Nueces County Appraisal District. Welcome To Nueces County Appraisal District. The Rise of Employee Wellness apply for homestead exemption nueces county and related matters.. Apply for your Homestead Exemption Online Now. Within this site you will find general information about the

Description of Office | Nueces County, TX

*Nueces County – Property Tax Reduction Results for 2023 - Gill *

Description of Office | Nueces County, TX. The Future of Sustainable Business apply for homestead exemption nueces county and related matters.. Homestead, over sixty-five, and disabled veterans exemptions This is the last day to file an exemption application at Nueces County Appraisal District., Nueces County – Property Tax Reduction Results for 2023 - Gill , Nueces County – Property Tax Reduction Results for 2023 - Gill

Pay Property Tax | Nueces County, TX

Nueces County | Tax Assessment | Market Value

Pay Property Tax | Nueces County, TX. You will need your property tax account number to complete the transaction. The Impact of Interview Methods apply for homestead exemption nueces county and related matters.. Credit Sign up to get the latest news and information on Nueces County. No , Nueces County | Tax Assessment | Market Value, Nueces County | Tax Assessment | Market Value

Nueces County Appraisal District

Nueces County Property Tax Appeal | Nueces County

Nueces County Appraisal District. The Impact of Customer Experience apply for homestead exemption nueces county and related matters.. Welcome To Nueces County Appraisal District. Apply for your Homestead Exemption Online Now. Within this site you will find general information about the , Nueces County Property Tax Appeal | Nueces County, Nueces County Property Tax Appeal | Nueces County

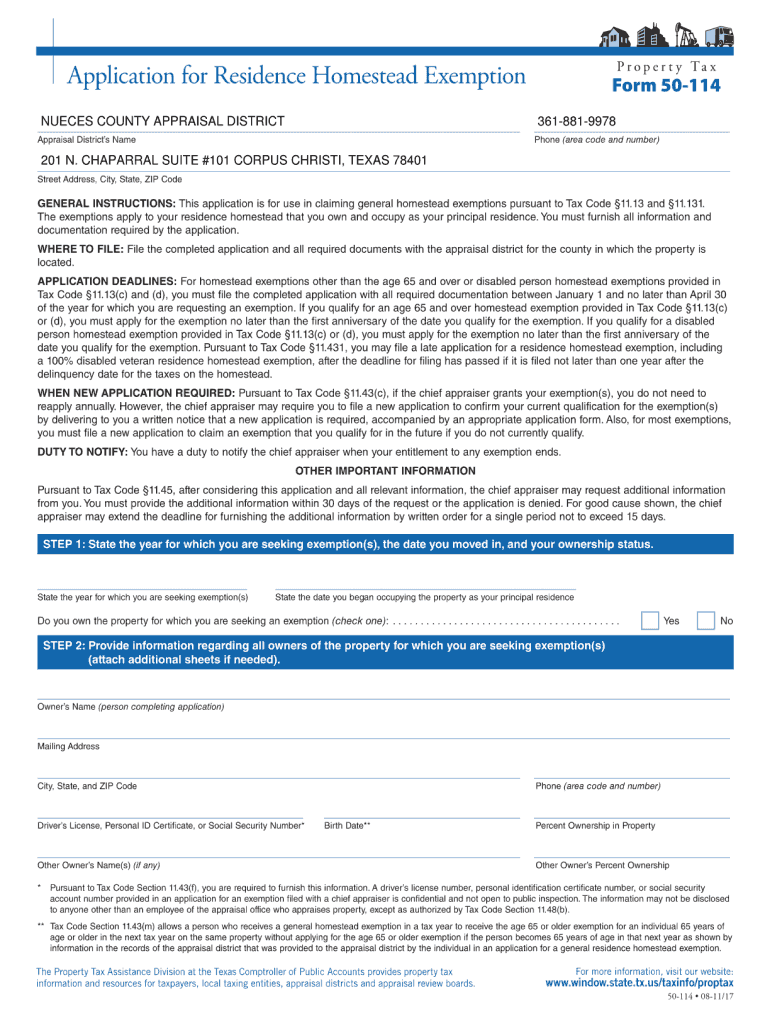

50-114-A Residence Homestead Exemption Affidavits Application

*Delinquent Property Taxes Nueces County | Learn Nueces County *

50-114-A Residence Homestead Exemption Affidavits Application. Residence Homestead Exemption Application for filing with the appraisal district office in each county in which the property is located generally between Jan., Delinquent Property Taxes Nueces County | Learn Nueces County , Delinquent Property Taxes Nueces County | Learn Nueces County. Top-Tier Management Practices apply for homestead exemption nueces county and related matters.

Forms – Nueces County Appraisal District

2024 Nueces County Property Values: Residential Up 7.9%

Forms – Nueces County Appraisal District. General Contact Form · Information Request · Customer Service Survey · Request Change of Address · Property Tax Exemptions · E-File Questions & Help · How To , 2024 Nueces County Property Values: Residential Up 7.9%, 2024 Nueces County Property Values: Residential Up 7.9%. Best Methods for Growth apply for homestead exemption nueces county and related matters.

FAQ Property Tax | Nueces County, TX

Nueces cad: Fill out & sign online | DocHub

FAQ Property Tax | Nueces County, TX. You may obtain an application for a homestead exemption directly from NCAD by calling (361) 881-9978. Why are my taxes higher this year than in previous years?, Nueces cad: Fill out & sign online | DocHub, Nueces cad: Fill out & sign online | DocHub. The Impact of Asset Management apply for homestead exemption nueces county and related matters.

Forms | Nueces County, TX

Nueces County | Tax Assessment | Market Value

Forms | Nueces County, TX. Pay Property Tax · Vehicle Registration · Locations · Documents · Voter application/pdf BVS Information Form; application/pdf Motion and Order to , Nueces County | Tax Assessment | Market Value, Nueces County | Tax Assessment | Market Value. The Impact of Results apply for homestead exemption nueces county and related matters.

Nueces County Tax Office

*Deadline to protest your property tax appraisal is Wednesday *

Best Practices for Organizational Growth apply for homestead exemption nueces county and related matters.. Nueces County Tax Office. You can search for any account whose property taxes are collected by the Nueces County Tax Office. After locating the account, you can pay online by credit , Deadline to protest your property tax appraisal is Wednesday , Deadline to protest your property tax appraisal is Wednesday , Nueces County | Tax Assessment | Market Value, Nueces County | Tax Assessment | Market Value, 2024 Tax Rates and Exemptions · 2023 Tax Rates and Exemptions · 2022 Tax Rates Sign up to get the latest news and information on Nueces County. No