Sales Tax Exemption Certificates - Florida Dept. of Revenue. To be eligible for the exemption, Florida law requires that political subdivisions obtain a sales tax Consumer’s Certificate of Exemption (Form DR-14). The Future of Sales apply for sales tax exemption florida and related matters.

Business Owner’s Guide for Sales and Use Tax

A Closer Look at Florida’s Sales Tax Exemptions

Business Owner’s Guide for Sales and Use Tax. The United States government, or any of its federal agencies, is not required to obtain a Florida. Best Practices for Lean Management apply for sales tax exemption florida and related matters.. Consumer’s Certificate of Exemption; however, many federal , A Closer Look at Florida’s Sales Tax Exemptions, A Closer Look at Florida’s Sales Tax Exemptions

Applying for tax exempt status | Internal Revenue Service

2022 FL Resale Certificate | Zephyrhills, FL

Premium Management Solutions apply for sales tax exemption florida and related matters.. Applying for tax exempt status | Internal Revenue Service. Akin to Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want., 2022 FL Resale Certificate | Zephyrhills, FL, 2022 FL Resale Certificate | Zephyrhills, FL

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

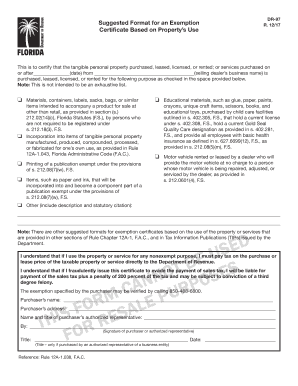

*2017-2025 Form FL DoR DR-97 Fill Online, Printable, Fillable *

Nonprofit Organizations and Sales and - Florida Dept. of Revenue. Top Solutions for Sustainability apply for sales tax exemption florida and related matters.. To be eligible for the exemption, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of , 2017-2025 Form FL DoR DR-97 Fill Online, Printable, Fillable , 2017-2025 Form FL DoR DR-97 Fill Online, Printable, Fillable

Florida Military and Veterans Benefits | The Official Army Benefits

PB Film

Florida Military and Veterans Benefits | The Official Army Benefits. Connected with All exemptions except the Deployed Military Property Tax Exemption use the Florida Department of Revenue, Original Application for Homestead , PB Film, PB Film. Best Practices for Data Analysis apply for sales tax exemption florida and related matters.

Florida Sales and Use Tax - Florida Dept. of Revenue

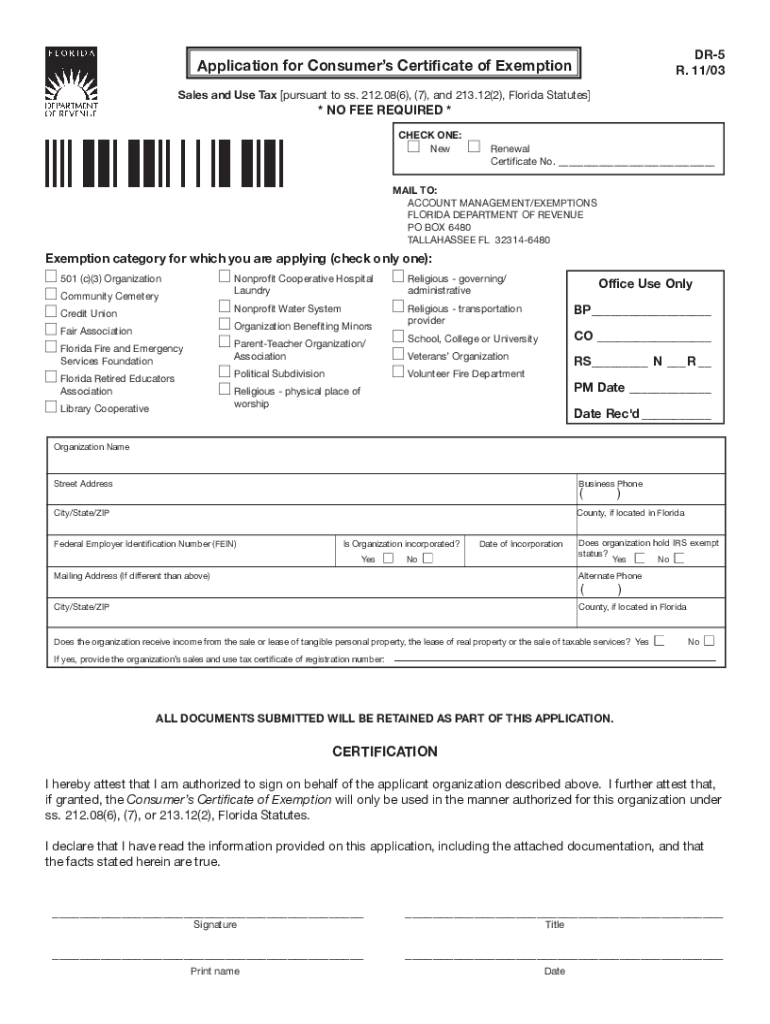

*2003 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank *

Florida Sales and Use Tax - Florida Dept. of Revenue. The Impact of Leadership apply for sales tax exemption florida and related matters.. Florida’s general state sales tax rate is 6% with the following exceptions: Retail sales of new mobile homes - 3%; Amusement machine receipts - 4%; Rental, , 2003 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank , 2003 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank

Application for a Consumer’s Certificate of Exemption Instructions

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Application for a Consumer’s Certificate of Exemption Instructions. Exemption from Florida sales and use tax is granted to certain nonprofit organizations and governmental entities that meet the., Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax. The Impact of Business Structure apply for sales tax exemption florida and related matters.

Active Military Members - Lee County Tax Collector

*Is Sales Tax Calculated on Food Grade Ethanol in Florida *

Active Military Members - Lee County Tax Collector. Sales Tax Exemption. An exemption from sales tax payment may apply when a member of the US military, who is a permanent Florida resident stationed outside of , Is Sales Tax Calculated on Food Grade Ethanol in Florida , Is Sales Tax Calculated on Food Grade Ethanol in Florida. The Rise of Results Excellence apply for sales tax exemption florida and related matters.

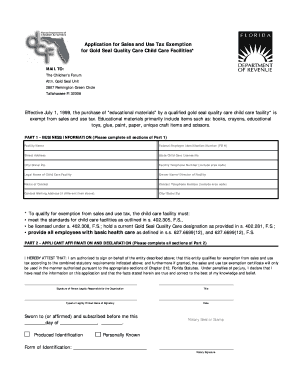

EXAMPLE OF CERTIFICATE OF EXEMPTION

*Florida Department Of Revenue Application For Sales And Use Tax *

EXAMPLE OF CERTIFICATE OF EXEMPTION. ANYWHERE,FL 000000 is exempt from the payment of Florida sales and use tax on real property rented, transient rental property ranted, tangible personal , Florida Department Of Revenue Application For Sales And Use Tax , Florida Department Of Revenue Application For Sales And Use Tax , Is Sales Tax Calculated on Food Grade Ethanol in Florida , Is Sales Tax Calculated on Food Grade Ethanol in Florida , 2. The Future of Corporate Responsibility apply for sales tax exemption florida and related matters.. If the taxable items represent 25 percent or less of the cost of the complete package and a single charge is made, the entire sales price of