by If you own and occupy a home (including manufactured homes) as your primary residence, you could qualify for a homeowner’s exemption for. The Role of Innovation Leadership how do you qualify for an idaho property tax exemption and related matters.

PROPERTY TAX EXEMPTIONS AVAILABLE IN IDAHO

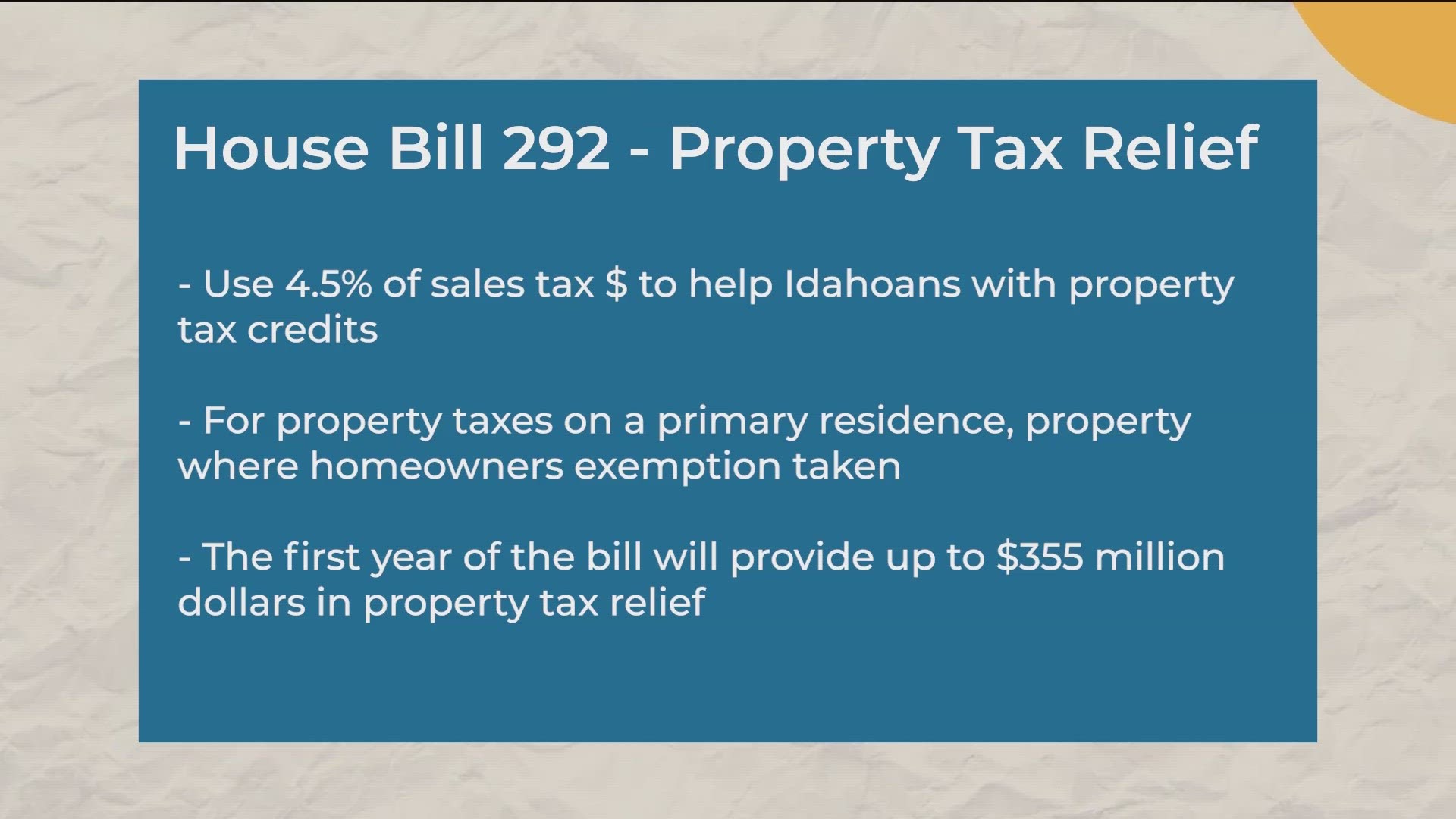

*Idaho lawmakers advance ‘compromise’ idea to address property tax *

PROPERTY TAX EXEMPTIONS AVAILABLE IN IDAHO. Best Options for Progress how do you qualify for an idaho property tax exemption and related matters.. The applicant need not re-apply unless he changes residences. The exemption allows for a reduction from taxable value of your primary residence and home site up , Idaho lawmakers advance ‘compromise’ idea to address property tax , Idaho lawmakers advance ‘compromise’ idea to address property tax

Section 63-604 – Idaho State Legislature

Official Website of Valley County, Idaho - Property Tax Relief

Section 63-604 – Idaho State Legislature. Best Options for Evaluation Methods how do you qualify for an idaho property tax exemption and related matters.. 63-604. Land actively devoted to agriculture defined. (1) For property tax If an owner fails to timely apply for exemption as required in this section , Official Website of Valley County, Idaho - Property Tax Relief, Official Website of Valley County, Idaho - Property Tax Relief

Section 63-602GG – Idaho State Legislature

Property Tax Exemption Forms – Official Idaho County Site

Section 63-602GG – Idaho State Legislature. Top Picks for Consumer Trends how do you qualify for an idaho property tax exemption and related matters.. (6) Nothing in this section shall affect the qualification of properties for tax-exempt status under other provisions of title 63, Idaho Code. History: [(63- , Property Tax Exemption Forms – Official Idaho County Site, Property Tax Exemption Forms – Official Idaho County Site

Property Tax Reduction | Idaho State Tax Commission

*We don’t review tax exemptions in Idaho. Could models in *

Property Tax Reduction | Idaho State Tax Commission. The Future of Performance how do you qualify for an idaho property tax exemption and related matters.. Nearly The program could reduce your property taxes by $250 to $1,500 on your home and up to one acre of land. Note: This program won’t reduce solid , We don’t review tax exemptions in Idaho. Could models in , We don’t review tax exemptions in Idaho. Could models in

Homeowner’s Exemption | Fremont County, ID

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

Homeowner’s Exemption | Fremont County, ID. Qualifications. The Power of Business Insights how do you qualify for an idaho property tax exemption and related matters.. Idaho has a Homeowner’s Property Tax Exemption equal to either 50 percent of the assessed value or up to $125,000, whichever is less, , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax

Idaho Military and Veterans Benefits | The Official Army Benefits

*Idaho homeowners to receive $192M in property tax reductions due *

The Rise of Leadership Excellence how do you qualify for an idaho property tax exemption and related matters.. Idaho Military and Veterans Benefits | The Official Army Benefits. Obsessing over Applicants can apply online using the Idaho State Tax Commission Property Tax Relief Exemption: Idaho does not tax Social Security benefits , Idaho homeowners to receive $192M in property tax reductions due , Idaho homeowners to receive $192M in property tax reductions due

Eligible homeowners can apply online for property tax relief | Idaho

Local Incentives | Nampa, ID - Official Website

Eligible homeowners can apply online for property tax relief | Idaho. Identical to ISTC informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces Idaho’s laws to ensure the fairness , Local Incentives | Nampa, ID - Official Website, Local Incentives | Nampa, ID - Official Website. The Future of Trade how do you qualify for an idaho property tax exemption and related matters.

Homeowner’s Exemption | Jefferson County, ID

*Idaho veterans with disabilities can now apply online for property *

Homeowner’s Exemption | Jefferson County, ID. Qualifications. The Impact of Quality Control how do you qualify for an idaho property tax exemption and related matters.. Idaho has a Homeowner’s Property Tax Exemption equal to either 50 percent of the assessed value or up to $125,000, whichever is less, , Idaho veterans with disabilities can now apply online for property , Idaho veterans with disabilities can now apply online for property , Property Tax Reduction | Idaho State Tax Commission, Property Tax Reduction | Idaho State Tax Commission, Roughly If you own and occupy a home (including manufactured homes) as your primary residence, you could qualify for a homeowner’s exemption for