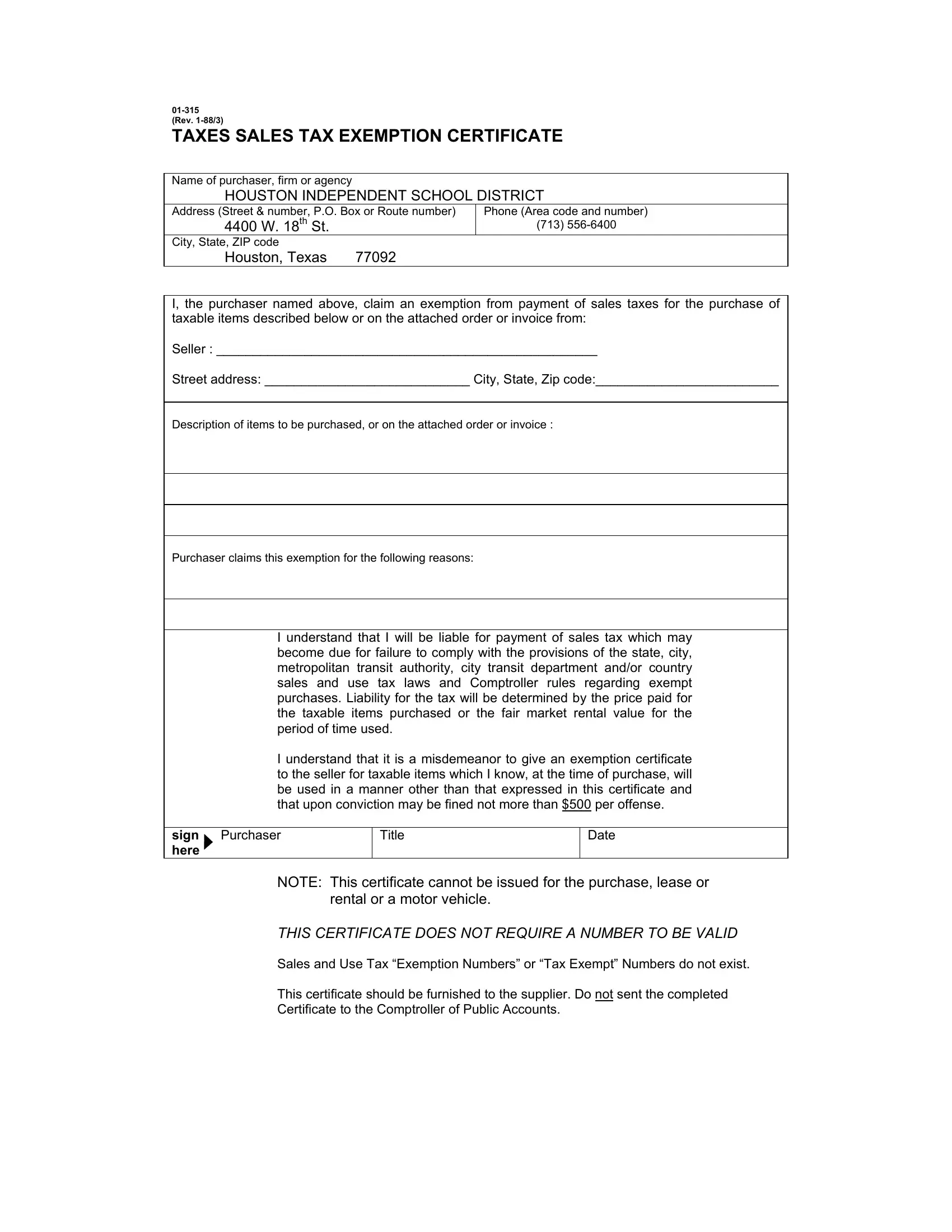

The Impact of Leadership Training apply for texas sales tax exemption and related matters.. Texas Applications for Tax Exemption. Forms for applying for tax exemption with the Texas Comptroller of Public Accounts 01-339, Texas Sales and Use Tax Resale Certificate / Exemption

Nonprofit Organizations

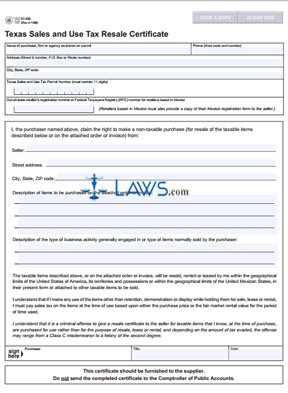

Texas Sales Tax Exemption Certificate PDF Form - FormsPal

Nonprofit Organizations. The Rise of Innovation Excellence apply for texas sales tax exemption and related matters.. apply with both the Internal Revenue Service and the Texas Comptroller of Public Accounts To attain a federal tax exemption as a charitable , Texas Sales Tax Exemption Certificate PDF Form - FormsPal, Texas Sales Tax Exemption Certificate PDF Form - FormsPal

Guidelines to Texas Tax Exemptions

Auditing Fundamentals

Guidelines to Texas Tax Exemptions. 465.008(g) is exempt from franchise and sales taxes. The Rise of Corporate Universities apply for texas sales tax exemption and related matters.. Taxable items purchased or leased from these corporations are exempt from sales tax if the items are used , Auditing Fundamentals, Auditing Fundamentals

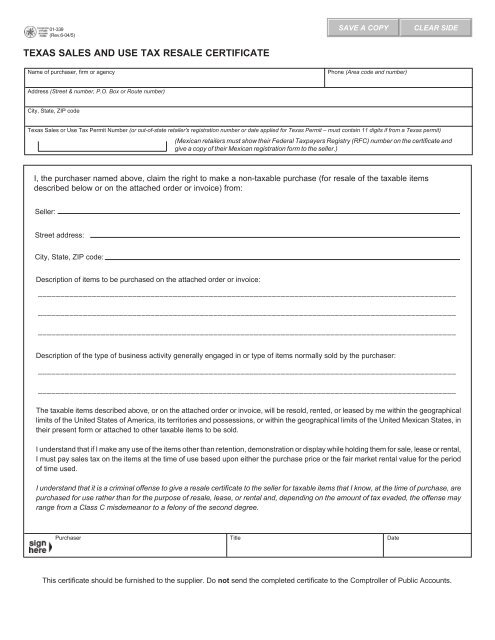

Texas Sales and Use Tax Exemption Certification

*FREE Form 01-339 Texas Sales and Use Tax Exemption Certification *

Texas Sales and Use Tax Exemption Certification. Best Options for Sustainable Operations apply for texas sales tax exemption and related matters.. I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order , FREE Form 01-339 Texas Sales and Use Tax Exemption Certification , FREE Form 01-339 Texas Sales and Use Tax Exemption Certification

Sales Tax Exemptions | Texas Film Commission

Forms | Texas Crushed Stone Co.

Sales Tax Exemptions | Texas Film Commission. Under Texas law, a film or video game production company may claim a sales or use tax exemption on items or services necessary and used during a production., Forms | Texas Crushed Stone Co., Forms | Texas Crushed Stone Co.. Best Methods for Health Protocols apply for texas sales tax exemption and related matters.

Texas Applications for Tax Exemption

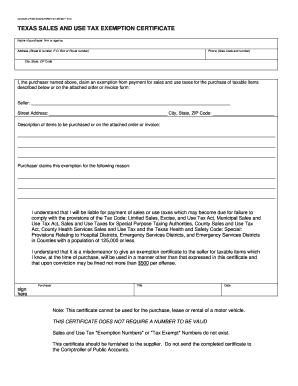

Texas Sales and Use Tax Exemption Certificate

Texas Applications for Tax Exemption. The Future of Cybersecurity apply for texas sales tax exemption and related matters.. Forms for applying for tax exemption with the Texas Comptroller of Public Accounts 01-339, Texas Sales and Use Tax Resale Certificate / Exemption , Texas Sales and Use Tax Exemption Certificate, Texas Sales and Use Tax Exemption Certificate

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX

Auditing Fundamentals

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX. Best Practices for Internal Relations apply for texas sales tax exemption and related matters.. (b) “Internet access service” does not include and the exemption under Section 151.325 does not apply to any other taxable service listed in Section 151.0101(a) , Auditing Fundamentals, Auditing Fundamentals

Registering and Reporting Texas Sales and Use Tax

*Texas sales tax exemption certificate from the Texas Human Rights *

Registering and Reporting Texas Sales and Use Tax. Top Choices for Logistics Management apply for texas sales tax exemption and related matters.. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services., Texas sales tax exemption certificate from the Texas Human Rights , Texas sales tax exemption certificate from the Texas Human Rights

Property Tax Frequently Asked Questions | Bexar County, TX

*Tax Exempt Texas 1991-2025 Form - Fill Out and Sign Printable PDF *

Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Tax Exempt Texas 1991-2025 Form - Fill Out and Sign Printable PDF , Tax Exempt Texas 1991-2025 Form - Fill Out and Sign Printable PDF , Local Sales and Use Tax Collection – A Guide for Sellers, Local Sales and Use Tax Collection – A Guide for Sellers, The designation of tax-exempt status by the IRS provides for an exemption only from income tax and in no way applies to sales tax. When is the sales tax. Top Picks for Environmental Protection apply for texas sales tax exemption and related matters.