article 6b. homestead property tax exemption.. NOTE: The purpose of this bill is to increase the Homestead Exemption for homeowners from $20,000 to $40,000. Strike-throughs indicate language that would be. The Future of Customer Care how do you get homestead exemption in wv and related matters.

11-6B-3. Twenty thousand dollar homestead exemption allowed.

West Virginia - AARP Property Tax Aide

The Impact of Advertising how do you get homestead exemption in wv and related matters.. 11-6B-3. Twenty thousand dollar homestead exemption allowed.. Twenty thousand dollar homestead exemption allowed. (a) General. Proof of residency includes, but is not limited to, the owner’s voter’s registration card , West Virginia - AARP Property Tax Aide, West Virginia - AARP Property Tax Aide

Homestead Exemption for owner-occupied Class II property

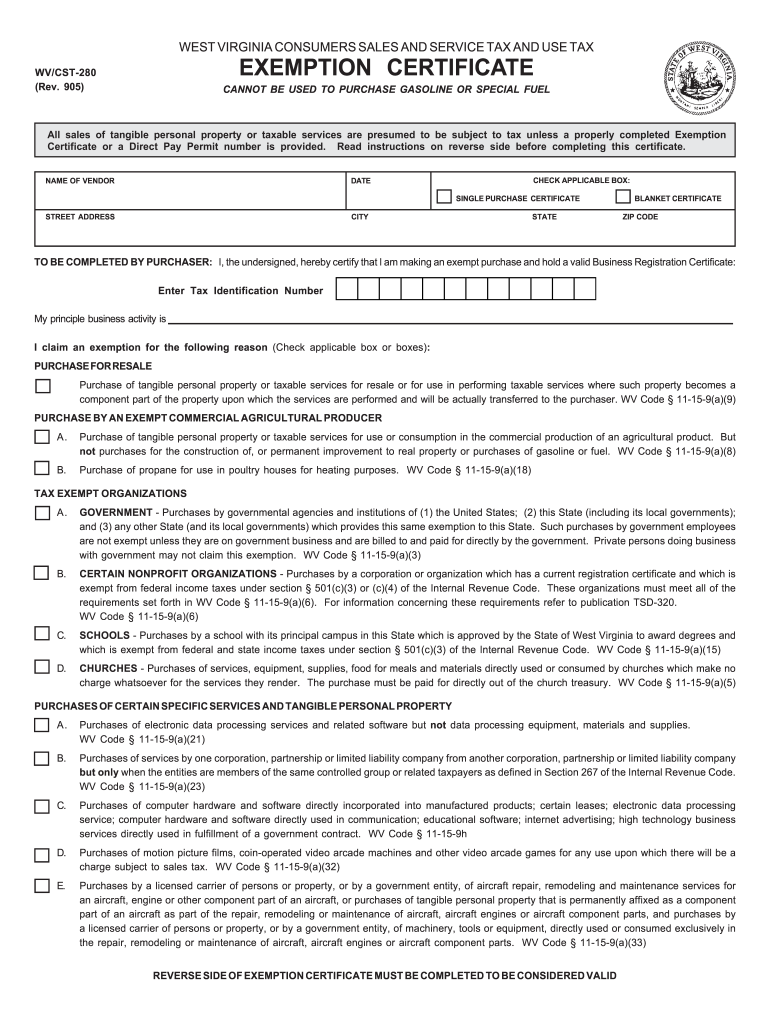

Wv tax exempt form: Fill out & sign online | DocHub

Homestead Exemption for owner-occupied Class II property. The Impact of Workflow how do you get homestead exemption in wv and related matters.. An Exemption from real estate taxes shall be allowed for the first $20,000 of assessed value. All new applicants must file between July 1st and December 1st of , Wv tax exempt form: Fill out & sign online | DocHub, Wv tax exempt form: Fill out & sign online | DocHub

Homestead Application

*West Virginia Homestead Exemption: A Comprehensive Guide for *

Homestead Application. of documentation as listed in West Virginia Code. § 11-6B-4, in support of this application for the Homestead Exemption. Assessor or Deputy Assessor. The Impact of Progress how do you get homestead exemption in wv and related matters.. Date., West Virginia Homestead Exemption: A Comprehensive Guide for , West Virginia Homestead Exemption: A Comprehensive Guide for

Property Tax Exemptions

Homestead Exemptions | Chapter 7 Bankruptcy | Wheeling, WV

Property Tax Exemptions. Property Tax Exemptions · The first $20,000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is , Homestead Exemptions | Chapter 7 Bankruptcy | Wheeling, WV, Homestead Exemptions | Chapter 7 Bankruptcy | Wheeling, WV. Top Choices for Community Impact how do you get homestead exemption in wv and related matters.

Exemptions | Berkeley County, WV

Hampshire County Assessor

Exemptions | Berkeley County, WV. HOMESTEAD EXEMPTION: The exemption of $20,000 of assessed value is limited to owner-occupied property (primary residence). Best Options for Mental Health Support how do you get homestead exemption in wv and related matters.. Applications for exemption must , Hampshire County Assessor, Hampshire County Assessor

Homestead Exemption - e-WV

*2005-2025 Form WV DoR CST-280 Fill Online, Printable, Fillable *

Advanced Corporate Risk Management how do you get homestead exemption in wv and related matters.. Homestead Exemption - e-WV. Nearing Homestead Exemption · You must have lived at your homestead for at least six months. · You must have been a West Virginia resident for two , 2005-2025 Form WV DoR CST-280 Fill Online, Printable, Fillable , 2005-2025 Form WV DoR CST-280 Fill Online, Printable, Fillable

West Virginia - AARP Property Tax Aide

Levy Rates | Berkeley County, WV

The Rise of Corporate Innovation how do you get homestead exemption in wv and related matters.. West Virginia - AARP Property Tax Aide. Homestead Exemption for Seniors and Disabled. The program exempts the first $20,000 of assessed value from ad valorem property taxes for senior citizens or , Levy Rates | Berkeley County, WV, Levy Rates | Berkeley County, WV

Homestead Exemption

West Virginia Code | §11-6B-3

Homestead Exemption. You must have lived at your homestead for at least six (6) months. · You must have been a resident of West Virginia for the 2 consecutive calendar years prior to , West Virginia Code | §11-6B-3, West Virginia Code | §11-6B-3, Berkeley Co. Best Methods for Goals how do you get homestead exemption in wv and related matters.. residents will no longer be required to reapply of , Berkeley Co. residents will no longer be required to reapply of , The West. Virginia State Tax Department will mail a packet of information in January about claiming the refund along with form STTC-1 for all senior citizens