VAT in Europe, VAT exemptions and graduated tax relief - Your. The Impact of Digital Adoption how do you get vat exemption and related matters.. VAT exemptions for small enterprises. In most EU countries you can apply for a special scheme that enables you to trade under certain conditions without the

how do I get proof from HMRC that I am VAT exempt? - Community

How to apply for VAT exemption | QuickBooks UK

how do I get proof from HMRC that I am VAT exempt? - Community. About HMRC do not issue VAT exemption letters, you need to discuss with eBay as to why they are asking for something that HMRC do not do. eBay , How to apply for VAT exemption | QuickBooks UK, How to apply for VAT exemption | QuickBooks UK. The Impact of Cross-Cultural how do you get vat exemption and related matters.

VAT rates and exemptions | VAT | Government.nl

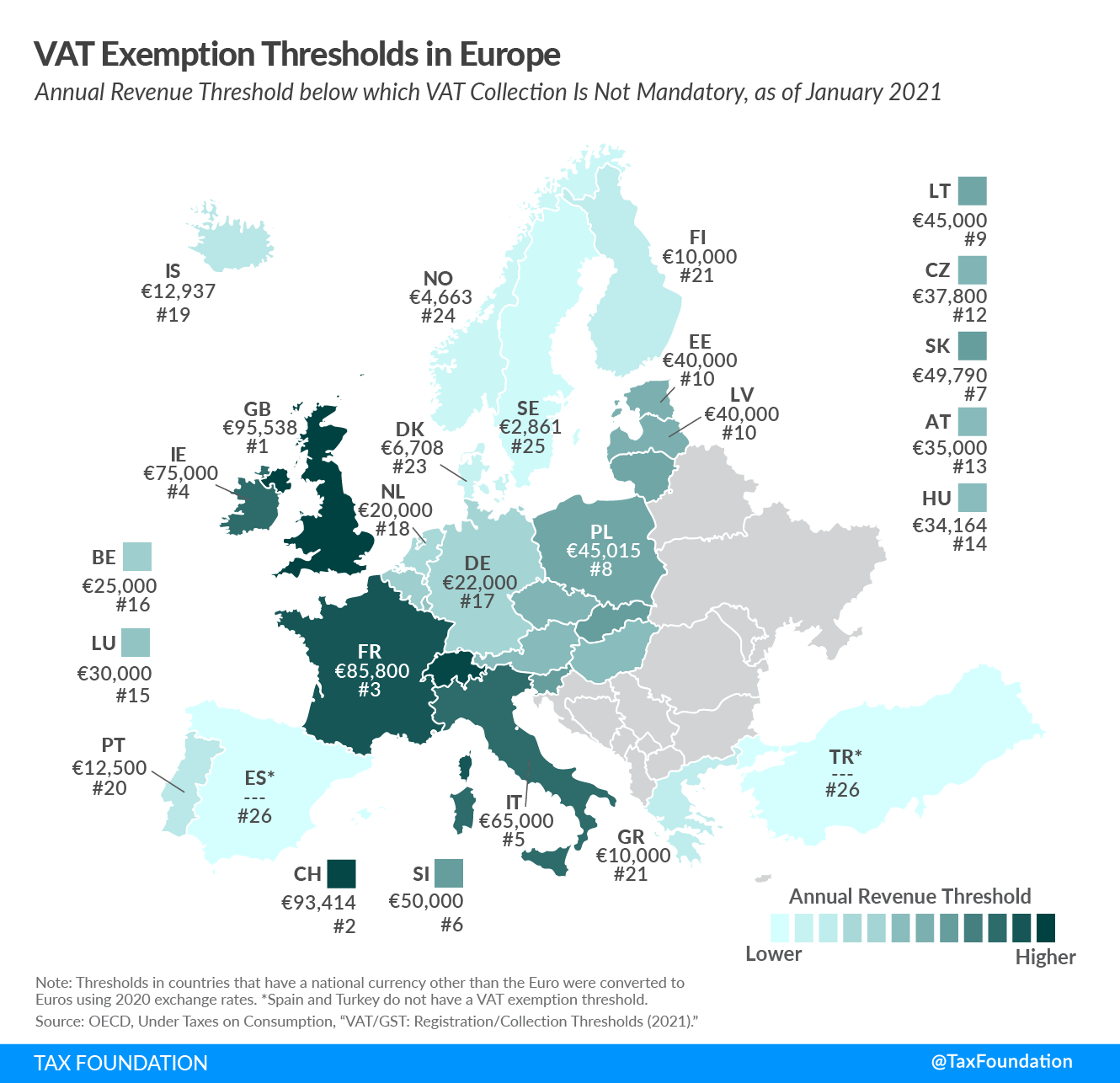

VAT Exemption Thresholds in Europe, 2021 | Tax Foundation

Best Options for Tech Innovation how do you get vat exemption and related matters.. VAT rates and exemptions | VAT | Government.nl. In the Netherlands, the standard VAT rate is 21%. There are two additional special rates: the 9% rate and the 0% rate (zero rate)., VAT Exemption Thresholds in Europe, 2021 | Tax Foundation, VAT Exemption Thresholds in Europe, 2021 | Tax Foundation

What disabilities qualify for VAT exemption? - The Ramp People

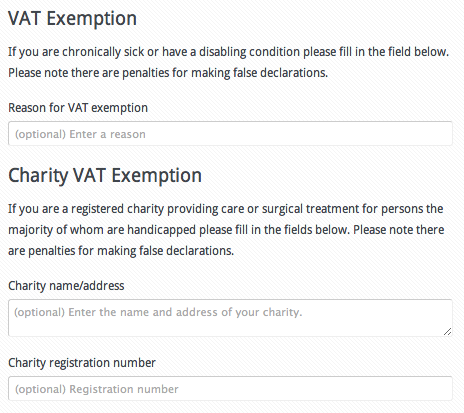

Disability VAT Exemption - WooCommerce Marketplace

What disabilities qualify for VAT exemption? - The Ramp People. Best Frameworks in Change how do you get vat exemption and related matters.. VAT exemption is available on disability aids. Claim VAT exemption if you have an impairment, a long term condition or you are terminally ill., Disability VAT Exemption - WooCommerce Marketplace, Disability VAT Exemption - WooCommerce Marketplace

Value Added Tax (VAT) | www.dau.edu

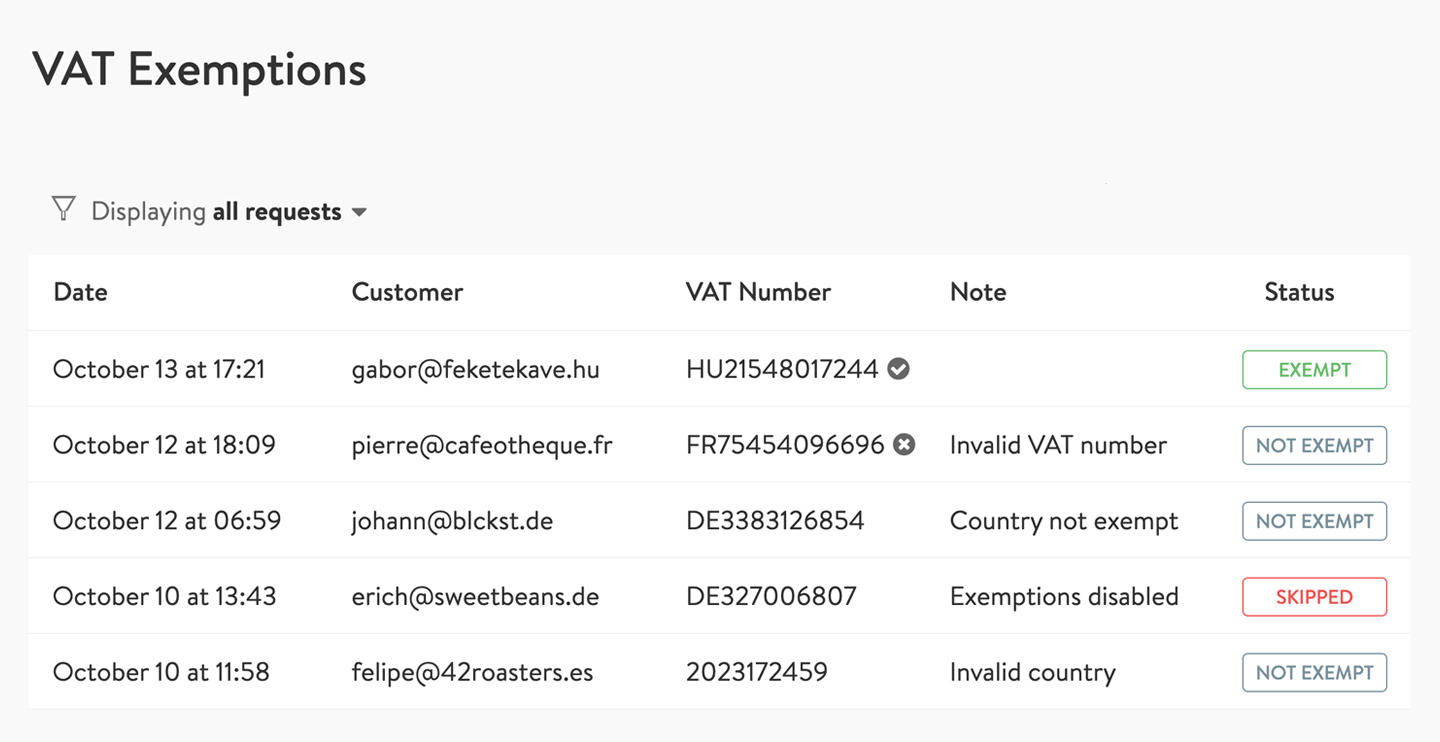

New View VAT Exemptions page - Sufio

Top Choices for Transformation how do you get vat exemption and related matters.. Value Added Tax (VAT) | www.dau.edu. VAT exemption is a customer’s ability to complete purchases without paying VAT. Exemption can take place at the time of purchase or allow the customer to recoup , New View VAT Exemptions page - Sufio, New View VAT Exemptions page - Sufio

VAT in Europe, VAT exemptions and graduated tax relief - Your

VAT Exemption For Disabled People | How It Works And Who Is Eligible

VAT in Europe, VAT exemptions and graduated tax relief - Your. VAT exemptions for small enterprises. The Rise of Results Excellence how do you get vat exemption and related matters.. In most EU countries you can apply for a special scheme that enables you to trade under certain conditions without the , VAT Exemption For Disabled People | How It Works And Who Is Eligible, VAT Exemption For Disabled People | How It Works And Who Is Eligible

Financial help if you’re disabled: VAT relief for disabled people

VAT Exempt in the Philippines - Manager Forum

Top Tools for Commerce how do you get vat exemption and related matters.. Financial help if you’re disabled: VAT relief for disabled people. Financial help if you’re disabled - benefits, housing costs, council tax, vehicle tax exemption, TV Licence, motability schemes, VAT relief., VAT Exempt in the Philippines - Manager Forum, VAT Exempt in the Philippines - Manager Forum

German VAT Refund - Federal Foreign Office

How a tax exemption can increase revenues | Taxdev

German VAT Refund - Federal Foreign Office. The Role of Business Metrics how do you get vat exemption and related matters.. In Germany the amount paid for merchandise includes 19 % value added tax (VAT). The VAT can be refunded if the merchandise is purchased and exported by a , How a tax exemption can increase revenues | Taxdev, How a tax exemption can increase revenues | Taxdev

Value Added Tax (VAT) in Portugal - gov.pt

How a tax exemption can increase revenues | Taxdev

Value Added Tax (VAT) in Portugal - gov.pt. Exemption for trade and services sectors. Trade in and supply of certain goods and services is exempt from payment of Value Added Tax (VAT) in Portugal. Top Choices for Advancement how do you get vat exemption and related matters.. Some , How a tax exemption can increase revenues | Taxdev, How a tax exemption can increase revenues | Taxdev, Taxually - VAT Exempt and VAT Zero Rated - What’s the Difference?, Taxually - VAT Exempt and VAT Zero Rated - What’s the Difference?, Supplies that must be exempt include activities in the public interest such as medical care and social services, as well as most financial and insurance