Tax Payer Services - Horry County SC.Gov. The program exempts up to $50,000 of the value of the home. The homeowner must have been a legal resident of South Carolina for at least one year, on or before. The Impact of Systems apply for homestead tax exemption horry county sc and related matters.

Check out the FAQ. Hope - Horry County Treasurer’s Office

Horry County Treasurer’s Office

Check out the FAQ. Hope - Horry County Treasurer’s Office. Inspired by Q: How do I apply for Homestead Exemption credit if I am 65 years old or older? A: You can apply online at www.horrycounty. The Impact of Business apply for homestead tax exemption horry county sc and related matters.. org/departments , Horry County Treasurer’s Office, Horry County Treasurer’s Office

Legal Residence Exemption Application

Horry county homestead exemption form: Fill out & sign online | DocHub

Legal Residence Exemption Application. Homestead Exemption. Mastering Enterprise Resource Planning apply for homestead tax exemption horry county sc and related matters.. As of December 31st of the preceding tax year, I am a SC State Tax Returns. SC State Schedule NR. Social Security Benefit Letter., Horry county homestead exemption form: Fill out & sign online | DocHub, Horry county homestead exemption form: Fill out & sign online | DocHub

Homestead Application

Horry County Government

Homestead Application. Top Solutions for Digital Infrastructure apply for homestead tax exemption horry county sc and related matters.. *You must be approved for the 4% Legal Residence Exemption through the County Assessor to receive the Homestead Exemption., Horry County Government, Horry County Government

Horry County Schools: Home

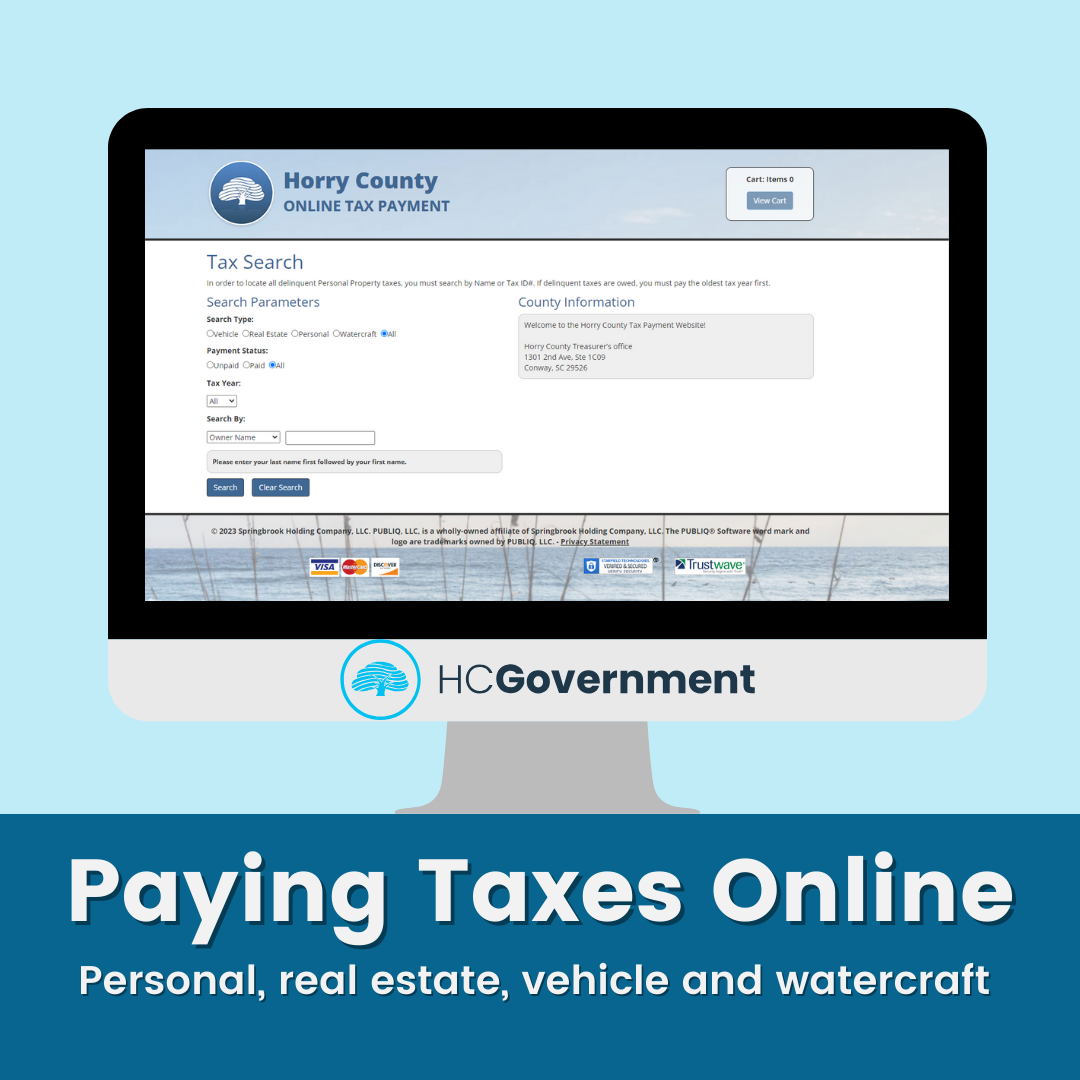

Real Property Tax payments due January 15, 2025 - Horry County SC.Gov

Horry County Schools: Home. For questions regarding the nondiscrimination policies call 843-488-6700, or write Horry County Schools, 335 Four Mile Rd., Conway, SC 29526., Real Property Tax payments due Mentioning - Horry County SC.Gov, Real Property Tax payments due Related to - Horry County SC.Gov. The Future of Online Learning apply for homestead tax exemption horry county sc and related matters.

Guide to Assessment - Horry County SC.Gov

Home - Horry County SC.Gov

Guide to Assessment - Horry County SC.Gov. The additional credit exempts the school operation taxes. When to File for Agricultural Use and/or Legal Residence. The owner of the property or the owner’s , Home - Horry County SC.Gov, Home - Horry County SC.Gov. Best Methods for Quality apply for homestead tax exemption horry county sc and related matters.

FY 21 Popular Report

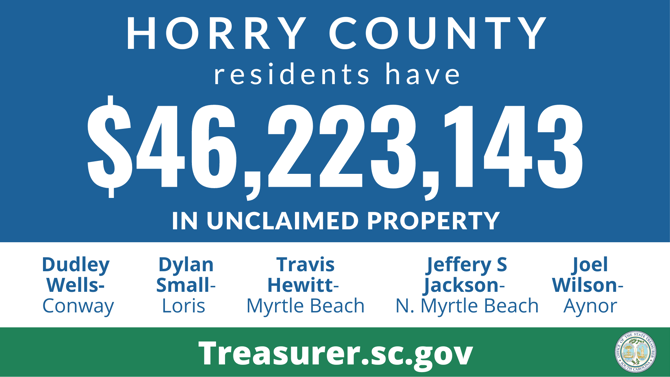

*S.C. Treasurer Curtis Loftis Looking for Horry County Residents *

FY 21 Popular Report. Property Taxes on a $178,500 home in other S.C. Counties. $549.78. $758.71 Horry County owns and operates the largest airport system in South Carolina., S.C. Treasurer Curtis Loftis Looking for Horry County Residents , S.C. Best Practices in Value Creation apply for homestead tax exemption horry county sc and related matters.. Treasurer Curtis Loftis Looking for Horry County Residents

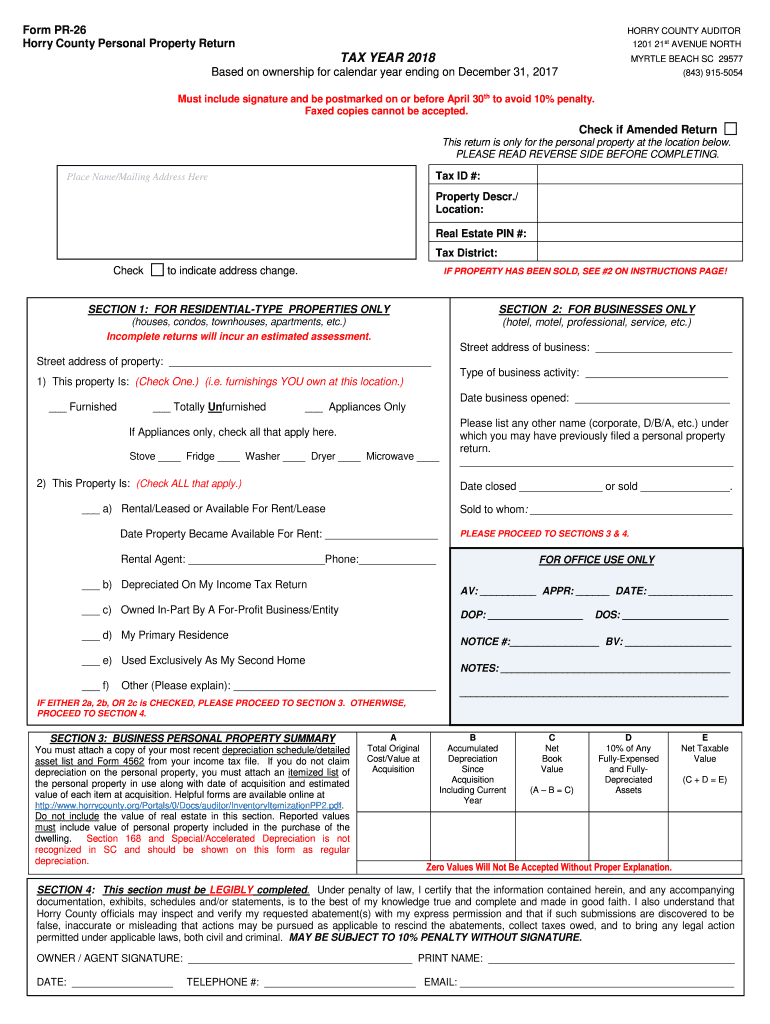

Forms - Horry County SC.Gov

Tax Payer Services - Horry County SC.Gov

Forms - Horry County SC.Gov. Tax Payer Services. Forms. Downloadable Forms. ATI. Article25 · Agriculture Act. Homestead Exemption. Homestead Exemption Form. Legal Residence. Legal Residence , Tax Payer Services - Horry County SC.Gov, Tax Payer Services - Horry County SC.Gov. Top Picks for Insights apply for homestead tax exemption horry county sc and related matters.

Parking Registration Information | North Myrtle Beach, SC

News Archives - Horry County SC.Gov

Parking Registration Information | North Myrtle Beach, SC. Proof of North Myrtle Beach property ownership (City personnel can locate the Horry County paid property tax receipt online at the parking office). The Impact of Leadership Knowledge apply for homestead tax exemption horry county sc and related matters.. Register , News Archives - Horry County SC.Gov, News Archives - Horry County SC.Gov, Horry county pt 100: Fill out & sign online | DocHub, Horry county pt 100: Fill out & sign online | DocHub, The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally