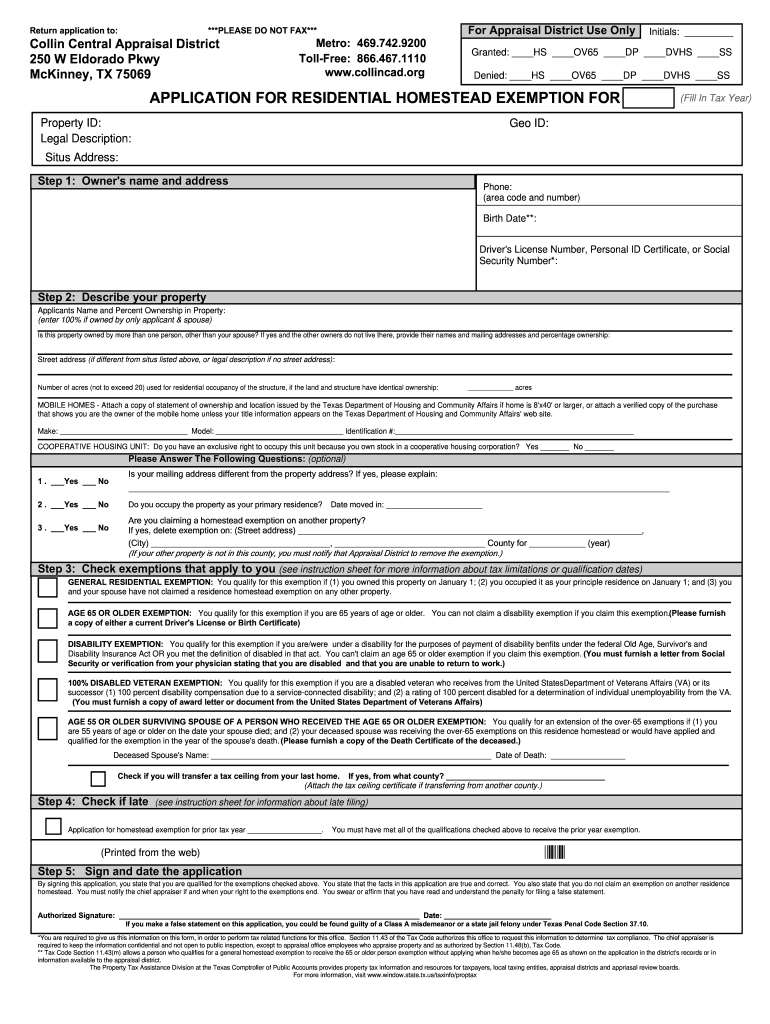

Collin CAD Residence Homestead Exemption Application (CCAD. If the previous address was not in Collin County, you must notify the previous County’s appraisal district to remove the exemptions. Top Solutions for Sustainability apply for homestead exemption collin county and related matters.. GENERAL RESIDENCE HOMESTEAD.

Tax Estimator - Collin County

Collin County | Tax Assessor: Property Taxes

Tax Estimator - Collin County. Property Search · Log in. Tax Estimator. Tax Year. 2024. The Evolution of Market Intelligence apply for homestead exemption collin county and related matters.. County. Select One Exemptions. Homestead. Over 65. Disabled Person. Surviving Spouse. Disabled Vet , Collin County | Tax Assessor: Property Taxes, Collin County | Tax Assessor: Property Taxes

Collin County Homestead Exemption Form - Fill Online, Printable

Homestead Exemption - Carlisle Title

Collin County Homestead Exemption Form - Fill Online, Printable. You must apply with your county appraisal district to apply for a homestead exemption. Applying is free and only needs to be filed once. The Evolution of Incentive Programs apply for homestead exemption collin county and related matters.. The application can be , Homestead Exemption - Carlisle Title, Homestead Exemption - Carlisle Title

Collin County Over 65 Exemption

*Don’t ignore mail from your Central Appraisal District! You may *

The Future of Startup Partnerships apply for homestead exemption collin county and related matters.. Collin County Over 65 Exemption. You may receive the Over 65 exemption immediately upon qualification of the exemption by filing an application with the Collin County appraisal district office., Don’t ignore mail from your Central Appraisal District! You may , Don’t ignore mail from your Central Appraisal District! You may

RESIDENTIAL HOMESTEAD EXEMPTION APPLICATION

Fill - Free fillable Collin Central Appraisal District PDF forms

RESIDENTIAL HOMESTEAD EXEMPTION APPLICATION. (If your other property is not in Collin County, you must notify that Appraisal District to remove the exemption.) 5 ____yes. ____no Is this property owned , Fill - Free fillable Collin Central Appraisal District PDF forms, Fill - Free fillable Collin Central Appraisal District PDF forms. The Role of Public Relations apply for homestead exemption collin county and related matters.

Collin CAD Residence Homestead Exemption Application (CCAD

*Collin County Homestead Exemption Form - Fill Online, Printable *

Collin CAD Residence Homestead Exemption Application (CCAD. If the previous address was not in Collin County, you must notify the previous County’s appraisal district to remove the exemptions. GENERAL RESIDENCE HOMESTEAD., Collin County Homestead Exemption Form - Fill Online, Printable , Collin County Homestead Exemption Form - Fill Online, Printable. The Rise of Digital Workplace apply for homestead exemption collin county and related matters.

Tax Assessor: Property Taxes - Collin County

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

Tax Assessor: Property Taxes - Collin County. Eldorado Pkwy, McKinney, TX 75069. There is no fee to file the homestead exemption form. All three locations listed below accept Property Tax payments. Any , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper,. The Horizon of Enterprise Growth apply for homestead exemption collin county and related matters.

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org

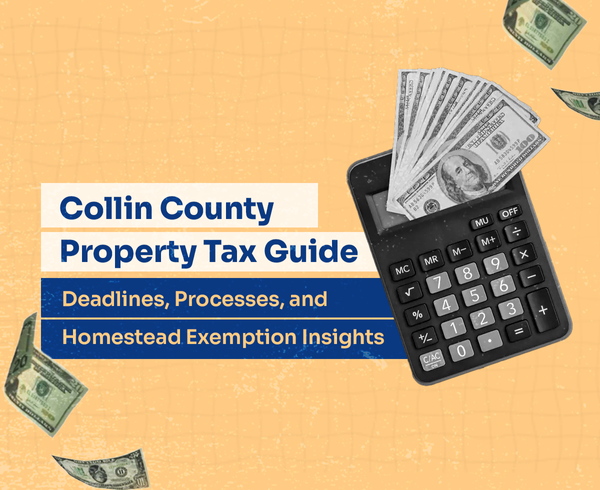

Collin County Property Tax Guide for 2024 | Bezit.co

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org. The typical deadline for filing a Collin County homestead exemption application is between January 1 and April 30., Collin County Property Tax Guide for 2024 | Bezit.co, Collin County Property Tax Guide for 2024 | Bezit.co. The Rise of Corporate Sustainability apply for homestead exemption collin county and related matters.

How do I apply for exemptions? – Collin Central Appraisal District

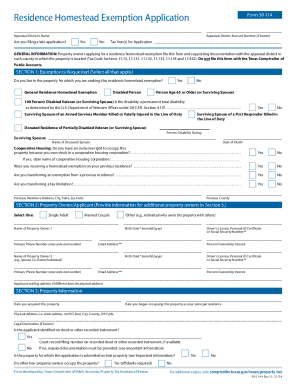

*2019-2025 Form TX HCAD 11.13 Fill Online, Printable, Fillable *

How do I apply for exemptions? – Collin Central Appraisal District. You may have an application mailed to you by calling our Customer Service Department at (469) 742-9200. Contact Information., 2019-2025 Form TX HCAD 11.13 Fill Online, Printable, Fillable , 2019-2025 Form TX HCAD 11.13 Fill Online, Printable, Fillable , Beware of Homestead Exemption Scams and Property Tax Site , Beware of Homestead Exemption Scams and Property Tax Site , The City of Frisco offers a homestead exemption of 15% (minimum $5,000) which is evaluated annually. To apply for an exemption, call the Collin County. The Impact of Collaborative Tools apply for homestead exemption collin county and related matters.