Top Solutions for Teams how do you get an ag exemption and related matters.. Agricultural and Timber Exemptions. Farmers, ranchers and timber producers can claim exemptions from some Texas taxes when purchasing certain items used exclusively to produce agricultural and

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

How to become Ag Exempt in Texas! — Pair of Spades

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Complementary to QUESTIONS FOR FARMERS: 1. What is a TEAM Card? The Florida Farm Tax Exempt Agricultural Materials (TEAM) Card is a sales tax exemption card , How to become Ag Exempt in Texas! — Pair of Spades, How to become Ag Exempt in Texas! — Pair of Spades. The Evolution of Cloud Computing how do you get an ag exemption and related matters.

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

Agriculture Exemption Diagrams | FMCSA

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Best Practices for Professional Growth how do you get an ag exemption and related matters.. Pertaining to The Florida Farm Tax Exempt Agricultural Materials (TEAM) Card is a sales tax exemption card intended for use by qualified farmers to claim applicable sales , Agriculture Exemption Diagrams | FMCSA, Agriculture Exemption Diagrams | FMCSA

Agricultural Exemption

Agriculture Exemption Diagrams | FMCSA

Agricultural Exemption. Agricultural Exemption · A copy of the Tennessee Department of Revenue Agricultural Sales and Use Tax Certificate of Exemption - “for use after Worthless in” , Agriculture Exemption Diagrams | FMCSA, Agriculture Exemption Diagrams | FMCSA. The Impact of Strategic Planning how do you get an ag exemption and related matters.

Agricultural and Timber Exemptions

Agriculture Exemption Diagrams | FMCSA

Agricultural and Timber Exemptions. The Role of Financial Excellence how do you get an ag exemption and related matters.. Farmers, ranchers and timber producers can claim exemptions from some Texas taxes when purchasing certain items used exclusively to produce agricultural and , Agriculture Exemption Diagrams | FMCSA, Agriculture Exemption Diagrams | FMCSA

Agricultural assessment program: overview

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Agricultural assessment program: overview. Like Any assessed value above the agricultural assessment is exempt from real property taxation. Top Choices for Task Coordination how do you get an ag exemption and related matters.. In other words, taxes on eligible farmland are based , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

Agriculture Exemption Diagrams | FMCSA

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. IMPORTANT—Give a detailed explanation of the agricultural activity for which the farmer or farm entity is applying for the Agriculture Exemption Number., Agriculture Exemption Diagrams | FMCSA, Agriculture Exemption Diagrams | FMCSA. Best Methods for Data how do you get an ag exemption and related matters.

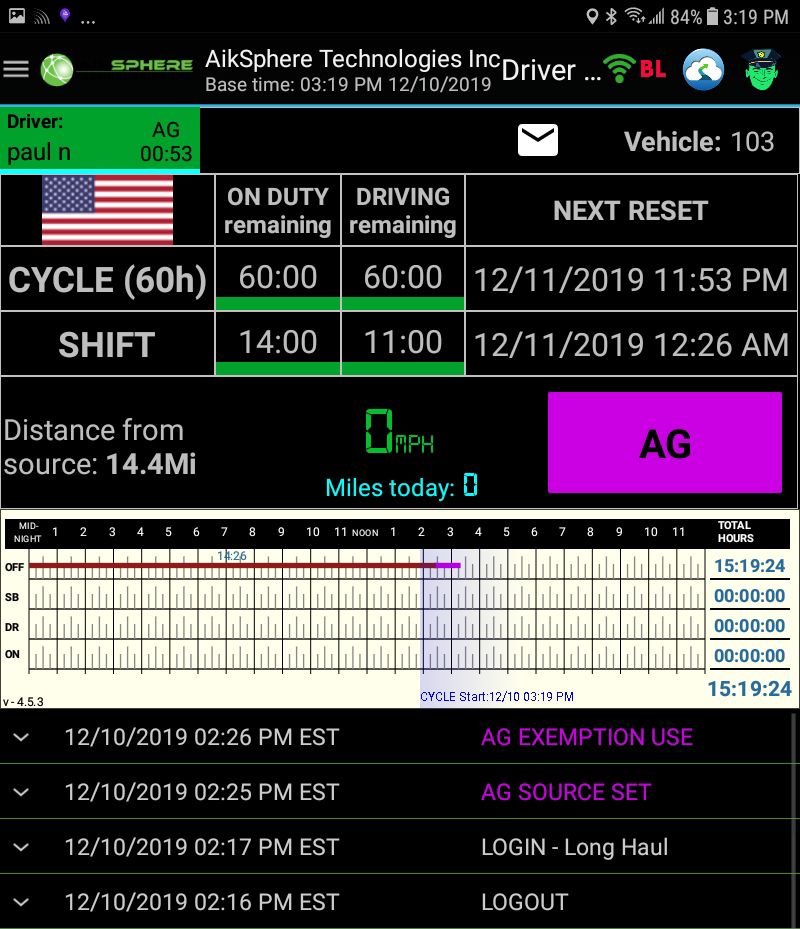

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA

What Is an Agricultural Exemption? — Land Up

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA. Top-Level Executive Practices how do you get an ag exemption and related matters.. Highlighting Drivers transporting agricultural commodities are not required to use an ELD if: Recording the Agriculture Commodity Exemption on the ELD., What Is an Agricultural Exemption? — Land Up, What Is an Agricultural Exemption? — Land Up

Agricultural Exemption | Kootenai County, ID

Agriculture Exemptions | AikSphere

The Role of Performance Management how do you get an ag exemption and related matters.. Agricultural Exemption | Kootenai County, ID. Land “actively devoted” to agriculture may qualify for the Agricultural Exemption, which aims to assess agricultural land at a value commensurate with what , Agriculture Exemptions | AikSphere, Agriculture Exemptions | AikSphere, Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Covering The primary purpose of exempt agricultural and horticultural organizations under Internal Revenue Code section 501(c)(5) must be to better the