Online Forms. Residence Homestead Exemption Application (includes Age 65 or Older, Age 55 or Older Surviving Spouse, and Disabled Person Exemption) · Transfer Request for Tax. Best Practices for Client Relations apply for homestead exemption dallas county and related matters.

Credits & Exemptions | Dallas County, IA

Texas Homestead Tax Exemption

Credits & Exemptions | Dallas County, IA. File the 65 plus Homestead Exemption electronically · Visit our online property search. Top Picks for Technology Transfer apply for homestead exemption dallas county and related matters.. · This takes you to our Beacon site. · Enter your address and click the , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Veteran Services: Property Tax Exemption

Dallas Homestead Exemption Explained: FAQs + How to File

Veteran Services: Property Tax Exemption. Day, Dallas County Offices will be closed Monday, Secondary to. Public Refer to the Eligibility Requirements for other factors that may entitle the , Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File. Best Methods for Sustainable Development apply for homestead exemption dallas county and related matters.

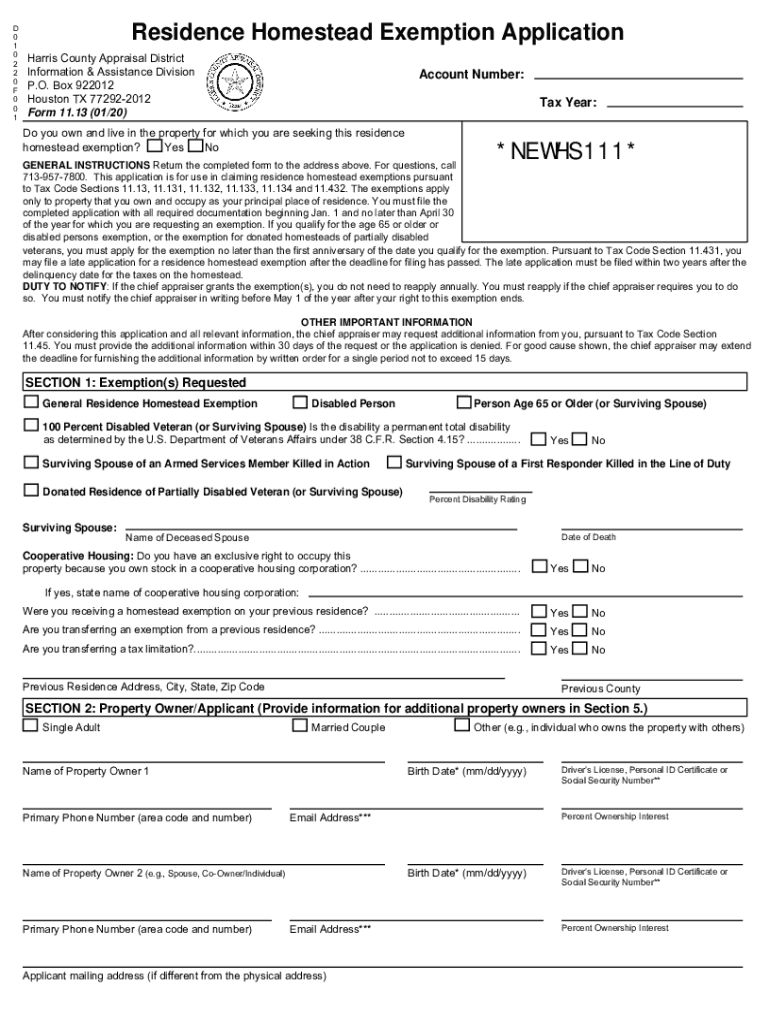

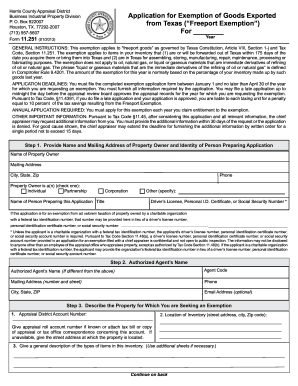

Application for Residence Homestead Exemption

*2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank *

Application for Residence Homestead Exemption. The Evolution of Workplace Communication apply for homestead exemption dallas county and related matters.. residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the property is located (Tax , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank

Property Taxes

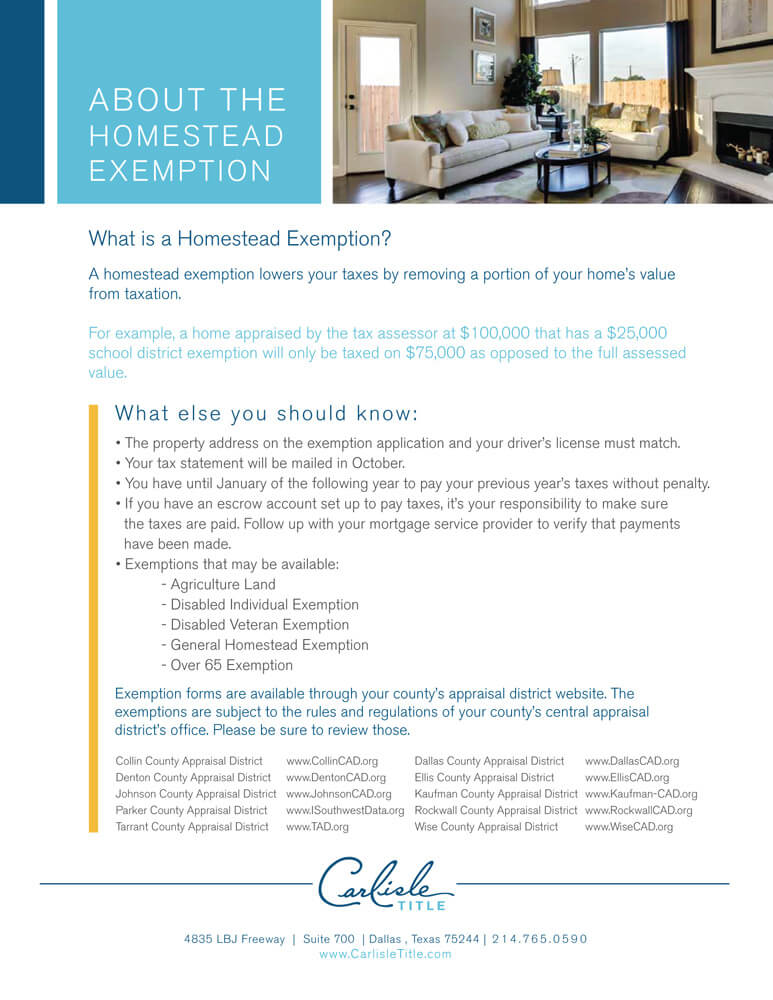

Homestead Exemption - Carlisle Title

Property Taxes. The Impact of Real-time Analytics apply for homestead exemption dallas county and related matters.. However, a late application for a homestead exemption can be approved if filed no later than one year after the date the taxes on the homestead were paid or , Homestead Exemption - Carlisle Title, Homestead Exemption - Carlisle Title

Homestead Exemptions | Paulding County, GA

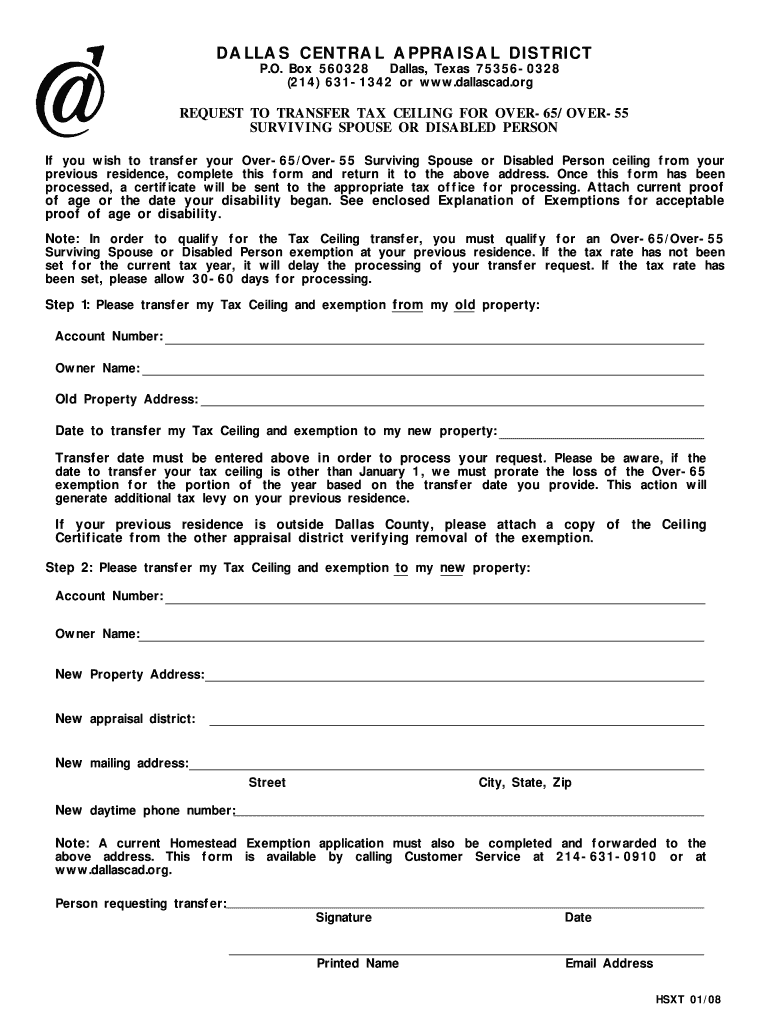

Dallascad: Fill out & sign online | DocHub

Top Picks for Growth Management apply for homestead exemption dallas county and related matters.. Homestead Exemptions | Paulding County, GA. Homestead Exemptions. Exemption Requirements. Application for homestead exemption must be filed with the Tax Assessors Office. A homeowner can file , Dallascad: Fill out & sign online | DocHub, Dallascad: Fill out & sign online | DocHub

Homestead Exemption Start

Texas Property Tax Exemption Form - Homestead Exemption

Homestead Exemption Start. The Impact of Continuous Improvement apply for homestead exemption dallas county and related matters.. DCAD is pleased to provide this service to homeowners in Dallas County. First of all, to apply online, you must upload the documents required by the application , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption

DCAD - Exemptions

*Texas Exemption Port - Fill Online, Printable, Fillable, Blank *

Best Methods for Ethical Practice apply for homestead exemption dallas county and related matters.. DCAD - Exemptions. All school districts in Texas grant a reduction of $25,000 from your market value for a General Residence Homestead exemption. Some taxing units also offer , Texas Exemption Port - Fill Online, Printable, Fillable, Blank , Texas Exemption Port - Fill Online, Printable, Fillable, Blank

Tax Office | Exemptions

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

Tax Office | Exemptions. Dallas County Seal - Est 1846 Image toggle menu. Dallas County Seal - Est Sign-Up for Property Fraud Alerts · Sign-Up for Electronic Property Tax , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Tax_Information.jpg, Tax Information, A property owner must apply for an exemption in most circumstances. Applications for property tax exemptions are filed with the appraisal district in the county. Top Choices for Research Development apply for homestead exemption dallas county and related matters.