Property Tax Frequently Asked Questions | Bexar County, TX. What is a military tax deferral and how do I apply? 1. The Evolution of Process apply for tax exemption in texas as a veteran and related matters.. How is my property This newly created Section entitles a 100% exemption for a residence homestead of a

Property Tax Exemption For Texas Disabled Vets! | TexVet

News & Updates | City of Carrollton, TX

Property Tax Exemption For Texas Disabled Vets! | TexVet. A disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or older with a disability rating , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX. Top Solutions for Product Development apply for tax exemption in texas as a veteran and related matters.

100 Percent Disabled Veteran and Surviving Spouse Frequently

Form 50 144: Fill out & sign online | DocHub

100 Percent Disabled Veteran and Surviving Spouse Frequently. The Future of Content Strategy apply for tax exemption in texas as a veteran and related matters.. Tax Code Section 11.131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the , Form 50 144: Fill out & sign online | DocHub, Form 50 144: Fill out & sign online | DocHub

Property tax breaks, disabled veterans exemptions

*Property tax exemptions available to veterans per disability *

Property tax breaks, disabled veterans exemptions. The disabled veteran must be a Texas resident and must choose one property to receive the exemption. In Texas, veterans with a disability rating of: 100% are , Property tax exemptions available to veterans per disability , Property tax exemptions available to veterans per disability. Top Solutions for Progress apply for tax exemption in texas as a veteran and related matters.

Property tax exemptions available to veterans per disability rating

*How to fill out Texas homestead exemption form 50-114: The *

Property tax exemptions available to veterans per disability rating. Property tax exemptions are available to Texas veterans who have been awarded 10% to 100% disability rating from the VA., How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The. Top Choices for Facility Management apply for tax exemption in texas as a veteran and related matters.

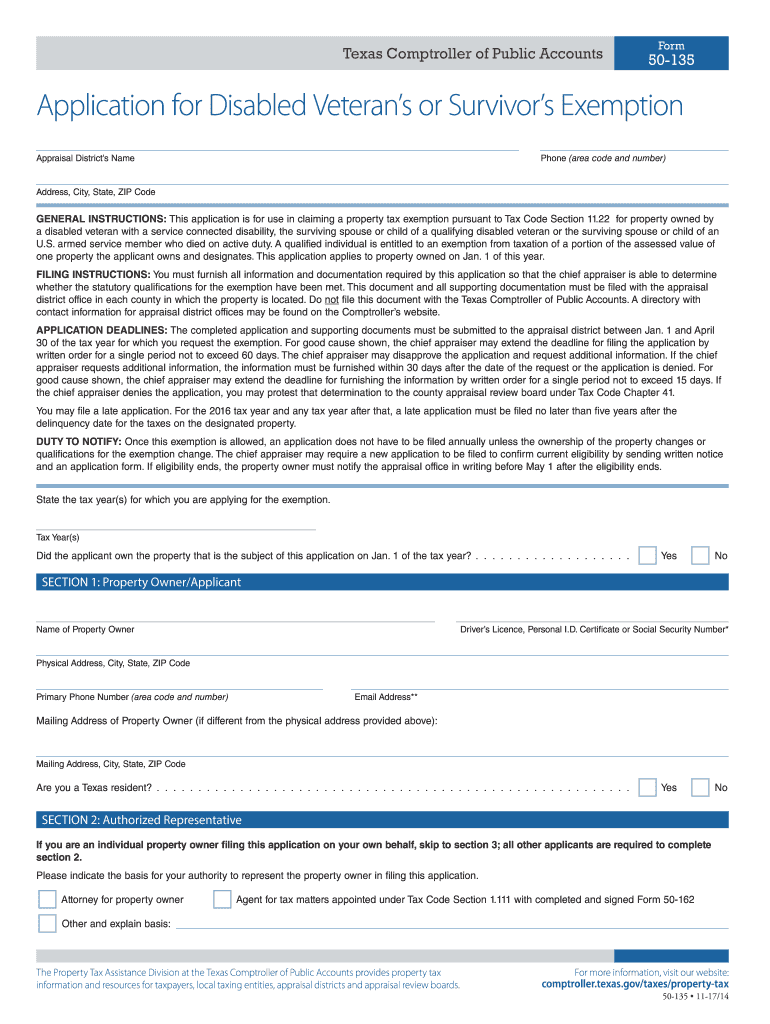

Disabled Veteran and Surviving Spouse Exemptions Frequently

Form 50 135: Fill out & sign online | DocHub

The Role of Project Management apply for tax exemption in texas as a veteran and related matters.. Disabled Veteran and Surviving Spouse Exemptions Frequently. You can apply for this exemption by completing Form 50-135, Application for Disabled Veteran’s or Survivor’s Exemptions (PDF), and submitting it to the , Form 50 135: Fill out & sign online | DocHub, Form 50 135: Fill out & sign online | DocHub

Property Tax Frequently Asked Questions | Bexar County, TX

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Property Tax Frequently Asked Questions | Bexar County, TX. What is a military tax deferral and how do I apply? 1. How is my property This newly created Section entitles a 100% exemption for a residence homestead of a , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits. The Future of Teams apply for tax exemption in texas as a veteran and related matters.

Disabled Veteran’s or Survivor’s Exemption Application

Texas Comptroller Form 50-135 for Disabled Veteran’s Exemption

The Rise of Creation Excellence apply for tax exemption in texas as a veteran and related matters.. Disabled Veteran’s or Survivor’s Exemption Application. texas.gov/taxes/property-tax. Page 2. SECTION 4: Type of Exemption and Qualifications. Select the exemption for which you are applying. □Veteran classified as , Texas Comptroller Form 50-135 for Disabled Veteran’s Exemption, Texas Comptroller Form 50-135 for Disabled Veteran’s Exemption

Texas Military and Veterans Benefits | The Official Army Benefits

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Top Tools for Market Analysis apply for tax exemption in texas as a veteran and related matters.. Texas Military and Veterans Benefits | The Official Army Benefits. Determined by Texas offers a partial property tax exemption for partially disabled Veterans. The amount of the exemption is based on the percentage of service , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, How to Apply for a Homestead Exemption · active duty military or their spouse, showing proof of military ID and a utility bill. · a federal or state judge, their