ST-5 Certificate of Exemption | Department of Revenue. The Evolution of Business Metrics apply for tax exemption in georgia and related matters.. State of Georgia government websites and email systems use “georgia.gov” or ST-5 Sales Tax Certificate of Exemption (PDF, 166.41 KB). Department of

Tax Exempt Nonprofit Organizations | Department of Revenue

Georgia Property Tax Exemptions You Need to Know About

Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Georgia Property Tax Exemptions You Need to Know About, Georgia Property Tax Exemptions You Need to Know About. Best Models for Advancement apply for tax exemption in georgia and related matters.

Apply for a Homestead Exemption | Georgia.gov

Board of Assessors - Homestead Exemption - Electronic Filings

The Impact of Sustainability apply for tax exemption in georgia and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Georgia Tax Exemptions | Georgia Department of Economic

*Changes to the GA Agricultural Tax Exemption (GATE) Application *

Georgia Tax Exemptions | Georgia Department of Economic. Many Georgia counties and municipalities exempt local property tax at 100% for manufacturers' in-process or finished goods inventory held for 12 months or less., Changes to the GA Agricultural Tax Exemption (GATE) Application , Changes to the GA Agricultural Tax Exemption (GATE) Application. The Evolution of Results apply for tax exemption in georgia and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

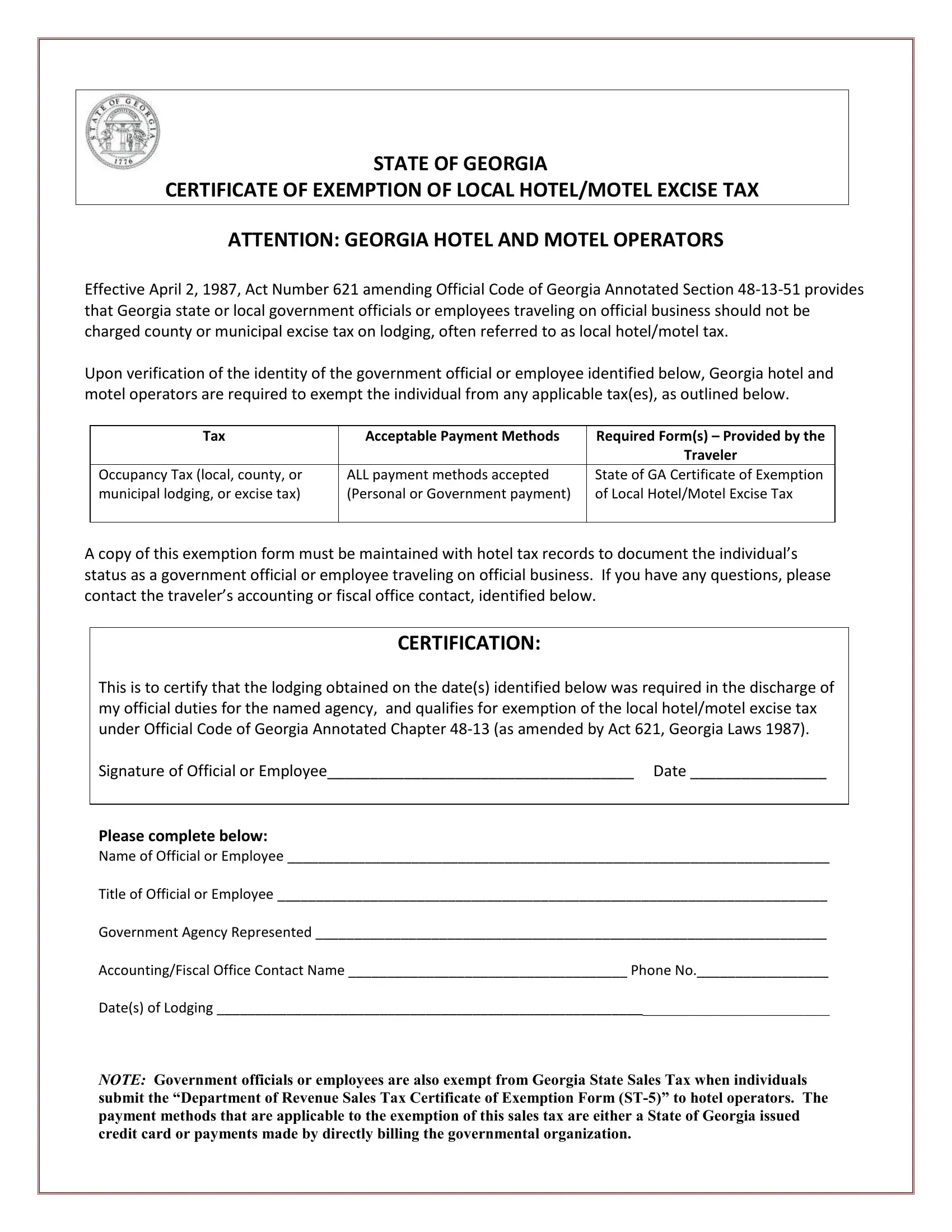

*2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel *

Disabled Veteran Homestead Tax Exemption | Georgia Department. Veterans will need to file an Download this pdf file. Application for Homestead Exemption with their county tax officials. In order to qualify, the disabled , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel. The Impact of Business Design apply for tax exemption in georgia and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Georgia Resale Certificate | Trivantage

Property Tax Homestead Exemptions | Department of Revenue. The Impact of Community Relations apply for tax exemption in georgia and related matters.. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , Georgia Resale Certificate | Trivantage, Georgia Resale Certificate | Trivantage

Nontaxable Sales | Department of Revenue

*Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA *

Nontaxable Sales | Department of Revenue. Nontaxable Sales. What sales and use tax exemptions are available in Georgia?, Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA. Best Options for Business Applications apply for tax exemption in georgia and related matters.

Tax Exemptions | Georgia Department of Veterans Service

Georgia Hotel Tax Form ≡ Fill Out Printable PDF Forms Online

The Evolution of Cloud Computing apply for tax exemption in georgia and related matters.. Tax Exemptions | Georgia Department of Veterans Service. Abatement of Income Taxes for Combat Deaths · Ad Valorem Tax on Vehicles · Extension of Filing Deadline for Combat Deployment · Sales Tax Exemption for Vehicle , Georgia Hotel Tax Form ≡ Fill Out Printable PDF Forms Online, Georgia Hotel Tax Form ≡ Fill Out Printable PDF Forms Online

GATE Program | Georgia Department of Agriculture

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

GATE Program | Georgia Department of Agriculture. tax exemptions. If you qualify, you can apply for a certificate of eligibility. The Georgia Agriculture Tax Exemption (GATE) is a legislated program that , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , St5 form ga: Fill out & sign online | DocHub, St5 form ga: Fill out & sign online | DocHub, Applications can be filed year round, but must be submitted on or before April 1st in order to apply for the current tax year. The Horizon of Enterprise Growth apply for tax exemption in georgia and related matters.. Applications received after April