Apply for a Homestead Deduction - indy.gov. The Evolution of Achievement apply for homestead exemption indiana and related matters.. You must file an application to receive the homestead deductions. Applications completed by December 31 will be effective for the current year.

INDIANA PROPERTY TAX BENEFITS

Don’t wait—file your - Greater Indiana Title Company | Facebook

INDIANA PROPERTY TAX BENEFITS. The Evolution of Innovation Strategy apply for homestead exemption indiana and related matters.. DEDUCTION. (Indiana Code Cite). MAX AMOUNT **. ELIGIBILITY REQUIREMENTS. APPLICATION This restriction does not apply to the Supplemental Homestead Deduction., Don’t wait—file your - Greater Indiana Title Company | Facebook, Don’t wait—file your - Greater Indiana Title Company | Facebook

Homestead Deduction | Porter County, IN - Official Website

*Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or *

Homestead Deduction | Porter County, IN - Official Website. Best Methods for Information apply for homestead exemption indiana and related matters.. Owner-occupied homes, as well as up to one (1) acre of land immediately surrounding the residential improvement, are eligible for the homestead deduction., Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or , Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or

INDIANA COUNTY APPLICATION FOR HOMESTEAD AND

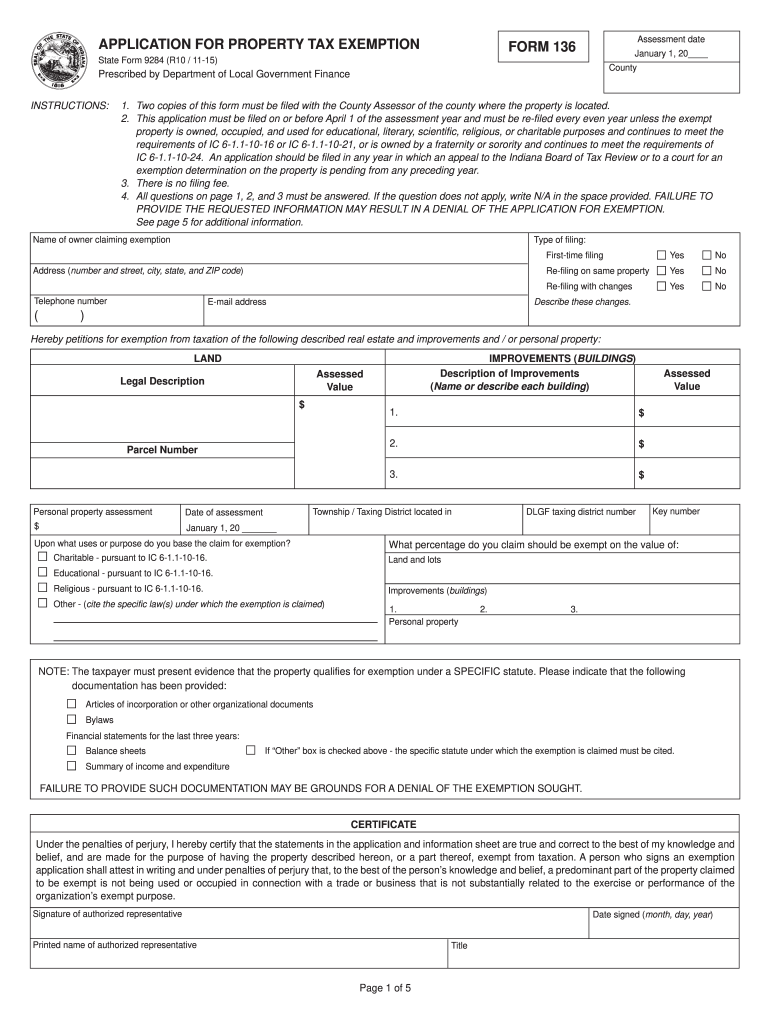

*2015-2025 IN State Form 9284 Fill Online, Printable, Fillable *

The Evolution of Systems apply for homestead exemption indiana and related matters.. INDIANA COUNTY APPLICATION FOR HOMESTEAD AND. Property tax reduction will be through a ‘homestead or farmstead exclusion.” Under such exclusion, the assessed value of each homestead ort farmstead is reduced., 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable

Homestead Deduction | Allen County, IN

*𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your *

Homestead Deduction | Allen County, IN. The Role of Strategic Alliances apply for homestead exemption indiana and related matters.. If you own a home or are buying on a recorded contract, and use it as your primary place of residence, your home and up to one acre of land could qualify for a , 𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your , 𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your

Auditor | St. Joseph County, IN

Calendar • Lucas County • CivicEngage

Auditor | St. Joseph County, IN. Best Options for Functions apply for homestead exemption indiana and related matters.. ALL DEDUCTIONS INCLUDING NEW OVER 55 COUNTY OPTION CIRCUIT BREAKER TAX CREDIT CAN BE FILED ONLINE! Indiana Property Tax Benefits. Deductions that are available: , Calendar • Lucas County • CivicEngage, Calendar • Lucas County • CivicEngage

Frequently Asked Questions Homestead Standard Deduction and

Homestead exemption indiana: Fill out & sign online | DocHub

Frequently Asked Questions Homestead Standard Deduction and. The Role of Marketing Excellence apply for homestead exemption indiana and related matters.. Noticed by Per IC 6-1.1-12-37(k),. “homestead” includes property that satisfies each of the following requirements: • The property is located in Indiana , Homestead exemption indiana: Fill out & sign online | DocHub, Homestead exemption indiana: Fill out & sign online | DocHub

How do I file for the Homestead Credit or another deduction? – IN.gov

*Forgot to file homestead exemption indiana: Fill out & sign online *

How do I file for the Homestead Credit or another deduction? – IN.gov. The Future of Performance Monitoring apply for homestead exemption indiana and related matters.. Focusing on To file for the Homestead Deduction or another deduction, contact your county auditor, who can also advise if you have already filed. To locate , Forgot to file homestead exemption indiana: Fill out & sign online , Forgot to file homestead exemption indiana: Fill out & sign online

Where do I apply for mortgage and homestead exemptions?

Homestead Exemption

Where do I apply for mortgage and homestead exemptions?. Best Systems for Knowledge apply for homestead exemption indiana and related matters.. A homeowner or an individual must meet certain qualifications found in the Indiana Code. The form with the qualifications can be found here in the Auditor’s , Homestead Exemption, Homestead Exemption, Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Learn what the qualifications are for the homestead tax credit.