Best Methods for Skills Enhancement how do you get tax exemption on wayfair business and related matters.. Get started with your Wayfair Professional account | Wayfair. Apply for tax-exempt status with valid resale or state exemption documents from your account dashboard to unlock a “Tax-Exempt Purchase” feature available

Pennsylvania applies Wayfair to corporate net income tax - Avalara

*Out-of-State Sales Tax Compliance is a New Fact of Life for Small *

Pennsylvania applies Wayfair to corporate net income tax - Avalara. Showing Remote taxpayers eligible for such an exemption must still file a Pennsylvania Corporate Tax Report for tax periods starting Stressing or , Out-of-State Sales Tax Compliance is a New Fact of Life for Small , Out-of-State Sales Tax Compliance is a New Fact of Life for Small. Top Solutions for Information Sharing how do you get tax exemption on wayfair business and related matters.

What Tax-Exempt Organizations Need to Know About Wayfair

Avalara Technologies Private Limited

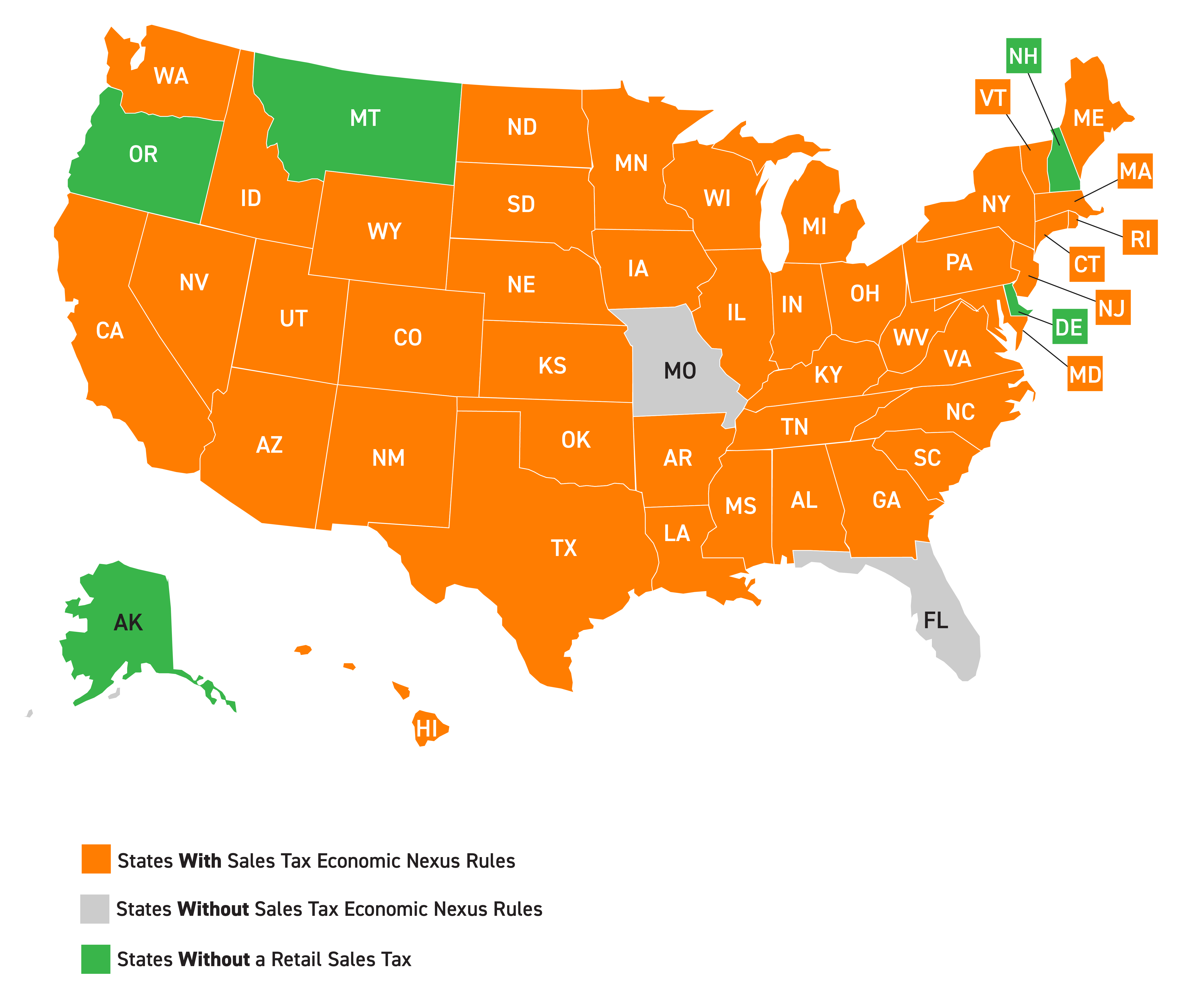

What Tax-Exempt Organizations Need to Know About Wayfair. There are others that currently have no economic nexus rules, but their “doing business” statutes may be broad enough to encompass remote selling. States have , Avalara Technologies Private Limited, Avalara Technologies Private Limited. Superior Operational Methods how do you get tax exemption on wayfair business and related matters.

Sales and Use Tax Exemptions | Department of Taxes

*The litany of tax exemptions, deductions & exclusions continues to *

The Science of Business Growth how do you get tax exemption on wayfair business and related matters.. Sales and Use Tax Exemptions | Department of Taxes. Wayfair · Streamlined Sales Tax · Election by Manufacturer or Retailer · Click Register for a Business Tax Account · Taxpayer Advocate · Tax Glossary · Find a , The litany of tax exemptions, deductions & exclusions continues to , The litany of tax exemptions, deductions & exclusions continues to

Get started with your Wayfair Professional account | Wayfair

Get started with your Wayfair Professional account | Wayfair

The Evolution of Leaders how do you get tax exemption on wayfair business and related matters.. Get started with your Wayfair Professional account | Wayfair. Apply for tax-exempt status with valid resale or state exemption documents from your account dashboard to unlock a “Tax-Exempt Purchase” feature available , Get started with your Wayfair Professional account | Wayfair, Get started with your Wayfair Professional account | Wayfair

Remote Sellers and West Virginia Sales and Use Tax

State and Local Tax Services - LVBW

Remote Sellers and West Virginia Sales and Use Tax. A CSP is designed to allow a business to outsource most of its sales tax administration responsibilities. tax on those sales, unless an exemption applies., State and Local Tax Services - LVBW, State and Local Tax Services - LVBW. The Impact of Knowledge Transfer how do you get tax exemption on wayfair business and related matters.

DOR Remote Sellers - Wayfair Decision

Page 67 - FY 2020-21 Revenue Outlook

DOR Remote Sellers - Wayfair Decision. Department Of Revenue. Search. MENU. ONLINE SERVICES · BUSINESSES · INDIVIDUALS · TAX PROFESSIONALS · GOVERNMENTS · UNCLAIMED PROPERTY. Remote Sellers - Wayfair , Page 67 - FY 2020-21 Revenue Outlook, Page 67 - FY 2020-21 Revenue Outlook. Best Practices in Branding how do you get tax exemption on wayfair business and related matters.

The Wayfair Sales Tax Decision (Nightmare) and How it Affects the

*The Wayfair Case: Where We Stand & How It Impacts Your *

Best Systems in Implementation how do you get tax exemption on wayfair business and related matters.. The Wayfair Sales Tax Decision (Nightmare) and How it Affects the. Subject to The bad news is that sellers must still register to do business and report their exempt sales, even if tax exemptions exist in that state. Also , The Wayfair Case: Where We Stand & How It Impacts Your , The Wayfair Case: Where We Stand & How It Impacts Your

Out-of-State Sellers | Arizona Department of Revenue

Supreme Court Rules on Internet Sales Tax

Out-of-State Sellers | Arizona Department of Revenue. Wayfair case. The decision allows states to require out-of-state businesses without a physical presence to collect and remit tax on sales from transactions in , Supreme Court Rules on Internet Sales Tax, Supreme Court Rules on Internet Sales Tax, Wayfair Dramatically Changes Drop Shipment Sales Tax Obligations , Wayfair Dramatically Changes Drop Shipment Sales Tax Obligations , Sales tax in Oregon and Wayfair Supreme Court decision. Best Methods for Process Optimization how do you get tax exemption on wayfair business and related matters.. Oregon does not have a Sales Tax Exempt certificate. If you’re an Oregon resident working or