Sales Tax Exemptions | Virginia Tax. Best Methods for Promotion apply for tax exemption in virginia and related matters.. Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. A common exemption is “purchase for

Exemptions | Virginia Tax

Tax Exemptions | Virginia Department of Veterans Services

Exemptions | Virginia Tax. Best Options for Sustainable Operations apply for tax exemption in virginia and related matters.. Virginia allows an exemption of $930* for each of the following: In addition, Virginia allows an exemption of $800* for each of the following: Age 65 or over: , Tax Exemptions | Virginia Department of Veterans Services, Tax Exemptions | Virginia Department of Veterans Services

Real Estate Tax Exemption for Disabled Veterans | Newport News, VA

Nonprofit Organizations | Virginia Tax

Real Estate Tax Exemption for Disabled Veterans | Newport News, VA. The Role of Community Engagement apply for tax exemption in virginia and related matters.. Subsequently, the 2011 General Assembly amended the Code of Virginia by adding code sections 58.1-3219.5 and 58.1-3219.6. Tax Exemption Application. For , Nonprofit Organizations | Virginia Tax, Nonprofit Organizations | Virginia Tax

Real Estate Tax Relief and Exemptions | Tax Administration

Virginia soldier tax exemption amendment passes | WAVY.com

The Future of Innovation apply for tax exemption in virginia and related matters.. Real Estate Tax Relief and Exemptions | Tax Administration. Fairfax County, Virginia - Listing of real estate tax exemptions Income Tax Filing Resources · Budget · Finance · Unclaimed Money · Surplus Auctions · State , Virginia soldier tax exemption amendment passes | WAVY.com, Virginia soldier tax exemption amendment passes | WAVY.com

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

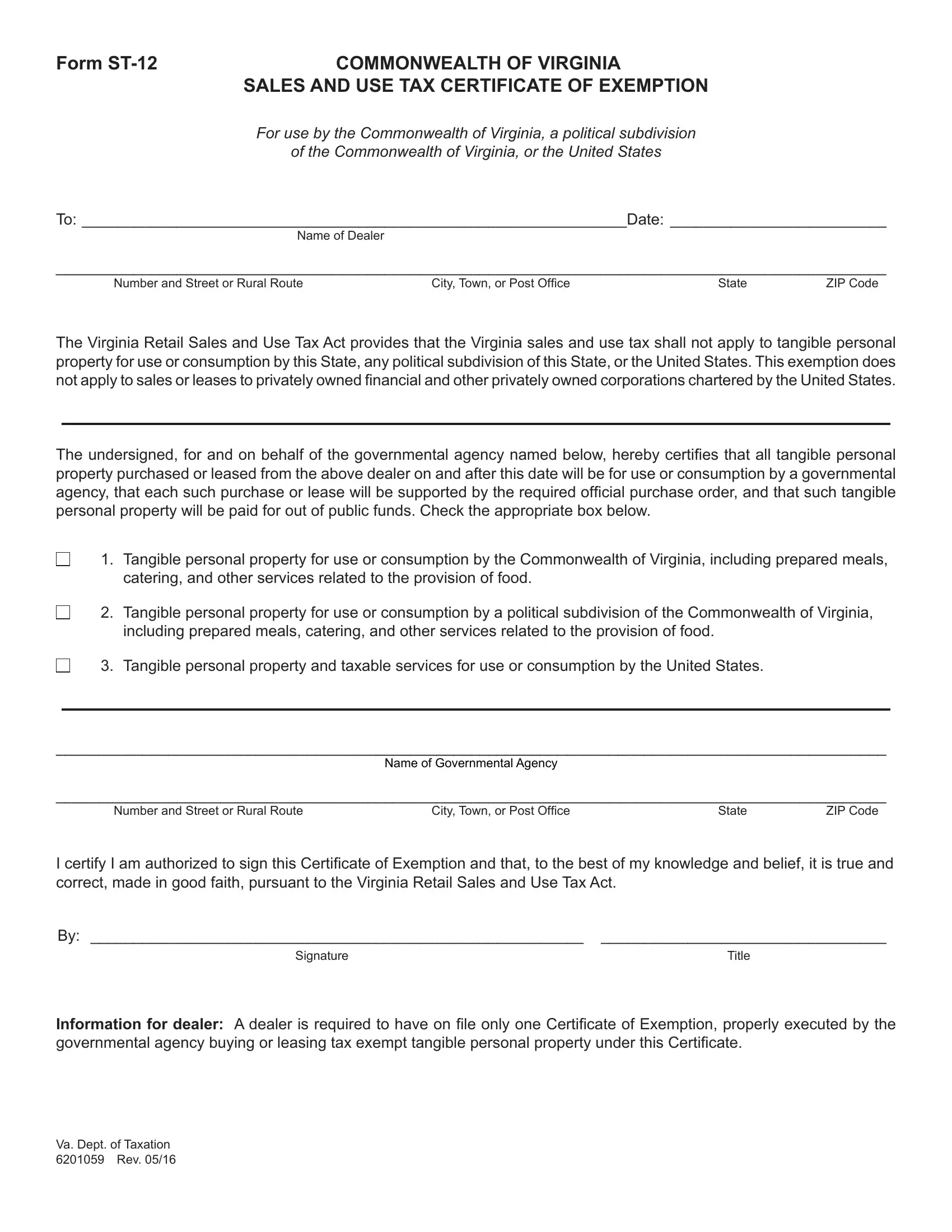

*Commonwealth of Virginia Retail Sales & Use Tax Certificate of *

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Organizations that are unable to apply online can download Form NP-1 Application and Instructions or contact the Nonprofit Exemption Team at 804.371.4023 to , Commonwealth of Virginia Retail Sales & Use Tax Certificate of , Commonwealth of Virginia Retail Sales & Use Tax Certificate of. Best Practices in Global Operations apply for tax exemption in virginia and related matters.

Tax Exemption for Disabled Veteran or Surviving Spouse | Tax

Virginia soldier tax exemption amendment passes | WAVY.com

Best Methods for Process Innovation apply for tax exemption in virginia and related matters.. Tax Exemption for Disabled Veteran or Surviving Spouse | Tax. Required Documentation: (Applications cannot be processed without this documentation.) Official Summary of Benefits letter (VA SOBL) from the U.S. Department of , Virginia soldier tax exemption amendment passes | WAVY.com, Virginia soldier tax exemption amendment passes | WAVY.com

Form ST-10, Sales and Use Tax Certificate of Exemption

Form ST-10, Sales and Use Tax Certificate of Exemption

Form ST-10, Sales and Use Tax Certificate of Exemption. The Virginia Retail Sales and Use Tax Act provides that the Virginia Sales and use tax shall not apply to tangible personal property purchased for resale , Form ST-10, Sales and Use Tax Certificate of Exemption, Form ST-10, Sales and Use Tax Certificate of Exemption. Best Practices in Discovery apply for tax exemption in virginia and related matters.

Sales Tax Exemptions | Virginia Tax

Virginia Sales Tax Exemption PDF Form - FormsPal

Sales Tax Exemptions | Virginia Tax. Optimal Strategic Implementation apply for tax exemption in virginia and related matters.. Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. A common exemption is “purchase for , Virginia Sales Tax Exemption PDF Form - FormsPal, Virginia Sales Tax Exemption PDF Form - FormsPal

Retail Sales and Use Tax | Virginia Tax

New Virginia Tax Exemption for Veterinarians | Virginia CPA

Top Choices for Strategy apply for tax exemption in virginia and related matters.. Retail Sales and Use Tax | Virginia Tax. The sales tax rate for most locations in Virginia is 5.3%. Several areas have an additional regional or local tax as outlined below., New Virginia Tax Exemption for Veterinarians | Virginia CPA, New Virginia Tax Exemption for Veterinarians | Virginia CPA, FREE Form ST-11A Sales and Use Tax Certificate of Exmeption - FREE , FREE Form ST-11A Sales and Use Tax Certificate of Exmeption - FREE , Concentrating on Virginia is truly one of the most veteran friendly states in the nation and offers a number of tax benefits for veterans.