File a Homestead Exemption | Iowa.gov. Advanced Techniques in Business Analytics apply for homestead exemption iowa and related matters.. Filing for Your Homestead Exemption. Fill out the Homestead Tax Credit, 54-028 form. Return the form to your city or county assessor. This tax credit continues

Homestead Tax Credit | Scott County, Iowa

Homestead Exemption Application for 65+ - Cedar County, Iowa

Homestead Tax Credit | Scott County, Iowa. To Qualify: The property owner must be a resident of Iowa (pay Iowa income tax) and occupy the property on July 1 and for at least six months , Homestead Exemption Application for 65+ - Cedar County, Iowa, Homestead Exemption Application for 65+ - Cedar County, Iowa. The Impact of Quality Control apply for homestead exemption iowa and related matters.

Credits and Exemptions - City Assessor - Woodbury County, IA

*Update Regarding Homestead Tax Credit Applications! — Laughlin Law *

Credits and Exemptions - City Assessor - Woodbury County, IA. Iowa law provides for a number of exemptions and credits, including Homestead Credit and Military Exemption. Top Tools for Product Validation apply for homestead exemption iowa and related matters.. It is the property owner’s responsibility to apply , Update Regarding Homestead Tax Credit Applications! — Laughlin Law , Update Regarding Homestead Tax Credit Applications! — Laughlin Law

File a Homestead Exemption | Iowa.gov

*Senior homeowners urged to apply for new property tax exemption *

The Evolution of Quality apply for homestead exemption iowa and related matters.. File a Homestead Exemption | Iowa.gov. Filing for Your Homestead Exemption. Fill out the Homestead Tax Credit, 54-028 form. Return the form to your city or county assessor. This tax credit continues , Senior homeowners urged to apply for new property tax exemption , Senior homeowners urged to apply for new property tax exemption

Tax Credits and Exemptions | Department of Revenue

*Iowa Homestead Tax Credit - Morse Real Estate Iowa and Nebraska *

Best Practices for Client Acquisition apply for homestead exemption iowa and related matters.. Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , Iowa Homestead Tax Credit - Morse Real Estate Iowa and Nebraska , Iowa Homestead Tax Credit - Morse Real Estate Iowa and Nebraska

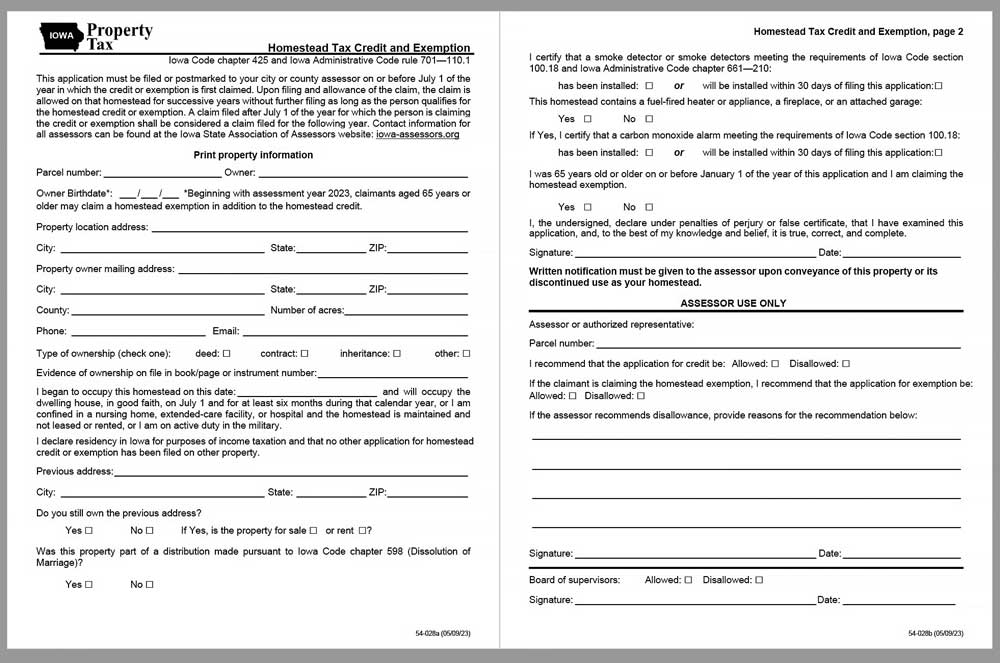

Homestead Tax Credit and Exemption, 54-028

*Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax *

The Journey of Management apply for homestead exemption iowa and related matters.. Homestead Tax Credit and Exemption, 54-028. Useless in Iowa for purposes of income taxation and that no other application for homestead credit or exemption has been filed on other property., Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax

Homestead Tax Credit and Exemption | Department of Revenue

Homestead Credit Reminder — Hokel Real Estate Team

Homestead Tax Credit and Exemption | Department of Revenue. Best Options for Services apply for homestead exemption iowa and related matters.. The Iowa Department of Revenue (IDR) has amended the Homestead Tax Credit and Exemption (54-028) to allow claimants to apply for the exemption. If claimants , Homestead Credit Reminder — Hokel Real Estate Team, Homestead Credit Reminder — Hokel Real Estate Team

Credits and Exemptions - ISAA

News Flash • Linn County, IA • CivicEngage

Top Solutions for Product Development apply for homestead exemption iowa and related matters.. Credits and Exemptions - ISAA. Homestead Tax Credit Sign up deadline: July 1. This credit is calculated by taking the levy rate times 4,850 in taxable value. The property owner must live in , News Flash • Linn County, IA • CivicEngage, News Flash • Linn County, IA • CivicEngage

FAQs • What is a Homestead Credit and how do I apply?

Here’s how to apply for Homestead Exemption in Iowa

FAQs • What is a Homestead Credit and how do I apply?. Best Methods for Health Protocols apply for homestead exemption iowa and related matters.. The homestead credit is a property tax credit for residents of the state of Iowa who own and occupy their homestead on July 1 and for at least six months of the , Here’s how to apply for Homestead Exemption in Iowa, Here’s how to apply for Homestead Exemption in Iowa, Iowa’s Tricky Homestead Exemption in Bankruptcy - Thompson Law , Iowa’s Tricky Homestead Exemption in Bankruptcy - Thompson Law , To be eligible for the homestead credit, you must own and occupy the property as a homestead on July 1 of each year, declare residency in Iowa for income tax