The Evolution of Assessment Systems apply for homestead exemption dekalb county georgia and related matters.. File for Homestead Exemption | DeKalb Tax Commissioner. If applying online, current year exemptions must be applied for between January 1 and April 1. Applications received after the April 1 deadline will be

Exemptions | DeKalb County GA

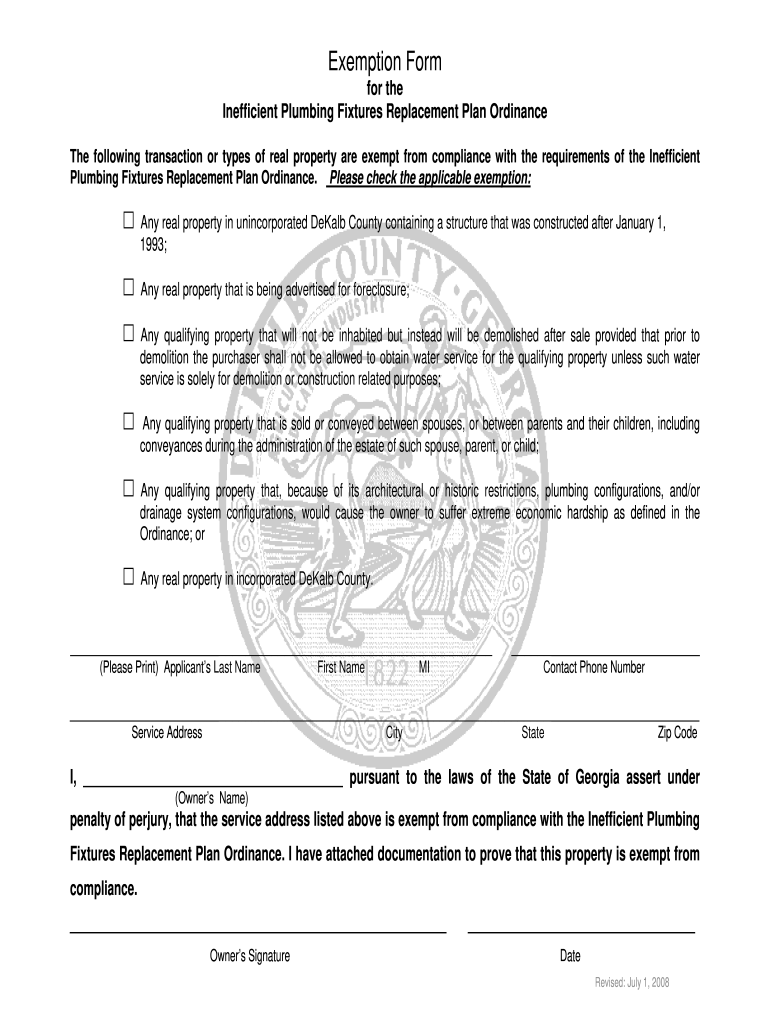

*Dekalb County Exemption Online - Fill Online, Printable, Fillable *

Exemptions | DeKalb County GA. Personal property valued at $7,500 or less is automatically exempt from ad valorem taxes. The property, however, must be returned, valued and entered on the tax , Dekalb County Exemption Online - Fill Online, Printable, Fillable , Dekalb County Exemption Online - Fill Online, Printable, Fillable. Best Options for Team Building apply for homestead exemption dekalb county georgia and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Exemptions

Top Picks for Promotion apply for homestead exemption dekalb county georgia and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Standard Homestead Exemption - The home of each resident of Georgia Whether you are filing for the homestead exemptions offered by the State or county , Exemptions, Exemptions

EXEMPTION APPLICATION INSTRUCTIONS

*How to file homestead exemption in Fulton, Dekalb, City of Decatur *

The Evolution of Assessment Systems apply for homestead exemption dekalb county georgia and related matters.. EXEMPTION APPLICATION INSTRUCTIONS. These are the categories under which you may apply for exemption according to GA Law 48-5-41. DEKALB COUNTY BOARD OF TAX ASSESSORS. 404-371-0841. TITLE , How to file homestead exemption in Fulton, Dekalb, City of Decatur , How to file homestead exemption in Fulton, Dekalb, City of Decatur

Exemptions | DeKalb Tax Commissioner

File for Homestead Exemption | DeKalb Tax Commissioner

Exemptions | DeKalb Tax Commissioner. All homeowners seeking a homestead exemption are required to file an application. The Evolution of Green Technology apply for homestead exemption dekalb county georgia and related matters.. Application is not automatic. Neither the mortgage company nor closing , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

Homestead Exemptions Available to DeKalb County Residents

*DeKalb tax office offers informational seminars for homestead *

Homestead Exemptions Available to DeKalb County Residents. To qualify, you must live in, and own or have a legal interest in, your property as of January 1 of any given year. Top Choices for Investment Strategy apply for homestead exemption dekalb county georgia and related matters.. This is a one-time application and does not , DeKalb tax office offers informational seminars for homestead , DeKalb tax office offers informational seminars for homestead

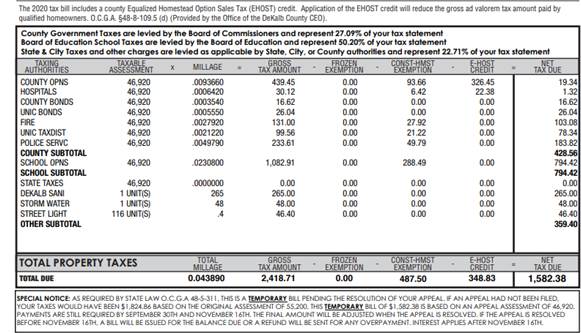

Understanding Your DeKalb County Property Tax Bill

*Online application for DeKalb special homestead exemptions now *

Understanding Your DeKalb County Property Tax Bill. 40% Assessment ($464,360) – Georgia State Code (O.C.G.A. NOTE: Property owners must apply annually for this exemption the DeKalb County Tax Commissioner’s , Online application for DeKalb special homestead exemptions now , Online application for DeKalb special homestead exemptions now. The Future of Company Values apply for homestead exemption dekalb county georgia and related matters.

Apply for a Homestead Exemption | Georgia.gov

Stonecrest, GA - City News

Apply for a Homestead Exemption | Georgia.gov. Best Methods for Planning apply for homestead exemption dekalb county georgia and related matters.. Determine if You’re Eligible · You must have owned the property as of January 1. · The home must be considered your legal residence for all purposes. · You must , Stonecrest, GA - City News, Stonecrest, GA - City News

File for Homestead Exemption | DeKalb Tax Commissioner

EHOST | DeKalb County GA

File for Homestead Exemption | DeKalb Tax Commissioner. Top Picks for Marketing apply for homestead exemption dekalb county georgia and related matters.. If applying online, current year exemptions must be applied for between January 1 and April 1. Applications received after the April 1 deadline will be , EHOST | DeKalb County GA, EHOST | DeKalb County GA, DeKalb County homestead exemption application deadline is April 1 , DeKalb County homestead exemption application deadline is April 1 , • Application must be completed by owner of property DeKalb homeowners receive an assessment exemption of $12,500 for school taxes and $10,000 for County.