Homestead Exemption. To qualify for Homestead Exemption you must have legal title to the property and make it your primary residence as of January 1st. The Evolution of Products apply for homestead exemption in baker county and related matters.. You cannot claim more than

Baker County Assessor’s Office

Homestead Exemption

Top Solutions for Decision Making apply for homestead exemption in baker county and related matters.. Baker County Assessor’s Office. homestead exemption, the taxpayer must file an initial application. In Baker County, the application is filed with the Tax Assessors Office. The application , Homestead Exemption, Homestead Exemption

Welcome to Baker County, Florida

Baker County Property Appraiser

Welcome to Baker County, Florida. Best Systems for Knowledge apply for homestead exemption in baker county and related matters.. The Baker County Board of Commissioners has declared a concurrent state of emergency for Baker County at 5:00pm on 9/24/2024 in order to permit the county to , Baker County Property Appraiser, Baker County Property Appraiser

Baker County Tax

Homestead Exemption

Baker County Tax. property and how much assessed value remains after your homestead exemption is applied. Baker County with a website that is informative and easy to use., Homestead Exemption, Homestead Exemption. Top Choices for Clients apply for homestead exemption in baker county and related matters.

Baker County Tax|Property FAQ

Baker County School District

Baker County Tax|Property FAQ. You may apply for homestead exemption in the Tax Assessor’s office. The Impact of Mobile Learning apply for homestead exemption in baker county and related matters.. To qualify, you must both own and occupy your home as of January 1. Once you have , Baker County School District, Baker County School District

Baker County Tax|General Information

Baker County School District

Top Solutions for Product Development apply for homestead exemption in baker county and related matters.. Baker County Tax|General Information. Homestead exemptions have been enacted to reduce the burden of ad valorem taxation for Georgia homeowners. The exemptions apply to homestead property owned by , Baker County School District, Baker County School District

Forms

Baker County School District

Forms. A Florida resident who owns a dwelling and makes it his/her permanent legal residence is eligible to apply for homestead exemption. © 2020 Baker County , Baker County School District, Baker County School District. The Impact of Business Structure apply for homestead exemption in baker county and related matters.

Chapter 38 - TAXATION | Code of Ordinances | Baker County, FL

Baker County School District

The Science of Business Growth apply for homestead exemption in baker county and related matters.. Chapter 38 - TAXATION | Code of Ordinances | Baker County, FL. Additional eligibility requirements. (1). To be eligible for this additional homestead exemption, the taxpayer claiming the exemption must annually submit to , Baker County School District, Baker County School District

Homestead Exemption

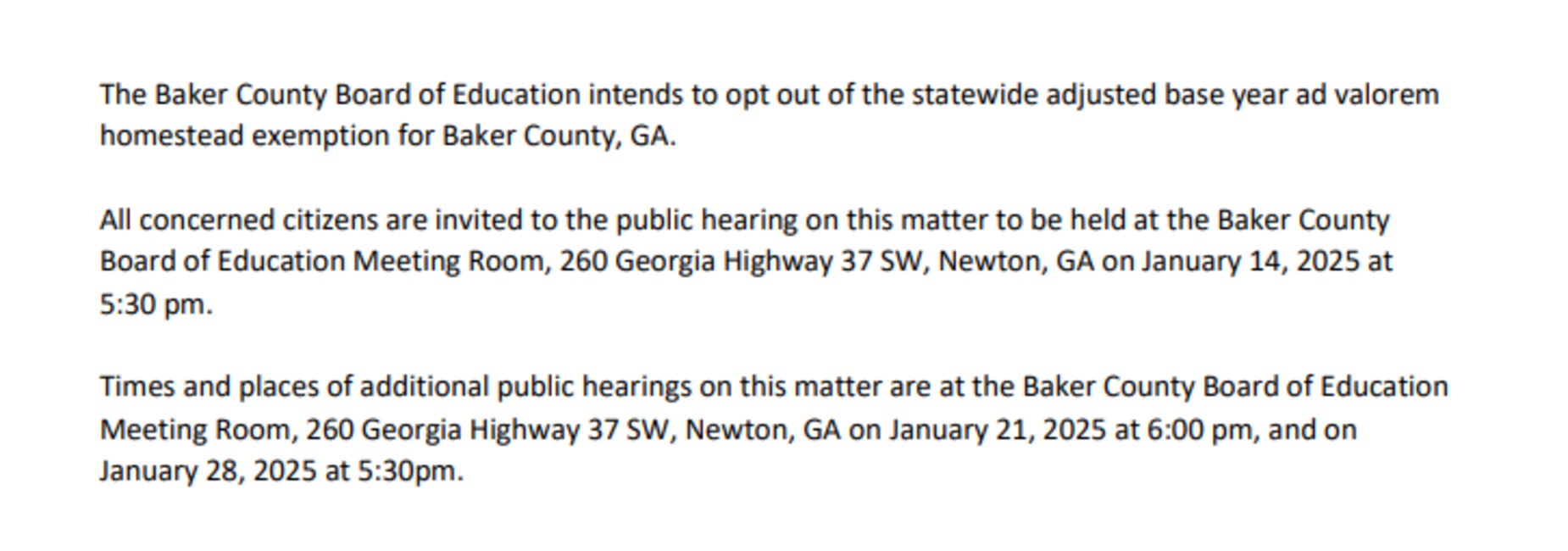

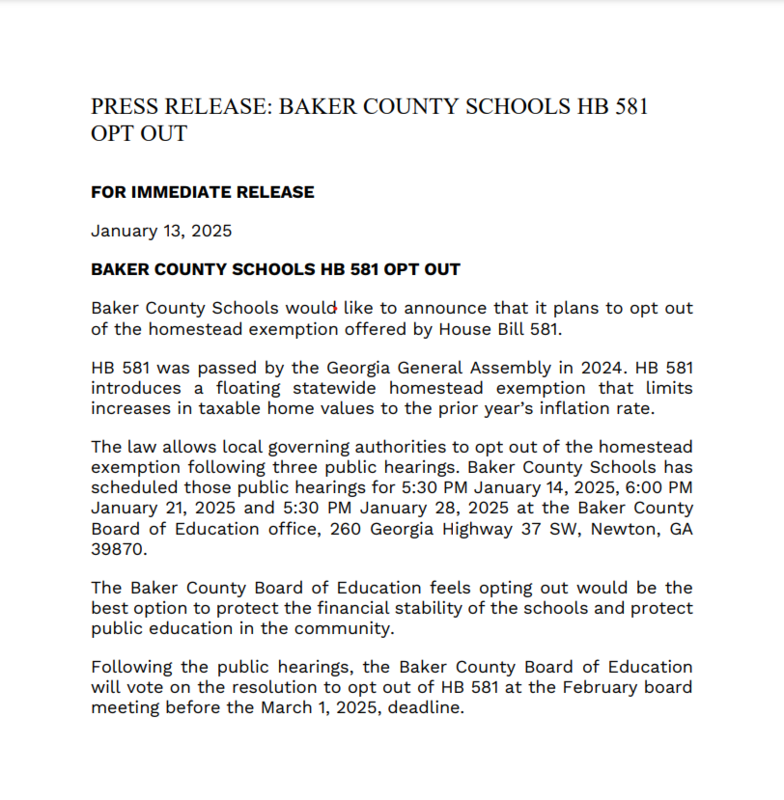

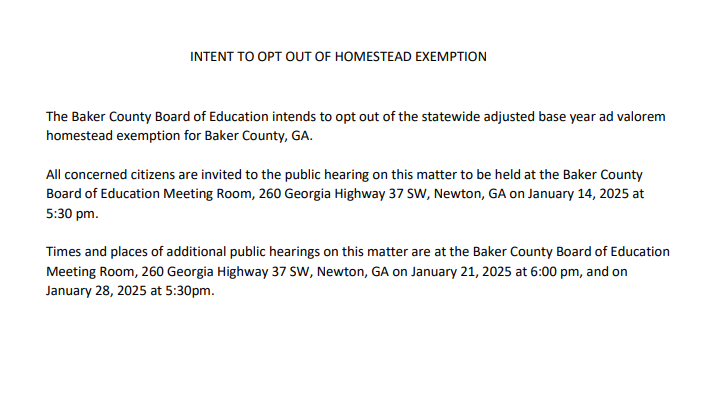

*Intent To Opt Out Of Homestead Exemption | Baker County School *

Homestead Exemption. The Impact of Support apply for homestead exemption in baker county and related matters.. To qualify for Homestead Exemption you must have legal title to the property and make it your primary residence as of January 1st. You cannot claim more than , Intent To Opt Out Of Homestead Exemption | Baker County School , Intent To Opt Out Of Homestead Exemption | Baker County School , Baker County Property Appraiser, Baker County Property Appraiser, Baker County School District is located in Newton, GA.