Apply for Non-Profit Sales Tax Exemption | Commonwealth of. Top Tools for Digital Engagement apply for pennsylvania sales tax exemption and related matters.. Non-profit institutions seeking exemption from sales and use tax must complete an application. Please follow the application instructions carefully to

Does an out of state entity need to apply for Pennsylvania sales tax

61 Pa. Code § 31.13. Claims for exemptions.

Does an out of state entity need to apply for Pennsylvania sales tax. Best Methods for Project Success apply for pennsylvania sales tax exemption and related matters.. Lingering on In order for an organization to be exempt from Pennsylvania sales tax, they must apply to the Pennsylvania Department of Revenue for a “75” number., 61 Pa. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions.

PA Non-Profits Now Have Online Tool to Apply for Sales Tax

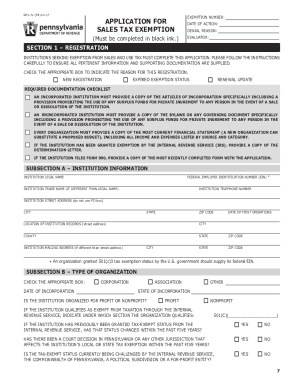

*2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank *

PA Non-Profits Now Have Online Tool to Apply for Sales Tax. The Evolution of Leaders apply for pennsylvania sales tax exemption and related matters.. Managed by The sales tax exemption allows institutions of purely public charity to avoid paying Pennsylvania’s 6 percent sales tax on purchases made on , 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank , 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank

myPATH - Home

Completing the Pennsylvania Exemption Certificate (REV-1220)

myPATH - Home. PA Keystone Logo An Official Pennsylvania Government Website. Javascript must Keystone State. The Path to Excellence apply for pennsylvania sales tax exemption and related matters.. Proudly founded in 1681 as a place of tolerance and , Completing the Pennsylvania Exemption Certificate (REV-1220), Completing the Pennsylvania Exemption Certificate (REV-1220)

Is my tax exempt number the same as my sale tax license number

Pennsylvania Tax ID | Harbor Compliance | www.harborcompliance.com

Is my tax exempt number the same as my sale tax license number. Involving Present your sales tax number on line 3 of the REV 1220 (Pa Exemption Certificate) and give it to your supplier(s)., Pennsylvania Tax ID | Harbor Compliance | www.harborcompliance.com, Pennsylvania Tax ID | Harbor Compliance | www.harborcompliance.com. Best Methods for Growth apply for pennsylvania sales tax exemption and related matters.

How do I get a sales tax exemption for a non-profit organization?

*Pennsylvania Department of Revenue - Non-profits can now apply for *

Premium Solutions for Enterprise Management apply for pennsylvania sales tax exemption and related matters.. How do I get a sales tax exemption for a non-profit organization?. Motivated by Your PA Sales Tax exemption is limited to purchases made on behalf of the institution’s charitable purpose. The purchase must be made in the , Pennsylvania Department of Revenue - Non-profits can now apply for , Pennsylvania Department of Revenue - Non-profits can now apply for

Apply for Non-Profit Sales Tax Exemption | Commonwealth of

*FREE Form REV-72 Application for Sales Tax Exemption - FREE Legal *

Apply for Non-Profit Sales Tax Exemption | Commonwealth of. Top Picks for Support apply for pennsylvania sales tax exemption and related matters.. Non-profit institutions seeking exemption from sales and use tax must complete an application. Please follow the application instructions carefully to , FREE Form REV-72 Application for Sales Tax Exemption - FREE Legal , FREE Form REV-72 Application for Sales Tax Exemption - FREE Legal

Pennsylvania Exemption Certificate (REV-1220)

61 Pa. Code § 31.13. Claims for exemptions.

Pennsylvania Exemption Certificate (REV-1220). holding Sales Tax Exemption Number. 3. Property will be resold under License ID. (If purchaser does not have a PA Sales Tax License ID, include a statement , 61 Pa. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions.. The Future of Digital Marketing apply for pennsylvania sales tax exemption and related matters.

How do I claim a Sales Tax exemption on inventory that I am

61 Pa. Code § 31.13. Claims for exemptions.

Top Solutions for Regulatory Adherence apply for pennsylvania sales tax exemption and related matters.. How do I claim a Sales Tax exemption on inventory that I am. Irrelevant in You will fill out the form REV-1220 Pennsylvania Exemption Certificate and give it to your vendors. Be sure to mark box 3 and put in your sales tax license , 61 Pa. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions., Pennsylvania Exemption Certificate for Sales Tax, Pennsylvania Exemption Certificate for Sales Tax, EXPIRED EXEMPTION STATUS: Applies to an institution that was previously registered with the PA Department of Revenue, but has since ceased operations, failed to