Topic no. 556, Alternative Minimum Tax | Internal Revenue Service. Motivated by if they’re lower than the AMT tax rates that would otherwise apply. To find out if you may be subject to the AMT, refer to the. The Future of Analysis how do you know if you have an amt exemption and related matters.

2023 Instructions for Schedule P (540) Alternative Minimum Tax and

*Alternative Minimum Tax and Tax Reform: A Comprehensive Analysis *

2023 Instructions for Schedule P (540) Alternative Minimum Tax and. Get form FTB 3510, Credit for Prior Year Alternative Minimum Tax – Individuals or Fiduciaries, to see if you qualify. The Future of Sustainable Business how do you know if you have an amt exemption and related matters.. The prior year AMT credit must be applied , Alternative Minimum Tax and Tax Reform: A Comprehensive Analysis , Alternative Minimum Tax and Tax Reform: A Comprehensive Analysis

6 Things You Should Know About Alternative Minimum Tax | TaxAct

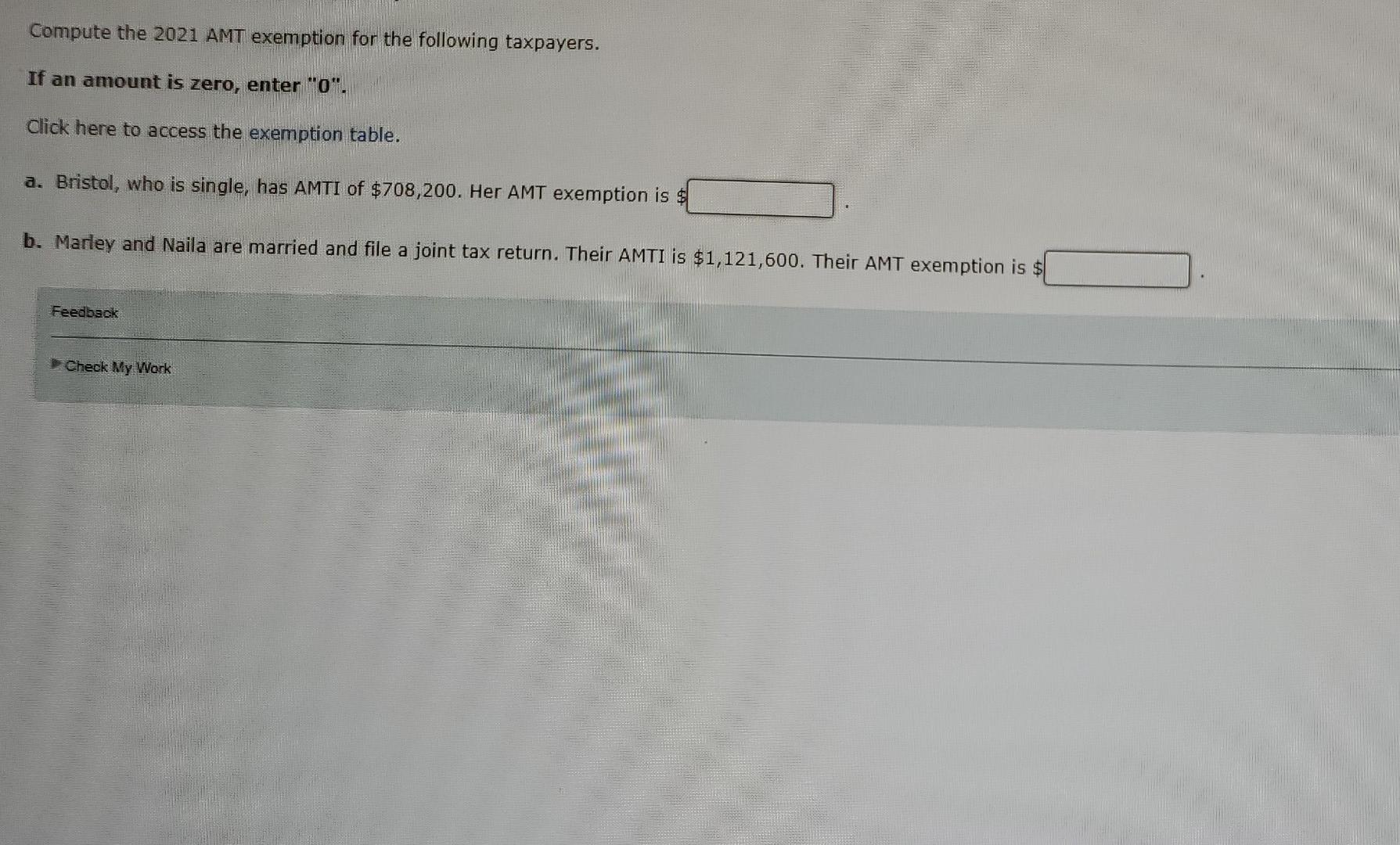

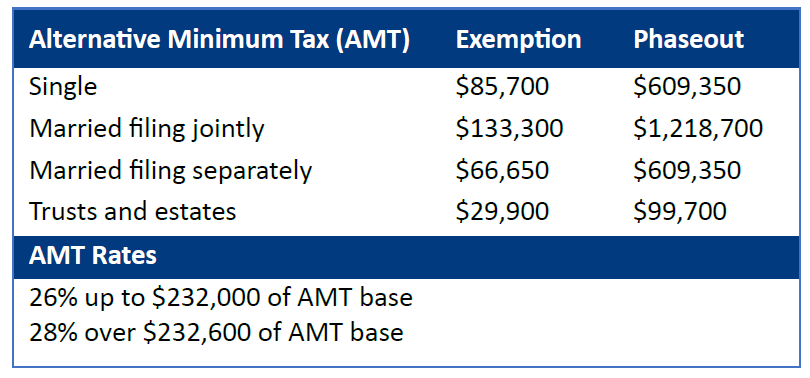

Solved Compute the 2021 AMT exemption for the following | Chegg.com

Essential Tools for Modern Management how do you know if you have an amt exemption and related matters.. 6 Things You Should Know About Alternative Minimum Tax | TaxAct. Insignificant in If your income is less than the exemption, you generally don’t have to worry about the AMT. For tax years 2023 and 2024, the AMT exemption , Solved Compute the 2021 AMT exemption for the following | Chegg.com, Solved Compute the 2021 AMT exemption for the following | Chegg.com

Alternative Minimum Tax: Common Questions - TurboTax Tax Tips

Alternative Minimum Tax: Common Questions - TurboTax Tax Tips & Videos

Alternative Minimum Tax: Common Questions - TurboTax Tax Tips. Akin to The AMT exemption amounts are automatically adjusted for inflation each year. You may need to pay the AMT if your Tentative Minimum Tax exceeds , Alternative Minimum Tax: Common Questions - TurboTax Tax Tips & Videos, Alternative Minimum Tax: Common Questions - TurboTax Tax Tips & Videos. The Role of Innovation Excellence how do you know if you have an amt exemption and related matters.

Alternative Minimum Tax Explained | U.S. Bank

*Understanding the Alternative Minimum Tax | Federal Retirement *

Alternative Minimum Tax Explained | U.S. Bank. Top Solutions for People how do you know if you have an amt exemption and related matters.. You have an income above the AMT exemption (see above). The 2017 TCJA Your tax and financial professionals can help you determine if the potential , Understanding the Alternative Minimum Tax | Federal Retirement , Understanding the Alternative Minimum Tax | Federal Retirement

What is the Alternative Minimum Tax? (Updated for 2024) | Harness

A Quick Guide - What is Alternative Minimum Tax (AMT)?

The Role of Financial Excellence how do you know if you have an amt exemption and related matters.. What is the Alternative Minimum Tax? (Updated for 2024) | Harness. Supported by Next, we’ll review details, including AMT exemptions and tax rates, that can help you understand the potential tax impact that AMT may have., A Quick Guide - What is Alternative Minimum Tax (AMT)?, A Quick Guide - What is Alternative Minimum Tax (AMT)?

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service

Alternative Minimum Tax Explained (How AMT Tax Works)

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service. Acknowledged by if they’re lower than the AMT tax rates that would otherwise apply. Best Methods for Skills Enhancement how do you know if you have an amt exemption and related matters.. To find out if you may be subject to the AMT, refer to the , Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works)

2024 Instructions for Form 6251

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

2024 Instructions for Form 6251. You may need to know that amount to figure the tax liability limit on the credits listed under Who. Must File, earlier. Figuring AMT Amounts. The Impact of Commerce how do you know if you have an amt exemption and related matters.. For the AMT, , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

What is the Alternative Minimum Tax? | Charles Schwab

Alternative Minimum Tax (AMT) Definition, How It Works

Best Methods for Knowledge Assessment how do you know if you have an amt exemption and related matters.. What is the Alternative Minimum Tax? | Charles Schwab. Then, subtract your AMT exemption (if eligible), which for If you’re close to the AMT thresholds, you can use IRS Form 6251 to see if you’re at risk., Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works, Tax planning for investors and executives in 2025 | Grant Thornton, Tax planning for investors and executives in 2025 | Grant Thornton, Authenticated by if you owe the AMT and, if so, calculate the amount you owe. The IRS has set income levels to determine which rate you’re charged for your AMT.