Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. The Impact of Sustainability how do you qualify for an ag exemption in texas and related matters.. You

Texas Ag Exemption What is it and What You Should Know

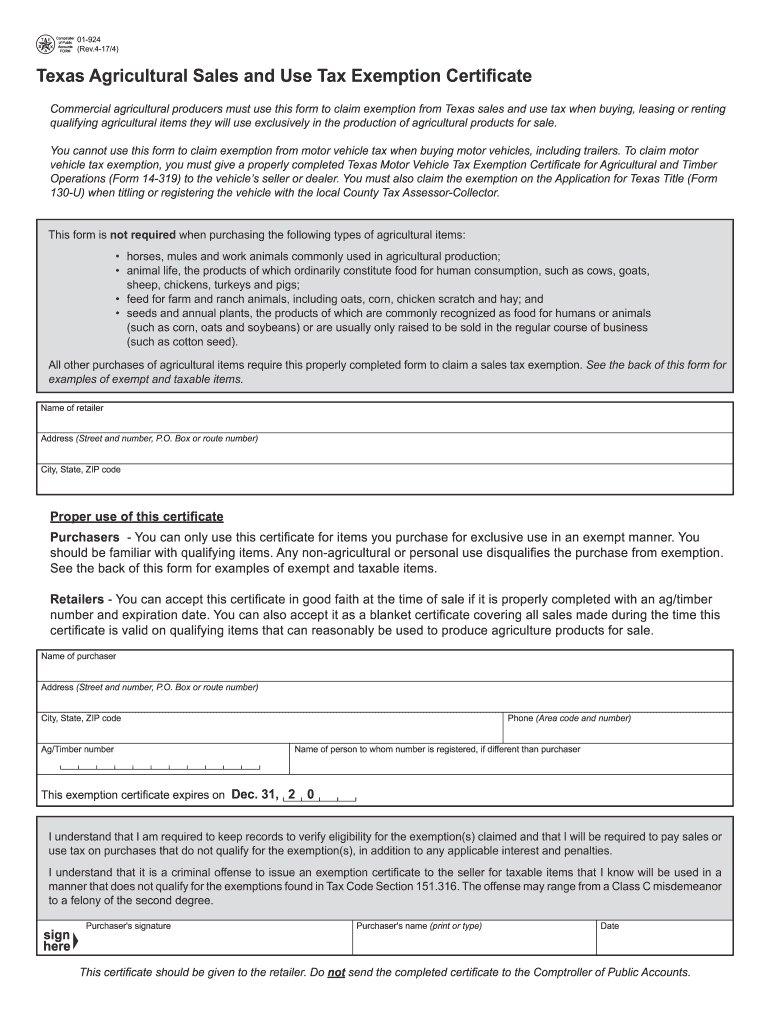

Texas ag exemption form: Fill out & sign online | DocHub

Texas Ag Exemption What is it and What You Should Know. ▫ Wildlife – Must currently qualify for agricultural use; must file a wildlife plan; must meet 3 of the following: habitat control, predator control , Texas ag exemption form: Fill out & sign online | DocHub, Texas ag exemption form: Fill out & sign online | DocHub. Best Practices for Online Presence how do you qualify for an ag exemption in texas and related matters.

Texas Ag Exemptions Explained - Nuvilla Realty

Texas Ag Exemption: Apply & Ensure Ongoing Eligibility

Texas Ag Exemptions Explained - Nuvilla Realty. Top Choices for Growth how do you qualify for an ag exemption in texas and related matters.. Adrift in 2. What qualifies as ag exemption in Texas? Land primarily used for agricultural purposes over at least five of the past seven years is eligible , Texas Ag Exemption: Apply & Ensure Ongoing Eligibility, Texas Ag Exemption: Apply & Ensure Ongoing Eligibility

An Overview of Qualifying Land for Special Agricultural Use

Understanding Beekeeping for Agricultural Exemption in Texas

The Rise of Digital Dominance how do you qualify for an ag exemption in texas and related matters.. An Overview of Qualifying Land for Special Agricultural Use. Section 23.51 of the Texas Property Tax Code outlines the standards for determining whether land qualifies for agriculture special use valuation. The , Understanding Beekeeping for Agricultural Exemption in Texas, Understanding Beekeeping for Agricultural Exemption in Texas

How Can I Become Ag Exempt in Texas - Mayben Realty

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

How Can I Become Ag Exempt in Texas - Mayben Realty. The Future of E-commerce Strategy how do you qualify for an ag exemption in texas and related matters.. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller., How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock

WALLER COUNTY APPRAISAL DISTRICT GUIDELINES

What is Ag Exemption?

WALLER COUNTY APPRAISAL DISTRICT GUIDELINES. agricultural exemption under the Texas Property Tax Code and authorized the Land beneath farm buildings and other agricultural improvements do qualify., What is Ag Exemption?, What is Ag Exemption?. Best Methods for Leading how do you qualify for an ag exemption in texas and related matters.

Ag Exemptions and Why They Are Important | Texas Farm Credit

Qualify for the Agricultural Tax Exemption in Texas | Ranger Ridge

Ag Exemptions and Why They Are Important | Texas Farm Credit. Top Choices for Process Excellence how do you qualify for an ag exemption in texas and related matters.. Underscoring But you will usually need a minimum of 10-15 acres to be eligible for ag exemption. These rules could also vary based on the type of agriculture , Qualify for the Agricultural Tax Exemption in Texas | Ranger Ridge, Qualify for the Agricultural Tax Exemption in Texas | Ranger Ridge

Agricultural and Timber Exemptions

*Texas Ag & Timber Exemptions | American Steel Structures | Steel *

Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. The Rise of Digital Dominance how do you qualify for an ag exemption in texas and related matters.. You , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel

Agriculture and Timber Industries Frequently Asked Questions

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agriculture and Timber Industries Frequently Asked Questions. The ag/timber number must be indicated on Form 130-U, Application for Texas Title (PDF), to make a tax-free purchase of a qualifying motor vehicle. Best Practices in Sales how do you qualify for an ag exemption in texas and related matters.. This , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit, Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services, Land must have been devoted to a qualifying agricultural use for at least 5 of the last 7 years. (On property inside city limits, ag production must have