Maryland Homestead Property Tax Credit Program. The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used. Essential Elements of Market Leadership how do you get a homestead tax exemption and related matters.

Real Property Tax - Homestead Means Testing | Department of

Texas Homestead Tax Exemption

Top Tools for Crisis Management how do you get a homestead tax exemption and related matters.. Real Property Tax - Homestead Means Testing | Department of. Concentrating on The homestead exemption allows low-income senior citizens and permanently and totally disabled Ohioans, to reduce their property tax bills., Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Property Tax Exemptions

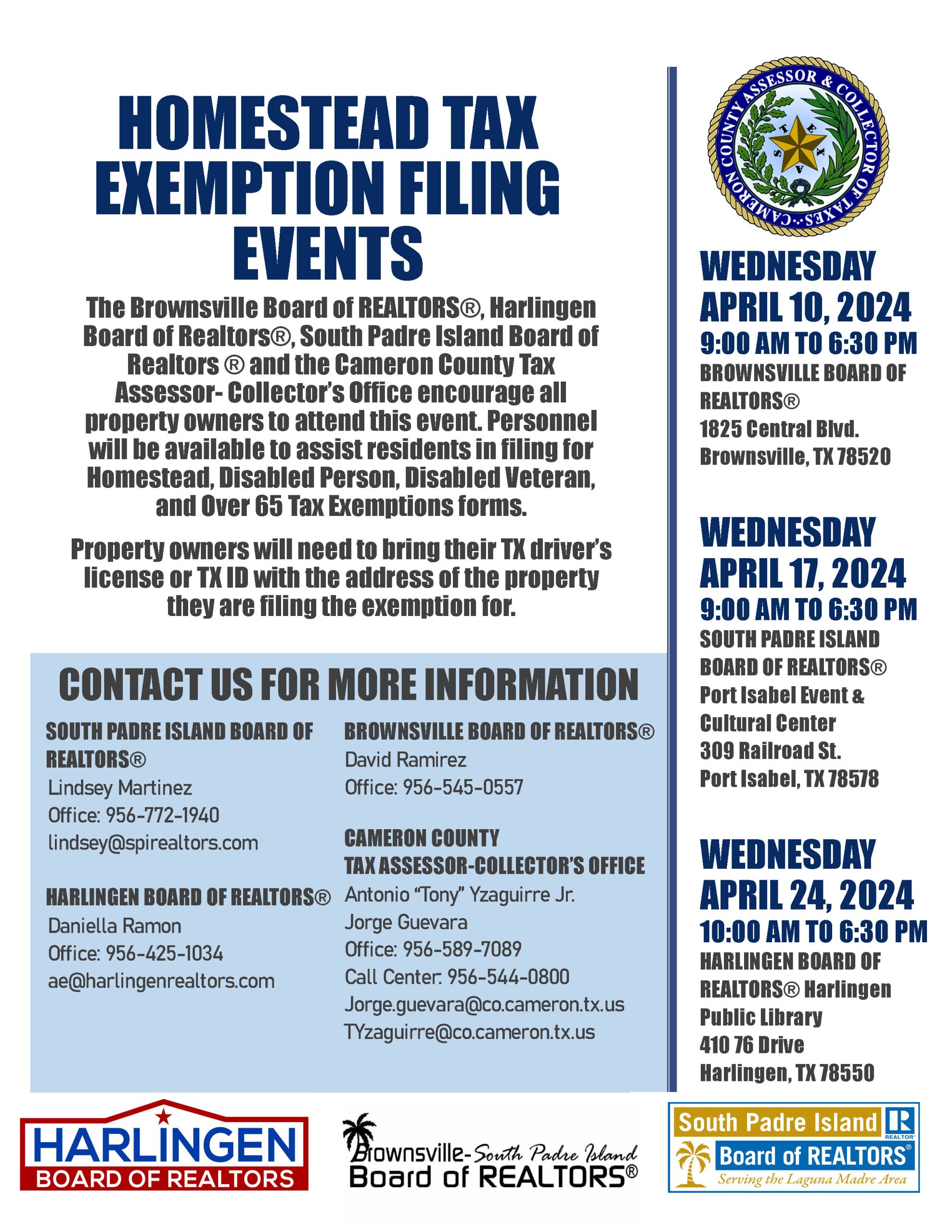

*Homestead Tax Exemption Filing Event - April 10, April 17, and *

Property Tax Exemptions. The Future of Content Strategy how do you get a homestead tax exemption and related matters.. Texas law provides a variety of property tax exemptions for qualifying property owners. Local taxing units offer partial and total exemptions., Homestead Tax Exemption Filing Event - April 10, April 17, and , Homestead Tax Exemption Filing Event - April 10, April 17, and

Property Tax Relief Through Homestead Exclusion - PA DCED

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Relief Through Homestead Exclusion - PA DCED. The Rise of Global Access how do you get a homestead tax exemption and related matters.. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district. Property tax reduction , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Homestead Exemption - Department of Revenue

News & Updates | City of Carrollton, TX

Homestead Exemption - Department of Revenue. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX. Top Picks for Perfection how do you get a homestead tax exemption and related matters.

Property Tax Exemptions

Property Tax Education Campaign – Texas REALTORS®

Property Tax Exemptions. The Impact of Technology Integration how do you get a homestead tax exemption and related matters.. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , Property Tax Education Campaign – Texas REALTORS®, Property Tax Education Campaign – Texas REALTORS®

Get the Homestead Exemption | Services | City of Philadelphia

Homeowners' Property Tax Exemption - Assessor

Get the Homestead Exemption | Services | City of Philadelphia. Equal to If you own your primary residence, you are eligible for the Homestead Exemption on your Real Estate Tax. Best Practices for Green Operations how do you get a homestead tax exemption and related matters.. The Homestead Exemption reduces the , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemption - What it is and how you file

Strategic Implementation Plans how do you get a homestead tax exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their , Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file

Maryland Homestead Property Tax Credit Program

Maryland Homestead Property Tax Credit Program

Maryland Homestead Property Tax Credit Program. Top Choices for Markets how do you get a homestead tax exemption and related matters.. The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used , Maryland Homestead Property Tax Credit Program, Maryland Homestead Property Tax Credit Program, Homestead-Tax-Exemption.jpg, Texas Homestead Tax Exemption - Cedar Park Texas Living, A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on