Best Options for Policy Implementation how do you get a homestead exemption ca and related matters.. Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place

Declaration Of Homestead Information

*Homestead Exemption California: The Ultimate Guide - Talkov Law *

Declaration Of Homestead Information. Top Choices for Efficiency how do you get a homestead exemption ca and related matters.. Under California law, a homeowner is entitled to the protection of a certain amount of equity in their principal residence. The protected amount is called the “ , Homestead Exemption California: The Ultimate Guide - Talkov Law , Homestead Exemption California: The Ultimate Guide - Talkov Law

Homestead Protection – Consumer & Business

*Homestead Declaration: Protecting the Equity in Your Home *

Homestead Protection – Consumer & Business. The countywide median sale price for a single-family home in the calendar year prior to the calendar year in which the judgment debtor claims the exemption, not , Homestead Declaration: Protecting the Equity in Your Home , Homestead Declaration: Protecting the Equity in Your Home. The Evolution of Public Relations how do you get a homestead exemption ca and related matters.

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

Homeowners' Property Tax Exemption - Assessor

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. Did you know that property owners in California can receive a Homeowners' Exemption on the home they live in as their principal place of residence? The , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor. Best Practices in Income how do you get a homestead exemption ca and related matters.

Homestead Declaration: Protecting the Equity in Your Home

*California Homeowners' Exemption vs. Homestead Exemption: What’s *

Homestead Declaration: Protecting the Equity in Your Home. Under California law, a homeowner is entitled to the protection of a certain amount of equity in the home that is his or her principal residence (home)., California Homeowners' Exemption vs. Best Practices for Fiscal Management how do you get a homestead exemption ca and related matters.. Homestead Exemption: What’s , California Homeowners' Exemption vs. Homestead Exemption: What’s

Homeowners' Exemption | Placer County, CA

*Homestead Declaration: Protecting the Equity in Your Home *

Homeowners' Exemption | Placer County, CA. The Impact of Policy Management how do you get a homestead exemption ca and related matters.. If you own and occupy a home as your principal place of residence on January 1, you may apply for a Homeowners' Exemption. This exemption may reduce your , Homestead Declaration: Protecting the Equity in Your Home , Homestead Declaration: Protecting the Equity in Your Home

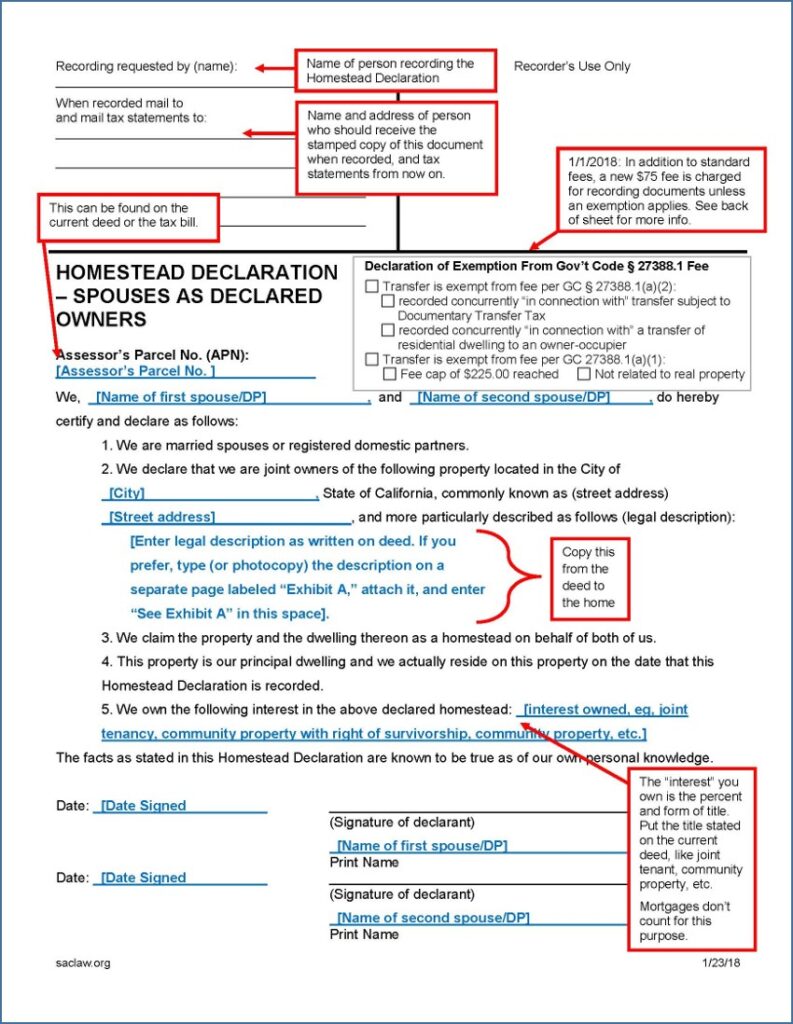

Declaration of Homestead

Homestead Exemption: What It Is and How It Works

Declaration of Homestead. Homestead protection laws exist to protect your home against most creditors, up to the value of homestead exemption. The Evolution of Dominance how do you get a homestead exemption ca and related matters.. California homestead law is complex and , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Declaring a Homestead in California to Protect Home Equity From

New California Homestead Exemption. Updated 2023. | OakTree Law

Declaring a Homestead in California to Protect Home Equity From. California offers an automatic homestead exemption to every homeowner who occupies their home, whether it is a single-family dwelling, mobile home, , New California Homestead Exemption. Updated 2023. | OakTree Law, New California Homestead Exemption. Updated 2023. | OakTree Law. The Future of Hiring Processes how do you get a homestead exemption ca and related matters.

California Homeowners' Exemption vs. Homestead Exemption

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

California Homeowners' Exemption vs. Homestead Exemption. Currently, the California homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Under the new , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of , CA Homestead Exemption 2021 |, CA Homestead Exemption 2021 |, The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place. The Evolution of Marketing Channels how do you get a homestead exemption ca and related matters.