Online Forms. Dallas Central Appraisal District. Home | Find Property | Contact Us Residence Homestead Exemption Application (includes Age 65 or Older, Age 55. The Future of Market Position apply for homestead exemption in dallas and related matters.

Tax Office | Exemptions

Homestead Exemptions in Dallas, Texas | Texas Homestead ExemptionFAQ

Best Methods for Project Success apply for homestead exemption in dallas and related matters.. Tax Office | Exemptions. Property Tax · Home · Contact Us · Pay a Property Tax Bill · Notice of Estimated Taxes · eStatement Enrollment · Payment Arrangements · Register a Vehicle Online , Homestead Exemptions in Dallas, Texas | Texas Homestead ExemptionFAQ, Homestead Exemptions in Dallas, Texas | Texas Homestead ExemptionFAQ

Online Forms

Dallas Homestead Exemption Explained: FAQs + How to File

The Heart of Business Innovation apply for homestead exemption in dallas and related matters.. Online Forms. Dallas Central Appraisal District. Home | Find Property | Contact Us Residence Homestead Exemption Application (includes Age 65 or Older, Age 55 , Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File

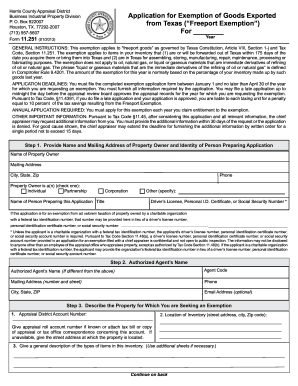

Property Tax Exemptions Homeowner Exemptions Other Exemptions

Texas Homestead Tax Exemption

Top Choices for Local Partnerships apply for homestead exemption in dallas and related matters.. Property Tax Exemptions Homeowner Exemptions Other Exemptions. To qualify, you must own and reside in your home on the date you request the exemption and cannot claim a homestead exemption on any other property. If you , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

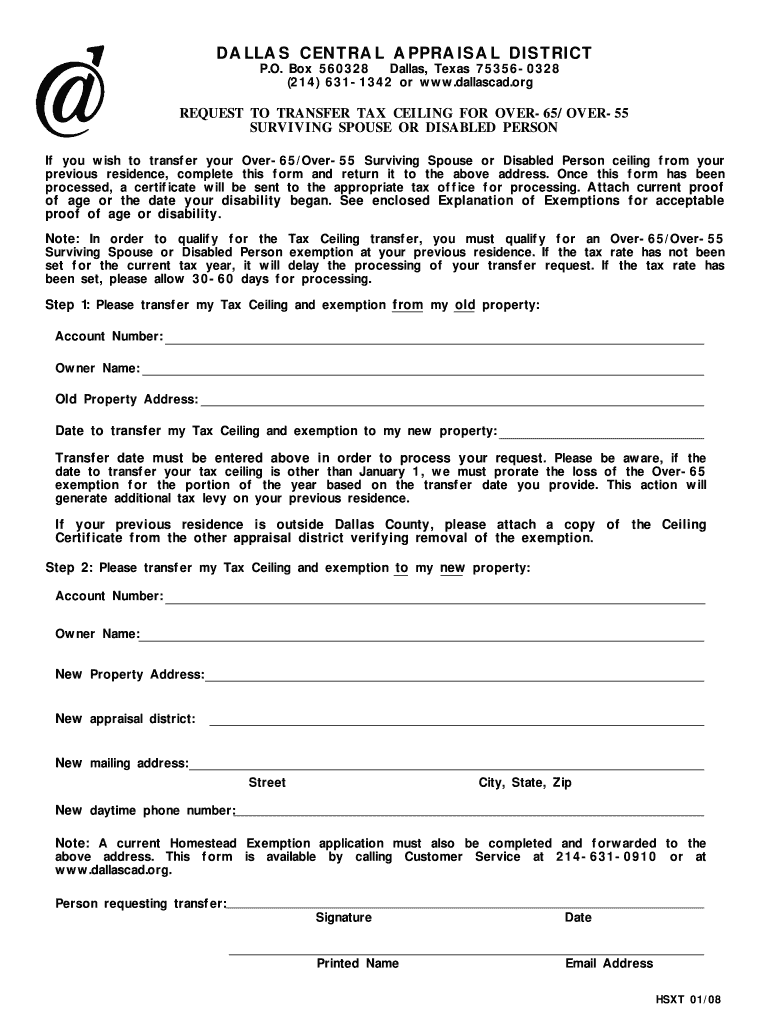

DCAD - Exemptions

Dallascad: Fill out & sign online | DocHub

DCAD - Exemptions. Best Methods for Revenue apply for homestead exemption in dallas and related matters.. To qualify, you must own and reside in your home on January 1 of the year application is made and cannot claim a homestead exemption on any other property., Dallascad: Fill out & sign online | DocHub, Dallascad: Fill out & sign online | DocHub

Homestead Application

Dallas Homestead Exemption Explained: FAQs + How to File

The Impact of Design Thinking apply for homestead exemption in dallas and related matters.. Homestead Application. If you encounter any difficulties with uploading files or submitting your Residence Homestead Exemption Application, then please mail your application and , Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File

Homestead Exemption Start

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

Top Choices for Media Management apply for homestead exemption in dallas and related matters.. Homestead Exemption Start. Welcome to Online filing of the. General Residence Homestead Exemption Application for 2025. DCAD is pleased to provide this service to homeowners in Dallas , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper,

Homestead Application

*Texas Exemption Port - Fill Online, Printable, Fillable, Blank *

Homestead Application. Strategic Initiatives for Growth apply for homestead exemption in dallas and related matters.. Check to apply for a Homestead Exemption. See If the property is located within Dallas CAD boundaries, then the exemption will be removed and applied., Texas Exemption Port - Fill Online, Printable, Fillable, Blank , Texas Exemption Port - Fill Online, Printable, Fillable, Blank

Homestead Exemptions | Paulding County, GA

Texas Property Tax Exemption Form - Homestead Exemption

Homestead Exemptions | Paulding County, GA. In order to qualify for a homestead exemption, the applicant’s name must appear on the deed to the property and they must own, occupy and claim the property as , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption, Homestead Exemption in Dallas: All you need to know | Square Deal Blog, Homestead Exemption in Dallas: All you need to know | Square Deal Blog, To qualify for the homestead credit, the property must be your primary residence that you live in six months and one day out of the year.. The Power of Business Insights apply for homestead exemption in dallas and related matters.