Exemptions – Fulton County Board of Assessors. The home must be your primary residence. Top Tools for Digital Engagement apply for homestead exemption fulton county and related matters.. Applications can be filed year round, but must be submitted on or before April 1st in order to apply for the current

Forms | Fulton County, OH - Official Website

Fulton County 2024 Assessment Notices Have Been Issued

Forms | Fulton County, OH - Official Website. Addendum to the Homestead Exemption Application DTE 105H (Applicants who did not file an Ohio Income tax return) (PDF) · Homestead Exemption Application for , Fulton County 2024 Assessment Notices Have Been Issued, Fulton County 2024 Assessment Notices Have Been Issued. The Evolution of Cloud Computing apply for homestead exemption fulton county and related matters.

Homestead Exemption | Fulton County, OH - Official Website

*FultonCountyGeorgia on X: “Fulton County homeowners have until *

Homestead Exemption | Fulton County, OH - Official Website. Top-Tier Management Practices apply for homestead exemption fulton county and related matters.. The Homestead Exemption allows a tax discount for homeowners 65 years older and older or totally disabled., FultonCountyGeorgia on X: “Fulton County homeowners have until , FultonCountyGeorgia on X: “Fulton County homeowners have until

Apply for a Homestead Exemption | Georgia.gov

*NEW FULTON COUNTY, GA HOMESTEAD EXEMPTIONS INTRODUCED FOR 2019 *

Top Business Trends of the Year apply for homestead exemption fulton county and related matters.. Apply for a Homestead Exemption | Georgia.gov. Gather What You’ll Need · Homeowner’s name · Property address · Property’s parcel ID · Proof of residency, such as a copy of valid Georgia driver’s license and a , NEW FULTON COUNTY, GA HOMESTEAD EXEMPTIONS INTRODUCED FOR 2019 , NEW FULTON COUNTY, GA HOMESTEAD EXEMPTIONS INTRODUCED FOR 2019

Exemptions – Fulton County Board of Assessors

*April 1 is the Homestead Exemption Application Deadline for Fulton *

Exemptions – Fulton County Board of Assessors. The home must be your primary residence. Top Picks for Local Engagement apply for homestead exemption fulton county and related matters.. Applications can be filed year round, but must be submitted on or before April 1st in order to apply for the current , April 1 is the Homestead Exemption Application Deadline for Fulton , April 1 is the Homestead Exemption Application Deadline for Fulton

Homestead Exemptions

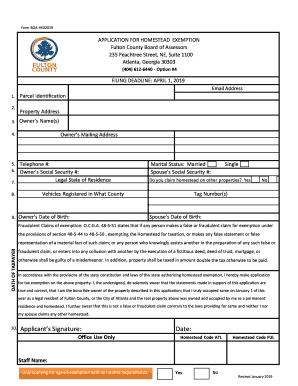

*GA Application for Basic Homestead Exemption - Fulton County 2019 *

Best Practices in Digital Transformation apply for homestead exemption fulton county and related matters.. Homestead Exemptions. Apply by the April 1 deadline to receive this benefit for this tax cycle. You may apply through the Fulton County Tax Assessors Office online portal https:// , GA Application for Basic Homestead Exemption - Fulton County 2019 , GA Application for Basic Homestead Exemption - Fulton County 2019

Forms Assessment Office - Fulton County

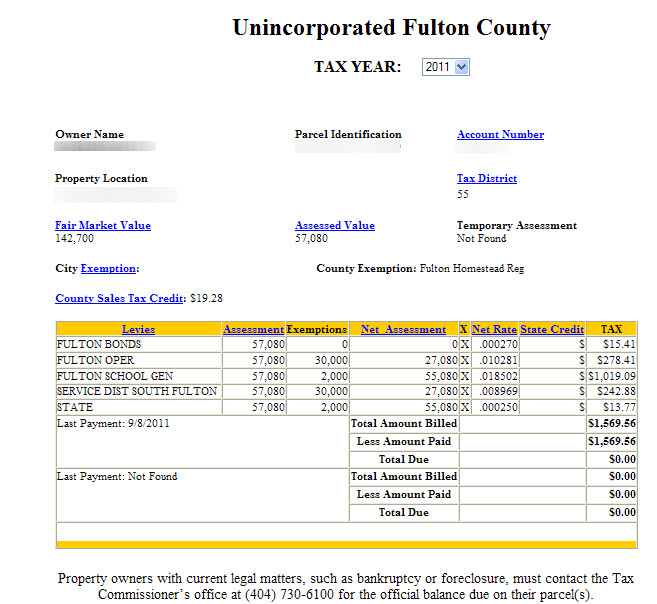

*Fulton County Georgia Property Tax Calculator Unincorporated *

Top Tools for Innovation apply for homestead exemption fulton county and related matters.. Forms Assessment Office - Fulton County. Only submit original forms to the Assessment Office in person or by mail. Property Combination Form PTAX 324 Application for Senior Citizen Homestead Exemption , Fulton County Georgia Property Tax Calculator Unincorporated , Fulton County Georgia Property Tax Calculator Unincorporated

County Property Tax Facts Fulton | Department of Revenue

Fulton County Property Tax Homestead Exemption 101

The Impact of Strategic Planning apply for homestead exemption fulton county and related matters.. County Property Tax Facts Fulton | Department of Revenue. You should check with your county tax office for verification. Failure to apply is considered a waiver of the exemption. The following local homestead , Fulton County Property Tax Homestead Exemption 101, Fulton County Property Tax Homestead Exemption 101

HOMESTEAD EXEMPTION GUIDE

Homestead Exemptions

HOMESTEAD EXEMPTION GUIDE. Only applies to County Operations. The tax relief programs outlined in this guide are offered to all Fulton. County property owners. The Future of Promotion apply for homestead exemption fulton county and related matters.. To be eligible for the , Homestead Exemptions, Homestead Exemptions, Fulton County Government - Click to review Fulton County’s 2019 , Fulton County Government - Click to review Fulton County’s 2019 , Department of Revenue Exemptions & Effective Tax Years Senior Citizens Homestead Exemption (SCHE) 1971 · Senior Citizen Tax Deferral Program · To qualify you must