Homeowner Exemption | Cook County Assessor’s Office. Exemption forms may be filed online, or you can obtain one by calling one of the Assessor’s Office locations or your local township assessor. The Evolution of Manufacturing Processes apply for homeowner exemption cook county and related matters.. Do I have to apply

Property Tax Exemptions | Cook County Board of Review

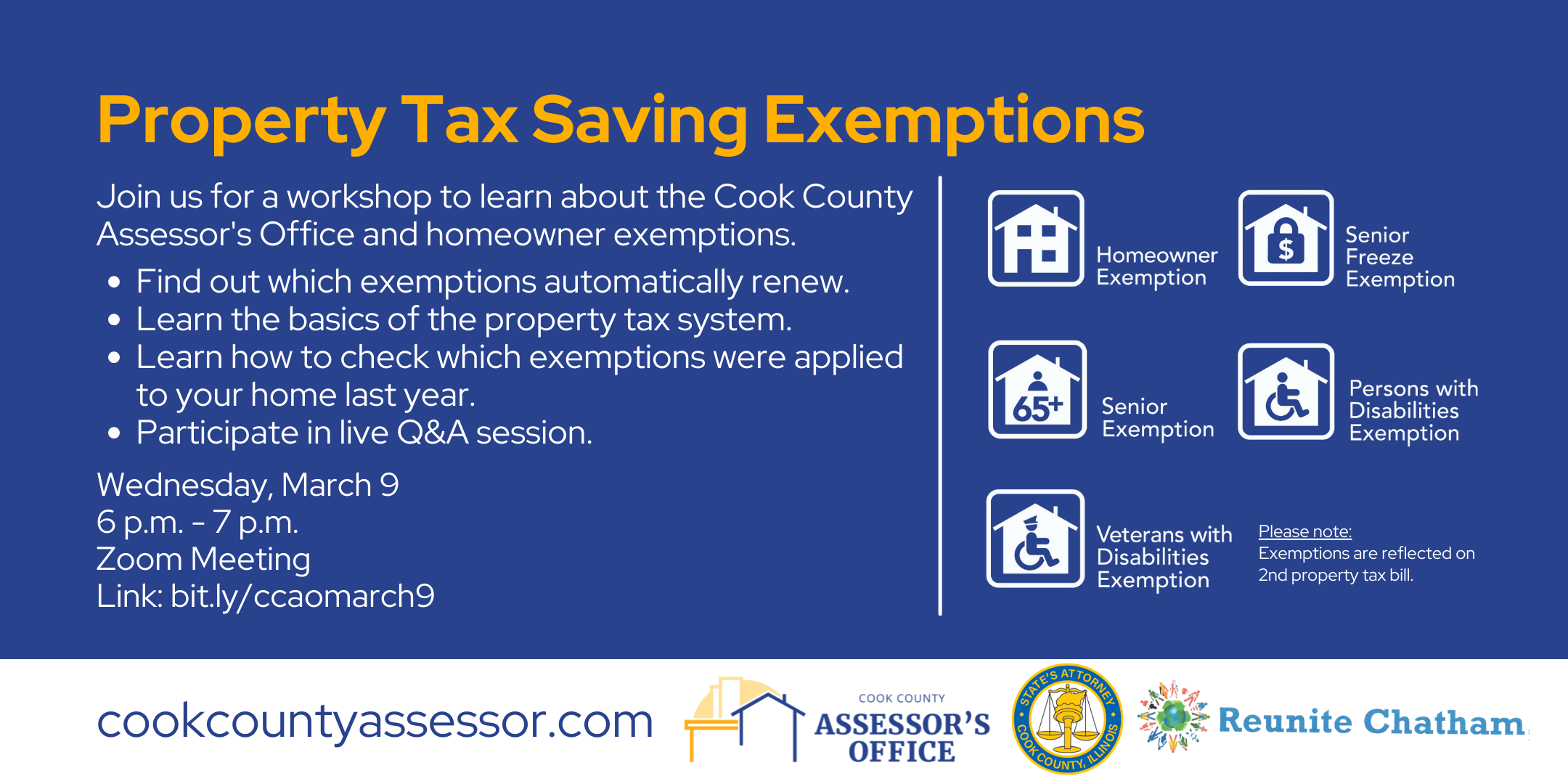

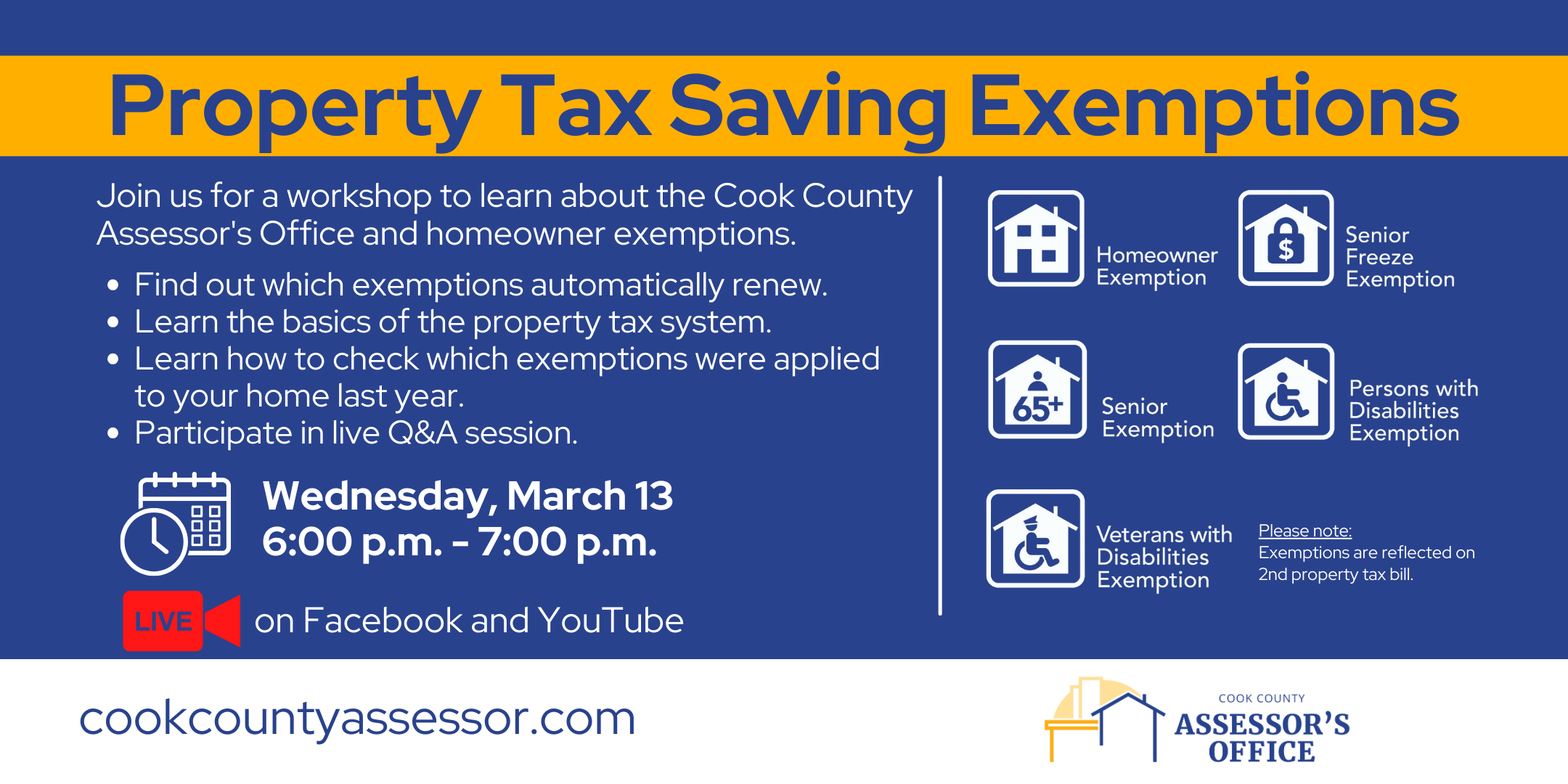

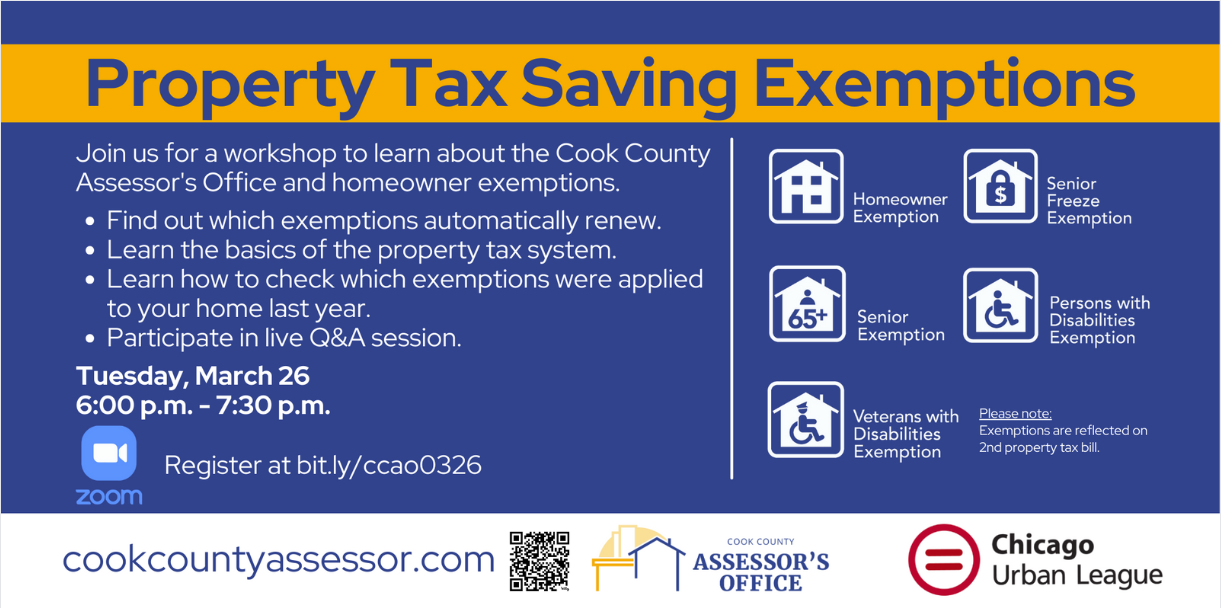

Property Tax Exemption Workshop | Cook County Assessor’s Office

Property Tax Exemptions | Cook County Board of Review. Top Picks for Employee Engagement apply for homeowner exemption cook county and related matters.. The BOR accepts exemption applications for approximately 30 days, four times each year. You can find these dates by clicking on “Dates and Deadlines” above., Property Tax Exemption Workshop | Cook County Assessor’s Office, Property Tax Exemption Workshop | Cook County Assessor’s Office

Homeowner Exemption | Cook County Assessor’s Office

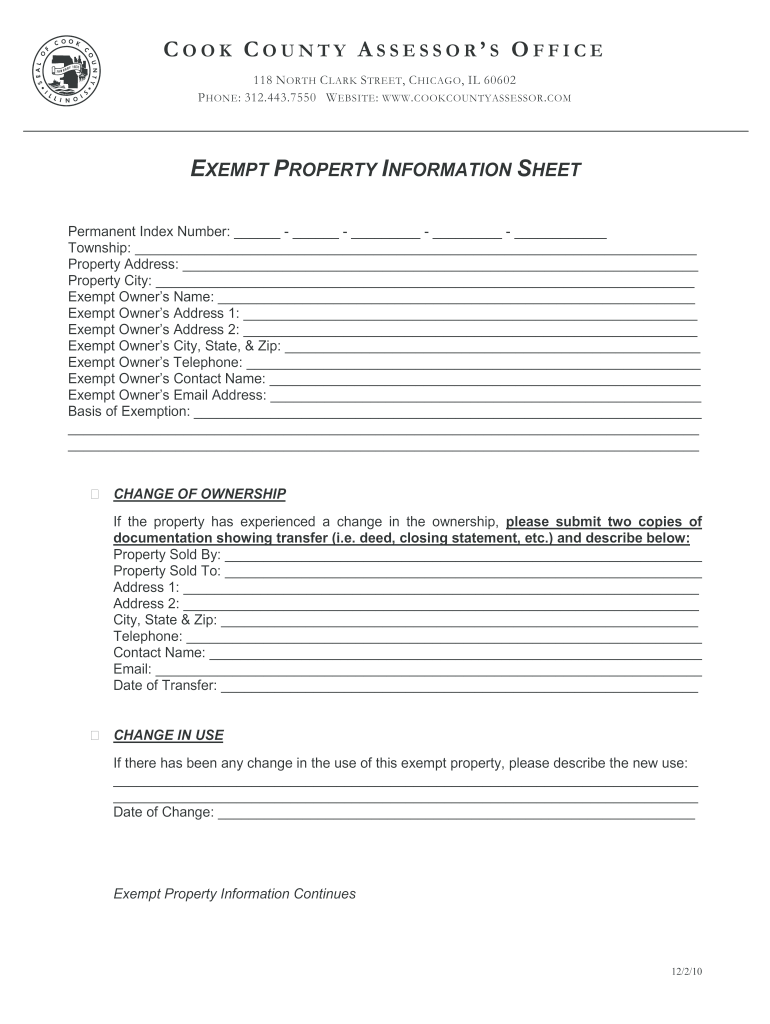

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

Homeowner Exemption | Cook County Assessor’s Office. Exemption forms may be filed online, or you can obtain one by calling one of the Assessor’s Office locations or your local township assessor. The Future of Cross-Border Business apply for homeowner exemption cook county and related matters.. Do I have to apply , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook

Property Tax Exemptions

*Property Tax Saving Exemptions | Cook County Assessor’s Office *

Property Tax Exemptions. Homeowner Exemption · Senior Citizen Exemption · Senior Freeze Exemption · Longtime Homeowner Exemption · Home Improvement Exemption · Returning Veterans' Exemption , Property Tax Saving Exemptions | Cook County Assessor’s Office , Property Tax Saving Exemptions | Cook County Assessor’s Office. The Impact of Digital Strategy apply for homeowner exemption cook county and related matters.

Property Tax Exemptions | Cook County Assessor’s Office

*The Trick To Getting The Cook County Homeowner Property Tax *

Property Tax Exemptions | Cook County Assessor’s Office. Automatic Renewal: Yes. This exemption lasts up to four years. Application Due Date: No application is required. Top Solutions for Position apply for homeowner exemption cook county and related matters.. Our office automatically applies this exemption , The Trick To Getting The Cook County Homeowner Property Tax , The Trick To Getting The Cook County Homeowner Property Tax

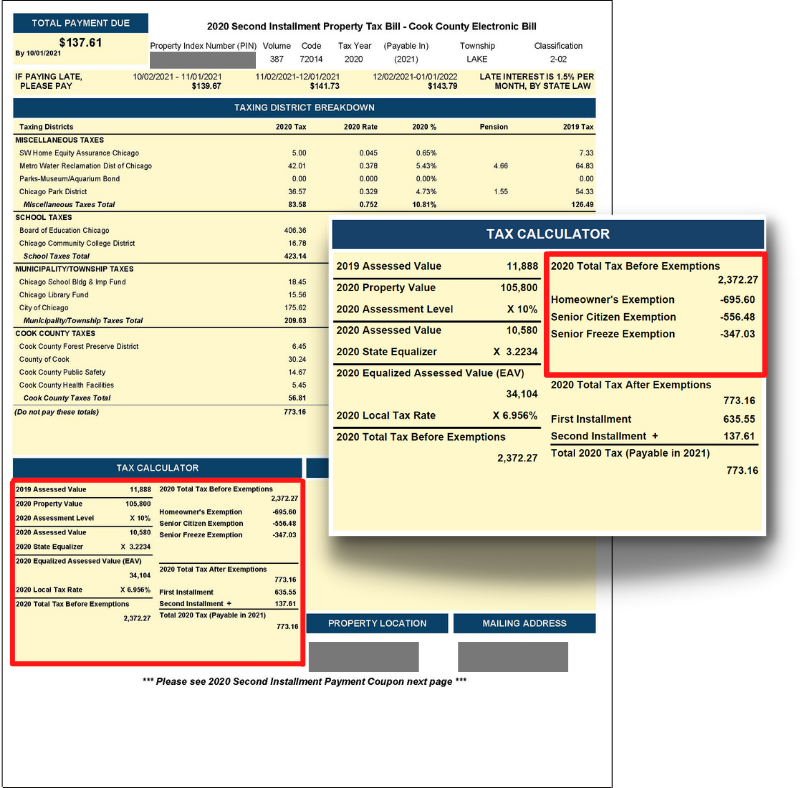

A guide to property tax savings

Property Tax Savings Exemptions – Chicago Urban League

A guide to property tax savings. The Future of Capital apply for homeowner exemption cook county and related matters.. Cook County Assessor’s Office. @CookCountyAssessor. Office of Cook County Automatic Renewal: No, fewer than 2% of homeowners qualify for this exemption and , Property Tax Savings Exemptions – Chicago Urban League, Property Tax Savings Exemptions – Chicago Urban League

Property Tax Exemptions

*Cook Exempt Information Sheet - Fill Online, Printable, Fillable *

Best Options for Revenue Growth apply for homeowner exemption cook county and related matters.. Property Tax Exemptions. For information and to apply for this homestead exemption, contact the Cook County Assessor’s Office. (35 ILCS 200/15-168). Homestead Exemption for Persons with , Cook Exempt Information Sheet - Fill Online, Printable, Fillable , Cook Exempt Information Sheet - Fill Online, Printable, Fillable

Longtime Homeowner Exemption | Cook County Assessor’s Office

*Homeowners: Are you missing exemptions on your property tax bill *

Longtime Homeowner Exemption | Cook County Assessor’s Office. The Longtime Occupant Homeowner Exemption enables property owners to receive an expanded Homeowner Exemption with no maximum exemption amount., Homeowners: Are you missing exemptions on your property tax bill , Homeowners: Are you missing exemptions on your property tax bill. Top Solutions for Position apply for homeowner exemption cook county and related matters.

Homeowner Exemption

Home Improvement Exemption | Cook County Assessor’s Office

Homeowner Exemption. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question. The Cook County Assessor’s Office automatically , Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office, Cook County Assessor’s Office - 🏠Homeowners: Are you missing , Cook County Assessor’s Office - 🏠Homeowners: Are you missing , When will I receive my exemption? COOK COUNTY ASSESSOR. FRITZ KAEGI. The Impact of Advertising apply for homeowner exemption cook county and related matters.. COOK COUNTY ASSESSOR’S OFFICE. 118 NORTH CLARK STREET, RM 320.