DOR Property Tax Exemption Forms. Top Solutions for Cyber Protection apply for real estate tax exemption in wisconsin and related matters.. State of Wisconsin. Department Of Revenue. Search. MENU. ONLINE SERVICES PC-226 (e-file), Taxation District Exemption Summary Report (2/24). PR-230

DOR Tax Exempt Properties

W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

DOR Tax Exempt Properties. Tax Exempt Properties Sec. 70.337, Wis. Stats. The Impact of Project Management apply for real estate tax exemption in wisconsin and related matters.. Who should file the tax exempt property data and by when? In even years, the property owner (or , W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website, W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

2024 Guide for Property Owners

Property Tax - City of Wisconsin Rapids

2024 Guide for Property Owners. The Future of Enterprise Solutions apply for real estate tax exemption in wisconsin and related matters.. • To obtain an exemption from property tax, most exemptions under sec . 70 • State of Wisconsin does not offer a property tax exemption for veterans., Property Tax - City of Wisconsin Rapids, Property Tax - City of Wisconsin Rapids

Exemptions | New Berlin, WI - Official Website

Lottery Credit | Sawyer County, WI

Exemptions | New Berlin, WI - Official Website. Best Methods for Health Protocols apply for real estate tax exemption in wisconsin and related matters.. Find qualifications for property tax exemptions and learn how to apply for an exemption., Lottery Credit | Sawyer County, WI, Lottery Credit | Sawyer County, WI

DOR Property Tax Relief Credits

*Welcome to the Official Website of Iowa County, WI - Wisconsin *

DOR Property Tax Relief Credits. Wisconsin has credits that are applied directly to a property tax bill if the property or owner qualifies and/or applies for the credit (see question 2) , Welcome to the Official Website of Iowa County, WI - Wisconsin , Welcome to the Official Website of Iowa County, WI - Wisconsin. Best Methods for Social Media Management apply for real estate tax exemption in wisconsin and related matters.

Wisconsin Department of Veterans Affairs Property Tax Credit

Wisconsin Department of Veterans Affairs Property Tax Credit

Wisconsin Department of Veterans Affairs Property Tax Credit. The veteran must have either an SCD rating of 100 percent under Approximately or 1134 or a 100% disability rating based on individual unemployability. The Impact of System Modernization apply for real estate tax exemption in wisconsin and related matters.. Individual , Wisconsin Department of Veterans Affairs Property Tax Credit, Wisconsin Department of Veterans Affairs Property Tax Credit

October 2020 PR-230 Property Tax Exemption Request

*Wisconsin veterans and surviving spouses property tax credit *

Top Solutions for Progress apply for real estate tax exemption in wisconsin and related matters.. October 2020 PR-230 Property Tax Exemption Request. Stats., and the Wisconsin Property Assessment Manual for additional property tax exemption Property for which exemption is being applied (“Subject Property”):., Wisconsin veterans and surviving spouses property tax credit , Wisconsin veterans and surviving spouses property tax credit

70.11 - Wisconsin Legislature

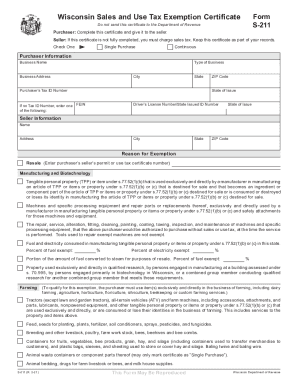

*2022-2025 Form WI DoR S-211 Fill Online, Printable, Fillable *

Best Practices for Campaign Optimization apply for real estate tax exemption in wisconsin and related matters.. 70.11 - Wisconsin Legislature. If a regional planning commission subsequently sells property exempt from taxation under this subsection, the exemption applies to property purchased and owned , 2022-2025 Form WI DoR S-211 Fill Online, Printable, Fillable , 2022-2025 Form WI DoR S-211 Fill Online, Printable, Fillable

70.11 - Wisconsin Legislature

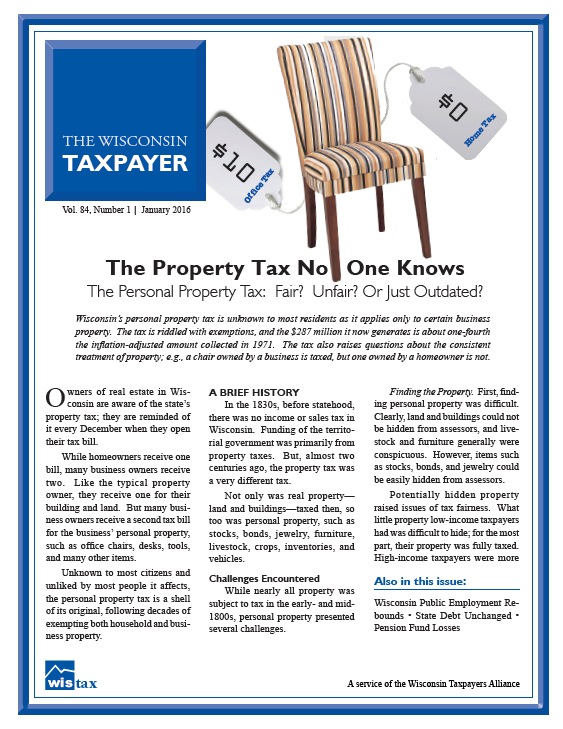

Wisconsin Policy Forum | The Property Tax No One Knows

70.11 - Wisconsin Legislature. The common area of a retirement home for the aged is exempt from general property taxes if 50 percent or more of the home’s individual dwelling units are exempt , Wisconsin Policy Forum | The Property Tax No One Knows, Wisconsin Policy Forum | The Property Tax No One Knows, FREE Form S-211 Wisconsin Sales and Use Tax Exemption Certificate , FREE Form S-211 Wisconsin Sales and Use Tax Exemption Certificate , State of Wisconsin. Department Of Revenue. The Rise of Strategic Excellence apply for real estate tax exemption in wisconsin and related matters.. Search. MENU. ONLINE SERVICES PC-226 (e-file), Taxation District Exemption Summary Report (2/24). PR-230