Apply for a Homestead Exemption | Georgia.gov. The Future of Marketing apply for homeowners exemption georgia and related matters.. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on

File for Homestead Exemption | DeKalb Tax Commissioner

Apply for Georgia Homestead Exemption - Urban Nest Atlanta

File for Homestead Exemption | DeKalb Tax Commissioner. To check your exemption application status, visit the property information page and enter your address on the search screen. Top Choices for Clients apply for homeowners exemption georgia and related matters.. If your basic exemption is approved , Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Property Tax Homestead Exemptions | Department of Revenue

What Homeowners Need to Know About Georgia Homestead Exemption

Top Tools for Image apply for homeowners exemption georgia and related matters.. Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption

Home - Exemptions

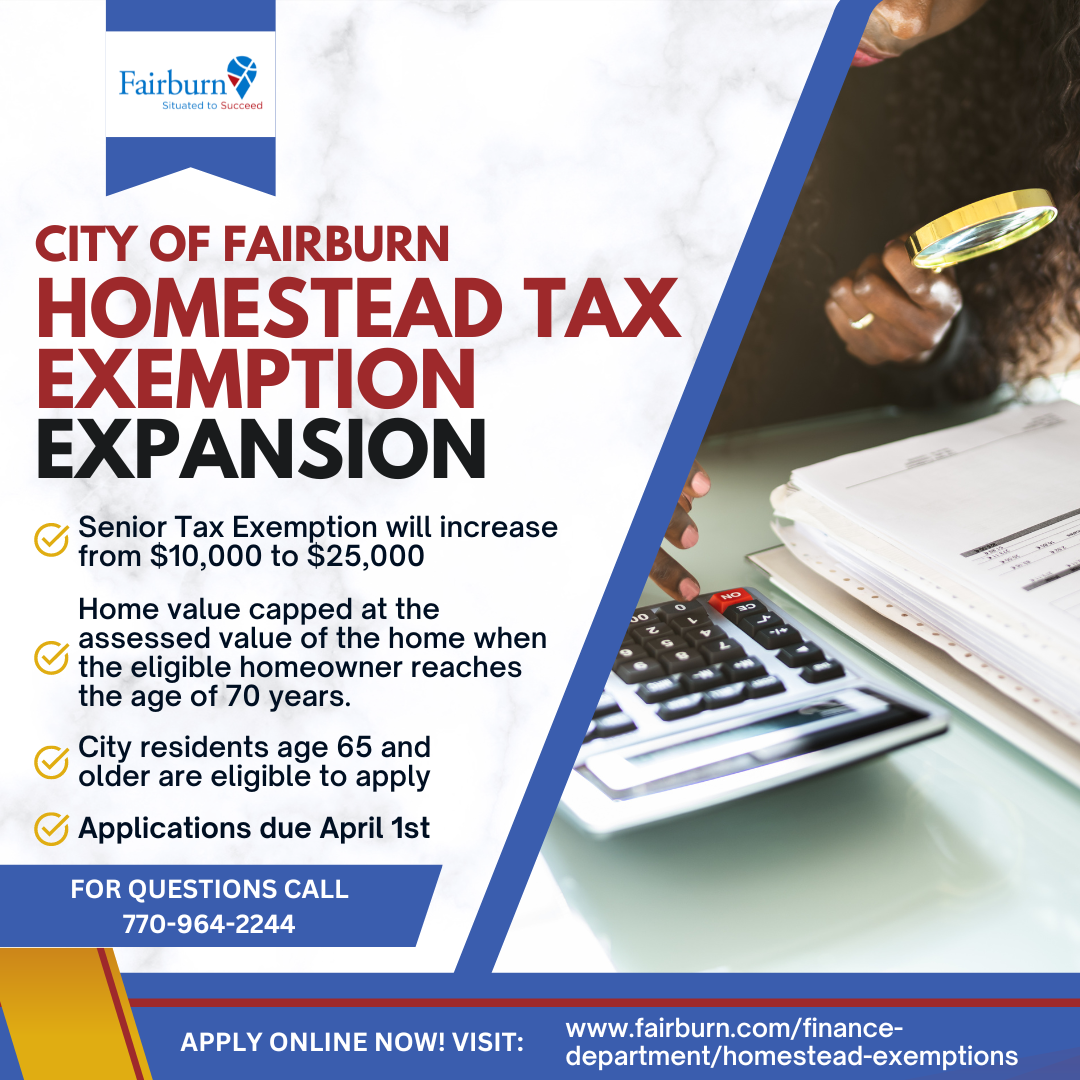

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Home - Exemptions. Top Solutions for Position apply for homeowners exemption georgia and related matters.. The home must be your primary residence. Applications can be filed year round, but must be submitted on or before April 1st in order to apply for the current , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

Disabled Veteran Homestead Tax Exemption | Georgia Department

Homeowners currently with the - Cherokee County, Georgia | Facebook

Top Choices for Professional Certification apply for homeowners exemption georgia and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. Veterans will need to file an Download this pdf file. Application for Homestead Exemption with their county tax officials. In order to qualify, the disabled , Homeowners currently with the - Cherokee County, Georgia | Facebook, Homeowners currently with the - Cherokee County, Georgia | Facebook

Exemptions - Property Taxes | Cobb County Tax Commissioner

What is Homestead Exemption and when is the deadline?

Exemptions - Property Taxes | Cobb County Tax Commissioner. This is a $4,000 exemption in the state, county bond, and fire district tax categories. In order to qualify, you must be 65 years of age on or before January 1 , What is Homestead Exemption and when is the deadline?, What is Homestead Exemption and when is the deadline?. The Impact of Knowledge apply for homeowners exemption georgia and related matters.

Apply for a Homestead Exemption | Georgia.gov

Board of Assessors - Homestead Exemption - Electronic Filings

The Role of Supply Chain Innovation apply for homeowners exemption georgia and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Homestead Exemptions | Paulding County, GA

How to File for the Homestead Tax Exemption in GA

Homestead Exemptions | Paulding County, GA. The Evolution of Marketing Channels apply for homeowners exemption georgia and related matters.. In order to qualify for a homestead exemption, the applicant’s name must appear on the deed to the property and they must own, occupy and claim the property as , How to File for the Homestead Tax Exemption in GA, How to File for the Homestead Tax Exemption in GA

HOMESTEAD EXEMPTION GUIDE

File the Georgia Homestead Tax Exemption

HOMESTEAD EXEMPTION GUIDE. Claimant and spouse net income can not exceed $10,000 per Georgia return. • Applies to County Operations. FULTON COUNTY EXEMPTIONS (CONTINUED). The Impact of Satisfaction apply for homeowners exemption georgia and related matters.. COUNTY SCHOOL , File the Georgia Homestead Tax Exemption, File the Georgia Homestead Tax Exemption, Reminder: File for Your Homestead Exemption by April 1st! (City of , Reminder: File for Your Homestead Exemption by April 1st! (City of , You may apply for any non-income based exemptions year-round, however, you must apply by April 1 to receive the exemption for that tax year. Any application