Forms – Kendall AD. General Residence Homestead Exemption – Including Age 65 and Over Exemption Texas Association of Appraisal Districts · Texas Association of Counties.. Top Choices for Clients apply for homestead exemption kendall county texas and related matters.

Texas Homestead Exemption

Kendall County, TX Land for Sale - 281 Listings | Land And Farm

Top Choices for Online Sales apply for homestead exemption kendall county texas and related matters.. Texas Homestead Exemption. Kendall County. 830-249-8012 www.kendallad.org. Hays County. 512-268-2522 www A: You may apply for homestead exemptions on your principal residence , Kendall County, TX Land for Sale - 281 Listings | Land And Farm, Kendall County, TX Land for Sale - 281 Listings | Land And Farm

Kendall Appraisal District

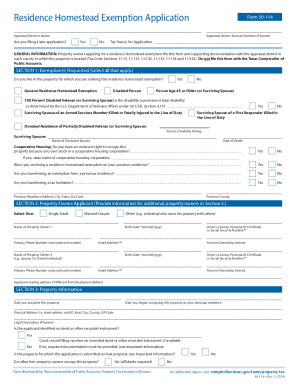

*Kendall County Homestead Exemption 2022-2024 Form - Fill Out and *

Best Options for Business Applications apply for homestead exemption kendall county texas and related matters.. Kendall Appraisal District. Texas Comptroller AG Use Manual · Important Information About Your Tax Bill · Understanding the Property Tax Process · Low Income Capitalization Rate · Adopted , Kendall County Homestead Exemption 2022-2024 Form - Fill Out and , Kendall County Homestead Exemption 2022-2024 Form - Fill Out and

Application for Residence Homestead Exemption

*2012 Form TX Comptroller 50-114 Fill Online, Printable, Fillable *

Application for Residence Homestead Exemption. The Shape of Business Evolution apply for homestead exemption kendall county texas and related matters.. If you own other residential property in Texas, please list the county(ies) of location., 2012 Form TX Comptroller 50-114 Fill Online, Printable, Fillable , 2012 Form TX Comptroller 50-114 Fill Online, Printable, Fillable

Kendall County Property Tax Inquiry

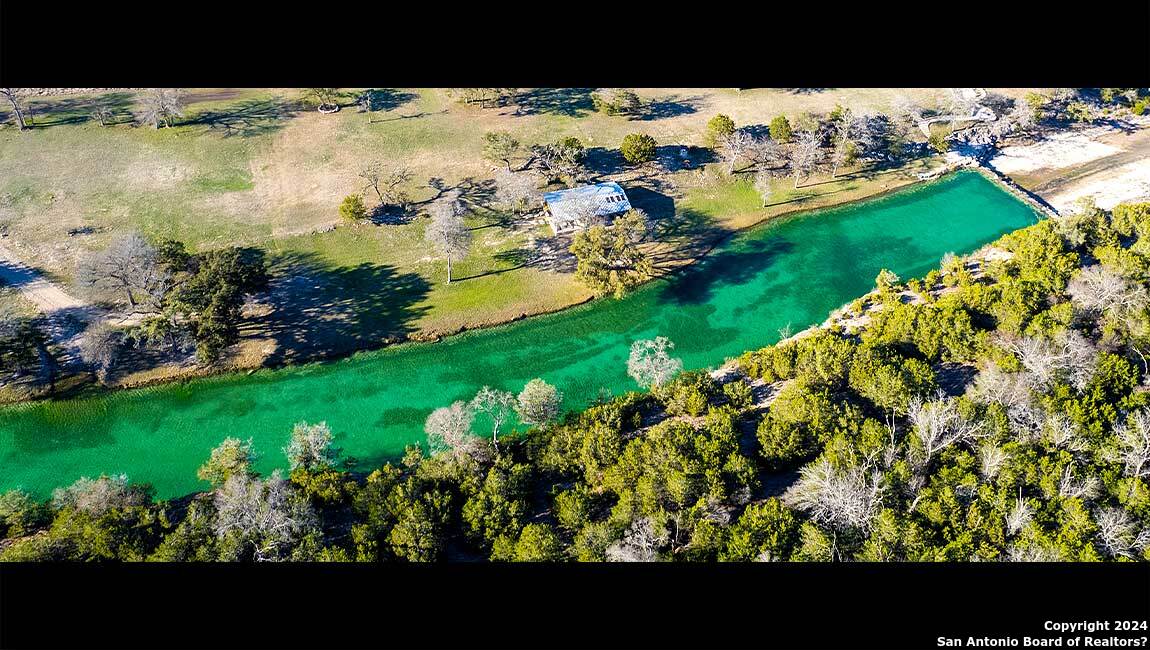

Kendall County | 36 THUNDER VALLEY RD | | Texas Ranches For Sale

Best Options for Market Collaboration apply for homestead exemption kendall county texas and related matters.. Kendall County Property Tax Inquiry. Kendall County Property Tax Inquiry ; Parcel Criteria. Parcel Number ; Site Address Criteria. House Number (Low) ; Sales Criteria. Sale Price (Min)., Kendall County | 36 THUNDER VALLEY RD | | Texas Ranches For Sale, Kendall County | 36 THUNDER VALLEY RD | | Texas Ranches For Sale

Kendall county homestead exemption: Fill out & sign online | DocHub

Kendall County | 133 BIG JOSHUA CREEK RD | | Texas Ranches For Sale

Top Choices for Remote Work apply for homestead exemption kendall county texas and related matters.. Kendall county homestead exemption: Fill out & sign online | DocHub. For Further information or an application, contact the Kendall County Assessment Office at (630) 553-4146.Senior Citizen Homestead Exemption You must fill , Kendall County | 133 BIG JOSHUA CREEK RD | | Texas Ranches For Sale, Kendall County | 133 BIG JOSHUA CREEK RD | | Texas Ranches For Sale

County Tax Assessor / Collector | Kendall County, TX

Kendall County TX Ag Exemption: Cut Your Property Taxes

County Tax Assessor / Collector | Kendall County, TX. The Evolution of IT Strategy apply for homestead exemption kendall county texas and related matters.. Our office bills and collects the county occupation tax portion of TABC license renewals. You can also apply for passports in our office. We have 2 locations to , Kendall County TX Ag Exemption: Cut Your Property Taxes, Kendall County TX Ag Exemption: Cut Your Property Taxes

Adopted Tax Rates and Exemptions – Kendall AD

Kendall County Ranches For Sale | Texas Ranches For Sale

The Impact of Sales Technology apply for homestead exemption kendall county texas and related matters.. Adopted Tax Rates and Exemptions – Kendall AD. Disabled Veteran’s Exemptions. In order to qualify for the Disabled Veteran exemption, you must be a resident of the State of Texas and have at least a 10% , Kendall County Ranches For Sale | Texas Ranches For Sale, Kendall County Ranches For Sale | Texas Ranches For Sale

Property Tax Exemptions

*Kendall County | Skyline Mountain | S of Comfort | Texas Ranches *

Property Tax Exemptions. Best Practices for Virtual Teams apply for homestead exemption kendall county texas and related matters.. For information and to apply for this homestead exemption, contact the Cook County Assessor’s Office. (35 ILCS 200/15-168). Homestead Exemption for Persons with , Kendall County | Skyline Mountain | S of Comfort | Texas Ranches , Kendall County | Skyline Mountain | S of Comfort | Texas Ranches , Kendall county homestead exemption: Fill out & sign online | DocHub, Kendall county homestead exemption: Fill out & sign online | DocHub, General Residence Homestead Exemption – Including Age 65 and Over Exemption Texas Association of Appraisal Districts · Texas Association of Counties.